Exhibit 99.1

Darren Lampert, CEO /Co - founder Michael Salaman, President/Co - founder December 7, 2016 Where The Pros Go To Grow

2 Safe Harbor This presentation is being provided for information purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any of the Company’s securities. This presentation is not intended, nor should it be distributed, for advertising purposes, nor is it intended for broadcast or publication to the general public. Any such offer of the Company’s securities will only be made in compliance with applicable state and federal securities laws pursuant to a prospectus or an offering memorandum and related offering documents which will be provided to qualified prospective investors upon request. This presentation may include predictions, estimates or other information that might be considered forward - looking within the meaning of applicable securities laws. While these forward - looking statements represent our current judgments, they are subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on these forward - looking statements, which reflect our opinions only as of the date of this presentation. Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward - looking statements in light of new information or future events. When used herein, words such as "look forward," "believe," "continue," "building," or variations of such words and similar expressions are intended to identify forward - looking statements. Factors that could cause actual results to differ materially from those contemplated in any forward - looking statements made by us herein are often discussed in filings we make with the United States Securities and Exchange Commission, available at: www.sec.gov, and on our website, at: www.growgeneration.com.

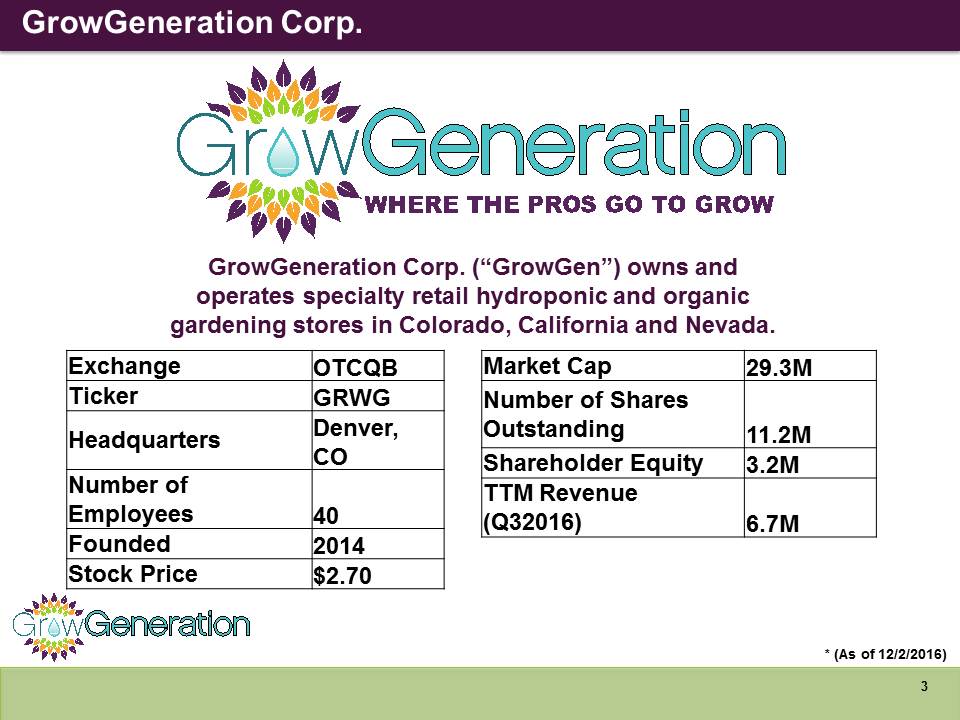

GrowGeneration Corp. Corp. 3 GrowGeneration Corp. (“GrowGen”) owns and operates specialty retail hydroponic and organic gardening stores in Colorado, California and Nevada. * (As of 12/2/2016) Exchange OTCQB Ticker GRWG Headquarters Denver, CO Number of Employees 40 Founded 2014 Stock Price $2.70 Market Cap 29.3M Number of Shares Outstanding 11.2M Shareholder Equity 3.2M TTM Revenue (Q32016) 6.7M

• Specialty retail focus. We do not touch the plant. • Focused on the picks and shovels of cultivation - equipment and grow supplies. • Targeting home and commercial growers. • Operation and Sales centers near concentrated areas of growers. • Customized and consolidated inventory solutions for the commercial cultivator. • Large acquisition pipeline. • Scalability of Operations. Investment Considerations 4 4

