Exhibit 99.2

RIDER

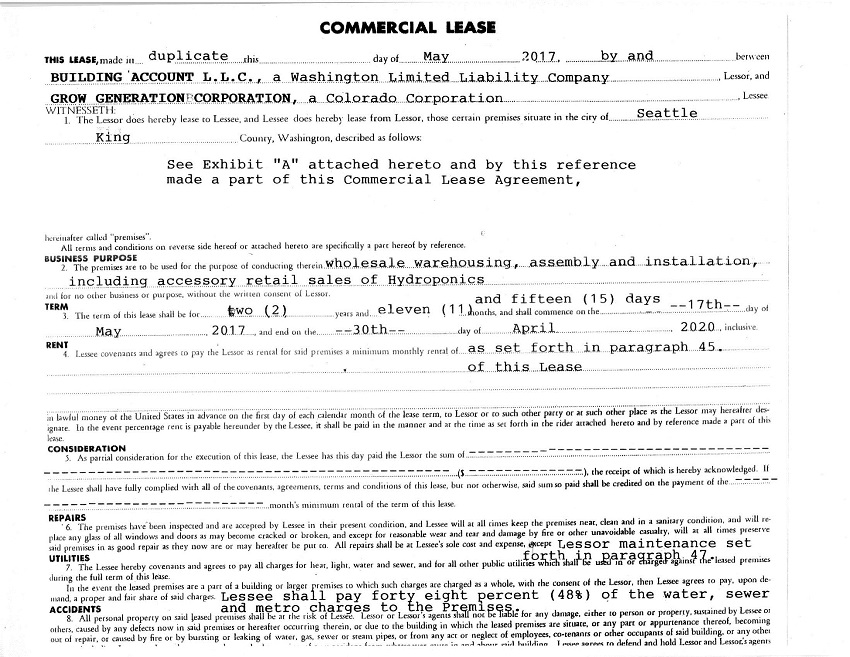

TO LEASE DATED MAY ____, 2017 BY AND BETWEEN

BUILDING ACCOUNT L.L.C., LESSOR

AND GROW GENERATION CORPORATION, LESSEE

REAL ESTATE TAXES

28. Lessee hereby covenants and agrees to pay to Lessor, as additional rent hereunder, forty eight percent (48%) of the general real estate taxes and surface water management fees charged against the land and building of which the leased premises are a part during the term of this lease and any extension thereof. Furthermore, Lessee agrees to pay all of any new additional charges which may be assessed by governmental entities and billed to Lessor through the King County Real Estate Tax statement during the term of this lease and any extension thereof. Said payment shall be made to the Lessor within thirty (30) days of receiving a statement showing the amount of real estate taxes, surface water management fees and other charges, if any, currently due and owing. In the event that Lessee leases the premises for only a portion of a year, the real estate taxes which Lessee shall pay will be pro-rated on the basis of the number of days during that year Lessee was subject to this lease agreement.

FIRE AND EXTENDED COVERAGE INSURANCE

29. The Lessor agrees to insure the building as provided for in this Paragraph 29. Lessee hereby covenants and agrees to pay Lessor, as additional rent hereunder, forty eight percent (48%) of the insurance premiums necessary for Lessor to maintain fire and extended coverage insurance in an amount which Lessor shall, in its sole discretion, deem adequate to protect against damage to the entire building in which the leased premises are situated, including loss of rents and rental values of such building during the term of this lease and any extension thereof. It is further agreed that said fire and extended coverage insurance shall include, but not be limited to, loss of rent insurance which shall protect Lessor against the perils of fire and other perils so as to guarantee a six (6) month loss of rent coverage from date of any insured peril. Lessee agrees to pay this cost to Lessor in full within thirty (30) days of receiving written notice of the amount of insurance premium(s) due. If necessary, the cost of such insurance shall be prorated for the first and last years of the lease term.

LIABILITY INSURANCE

30. The Lessee, during the term of this lease and any extension thereof, shall maintain in full force and effect a policy or policies of public liability and property damage insurance with respect to the above-described real property and all improvements thereon and pertaining to business operated by the Lessee, in which the limits of public liability shall not be less than $1,000,000 combined single limits. The policy shall name the Lessor or any persons, firms or corporations designated by the Lessor and the Lessee as assureds, and shall contain a clause that the insurer will not cancel or change the insurance without first giving the Lessor thirty (30) days prior written notice. The insurance shall be in an insurance company or companies and in a form approved by Lessor and a copy of such policy or certificate of insurance shall be delivered to the Lessor. In addition, Lessee shall reimburse Lessor for Lessor’s premium for the commercial general liability policy on described premises not to exceed the premium amount for limits of $1,000,000.

COMMERCIAL LEASE - PAGE 3

SECURITY DEPOSIT

31. As provided in Termination of Lease Agreement dated May 1, 2017 for Commercial Lease dated August 23, 2011 and First Lease Extension Agreement dated July 15, 2013 and Second Lease Extension Agreement dated April 13, 2016 by and between Building Account L.L.C. and Seattle’s Hydro Spot L.L.C., and provided for in the Agreement to Purchase and Sell Assets Agreement by and between Seattle’s Hydro Spot L.L.C. and Grow Generation Corporation, dated March 6, 2017, the security deposit in the amount of TWO THOUSAND EIGHT HUNDRED AND FIFTY AND NO/100 DOLLARS ($2,850.00) shall be assigned to Lessee and Lessor agrees that said security deposit has this day been paid to Lessor. Upon execution of this Lease, Lessee agrees to pay Lessor an additional security deposit in the sum of SEVEN HUNDRED SEVENTY FIVE AND NO/100 DOLLARS ($775.00) for a total security deposit of THREE THOUSAND SIX HUNDRED TWENTY FIVE AND NO/100 DOLLARS ($3,625.00) as security for Lessee’s faithful performance of Lessee’s obligations hereunder. If the Lessee fails to pay rent or