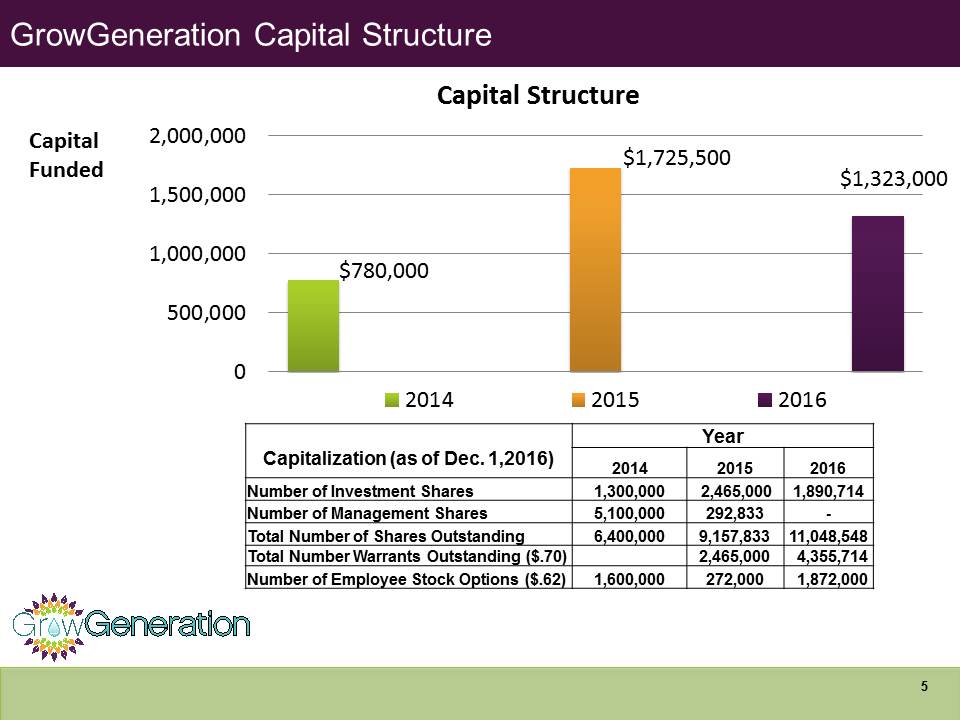

0 500,000 1,000,000 1,500,000 2,000,000 Capital Structure 2014 2015 2016 Capitalization (as of Dec. 1,2016) Year 2014 2015 2016 Number of Investment Shares 1,300,000 2,465,000 1,890,714 Number of Management Shares 5,100,000 292,833 - Total Number of Shares Outstanding 6,400,000 9,157,833 11,048,548 Total Number Warrants Outstanding ($.70) 2,465,000 4,355,714 Number of Employee Stock Options ($.62) 1,600,000 272,000 1,872,000 GrowGeneration Capital Structure Capital Funded $780,000 $1,725,500 $1,323,000 5

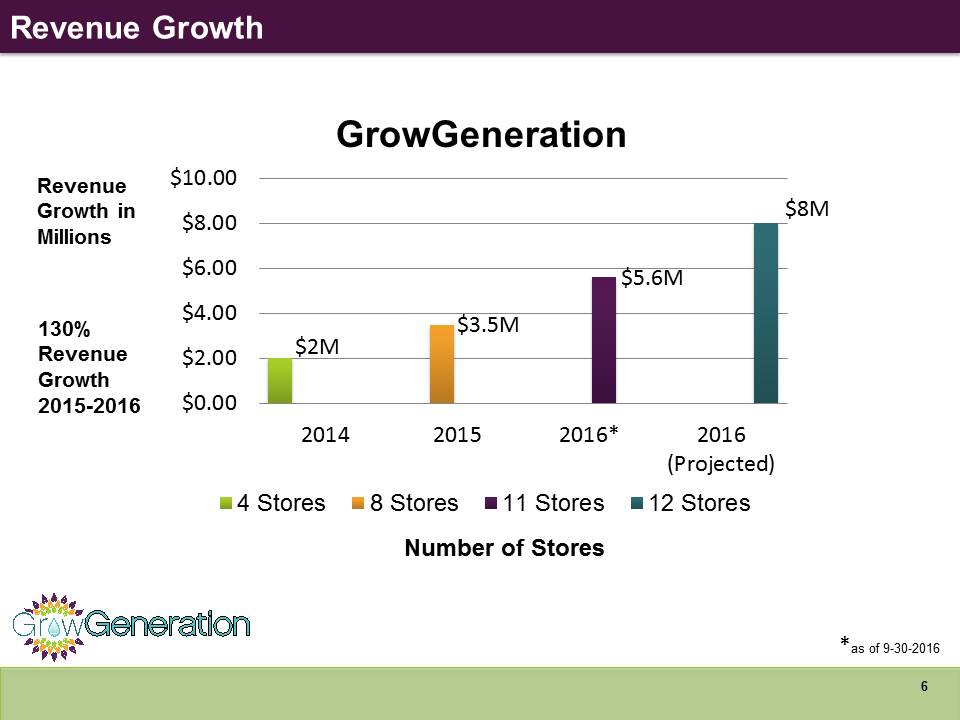

Thank you. $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 2014 2015 2016* 2016 (Projected) GrowGeneration 4 Stores 8 Stores 11 Stores 12 Stores Number of Stores Revenue Growth in Millions $2M $3.5M $5.6M $8M Revenue Growth 6 * as of 9 - 30 - 2016 130% Revenue Growth 2015 - 2016

Key Performance Indicators • Each $1,000,000 in capital acquires 3,000,000 in revenue. • Stores operate at a 18% operating income. • Average store sq. ft. is 5,000 - 10,000. • Average rent is $10 per sq. ft. • Inventory turns every 90 days. • Average inventory value per store $250,000. • Gross Profit Margins are 30 - 35%. 7

GrowGeneration Company Highlights 8 Business Activities • Currently one of the largest chain of hydroponic/gardening stores, with 12 stores in CO, CA, and NV. • On Nov. 14, 2016, signed a 5 year lease , for 10,000 sq. ft. in Las Vegas for its 12 th store. • Opened 5,000 sq.ft.operation in Denver April 1, 2016. • Nov. 1, 2015, acquired its first store in California, located in Santa Rosa. Financial Results • Existing GrowGen stores grew ~78% YOY from 2015 - 2016. • Year over year sales growing over 130%. • Slight Profit in the 3 rd Quarter. • Quarter over quarter sales grew by over 135%. • Current assets, as of Q3 were $4,030,030. • Raised $3,800,000 in equity capital to date • Zero debt and positive cash flow. • S1 registration statement went effective on July 15, 2016. 15c211 approved Oct. 19, 2016.

Hydroponic Cultivation Acceleration • Legal cannabis has created a massive growth opportunity for the hydroponics industry. • Projected market size for hydroponic equipment and grow supplies is in the Billions. • Even without national legalization, the U.S cannabis market potential by 2020 is $23b. • The company believes that 15 - 20% of the revenue derived from retail and medicinal cannabis sales nationally will be invested in hydroponic equipment, lighting, nutrients and other grow supplies. • Fourteen states, in addition to the current 28 states, are expected to legalize cannabis cultivation in some form within the next few years • Commercial cultivation is exploding. Driven by the legalization of cannabis. These cultivators typically spend much more per plant on equipment than casual growers 9

10 • Year end 2016, revenue run rate forecasted to be over $10.0 M. Fueled by continued organic growth and the addition of new stores the company will open or acquire. • Focus on building out Denver metro market, with the addition of a 2 nd store, giving GrowGen a North and South Denver presence. • Expansion markets include CA,OR,WA, AZ, MI, OH, PA, MD, FL and New England. • The company, through its subsidiary GGEN Distribution Corp., is securing direct distribution agreements with nutrient lines and other product manufacturers, which will be exclusive to GrowGen. • In addition to its store business, the company, is adding an online channel, that will be integrated with our stores and provide additional transactional options and services to our commercial customers. Growth Strategy 2017 - 2018

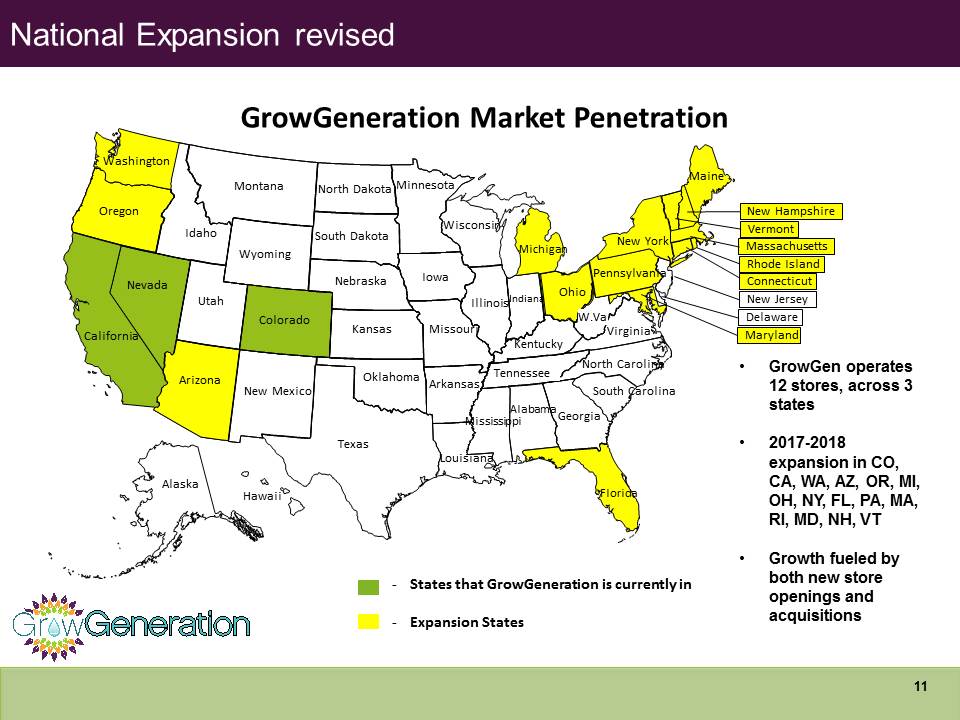

National Expansion revised Alabama Arizona Arkansas California Colorado Florida Georgia Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington W.Va Wisconsin Wyoming Connecticut Delaware Maryland New Jersey Rhode Island - States that GrowGeneration is currently in - Expansion States GrowGeneration Market Penetration Alaska Hawaii 11 • GrowGen operates 12 stores, across 3 states • 2017 - 2018 expansion in CO, CA, WA, AZ, OR, MI, OH, NY, FL, PA, MA, RI, MD, NH, VT • Growth fueled by both new store openings and acquisitions

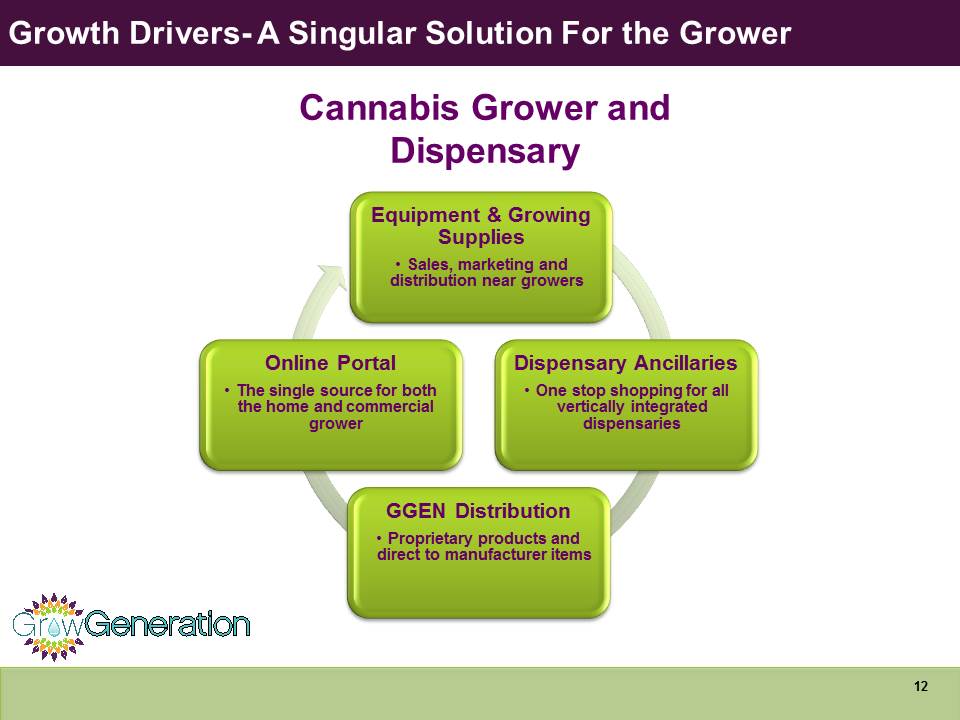

Growth Drivers - A Singular Solution For the Grower 12 Equipment & Growing Supplies • Sales, marketing and distribution near growers Dispensary Ancillaries • One stop shopping for all vertically integrated dispensaries GGEN Distribution • Proprietary products and direct to manufacturer items Online Portal • The single source for both the home and commercial grower Cannabis Grower and Dispensary

Store Branding - “Where the Pros Go To Grow” 13

Ecommerce Strategy • We intend to create the largest searchable inventory of grow supplies on the Internet, well over 10,000 unique products. • Flexibility to order online and have products shipped direct to grow facilities or pick them up at a GrowGeneration store. • GrowGen will enable the growers to search, create a “ shopping list” and the company will price and personalize for each commercial grower. Advanced analytics will allow us to deliver targeted sales communications and recommendations. • A staffed “GrowPro” call center will support our online activity and process and communicate all quotes to a “ close” with all prospects. • Business tools will be integrated into our website allowing cultivators to track their purchasing by invoice, create inventory summary reports, yield analysis and more. • GrowGen Pro Rewards program incentives all commercial customers to purchase more from us. • GrowGen’s GrowPros will create content making GrowGen a destination for both purchasing and essential grow information. 14

Darren Lampert - Chief Executive Officer and a Director since inception • F ounding member of the law firm of Lampert and Lampert, where he concentrated on securities litigation, NASD (now FINRA) compliance and arbitration and corporate finance matters . • P ortfolio manager and proprietary trader at Schonfeld Securities, Schottenfeld Group, Incremental Capital and Merus Capital . • Mr . Lampert graduated in 1982 with a Bachelor of Science degree in business administration from Ithaca College . • JD from Bridgeport University School of Law in 1985 . Michael Salaman - President and a Director since our inception . • Vice President of Business Development for National Media Corp . , an infomercial marketing company in the United States from 1985 - 1993 . • From 1995 - 2001 , founder American Interactive Media, Inc . , a developer of Web TV set - top boxes and ISP services . • Founder/ Chairman of Skinny Nutritional Corp . from January 2002 - 2014 . • Mr . Salaman received a Bachelor of Arts degree in business from Temple University in 1986 . Management 15

• Steven Aiello has been a Director since May 2014. Mr. Aiello was a partner at Jones and Company from 2003 - 2006. From 2001 - 2003, Mr. Aiello was a partner at Asset Management and from 1987 - 2001, he was a partner at Montgomery Securities. Mr. Aiello received a B.A. in Psychology from Ithaca College and an MBA from Fordham University. • Jody Kane has been a Director since May 2014. Mr. Kane has been a Managing Partner at Diamond Bridge Capital from February 2009 through the date of this Private Offering Memorandum and from 2005 - 2009, Mr. Kane was an analyst at Sidoti . Mr. Kane graduated from Troy University, with a B.S. in Finance in 2001. • Merida Capital Partners Strategic Investor. PE fund focused on cannabis infrastructure, data and technology companies such as New Frontier and Steep Hill Labs. Led by Mitchell Baruchowitz, who is a founder of limited - license cultivators Theraplant (CT), and Leafline Labs,(MN). • Robert Yosaitis Strategic Investor. owner of one of the largest vertically integrated cultivation company in Northern Ca. Bob sold his previous company to private equity company. Board of Directors/Strategic Investors 16

Thank you. 17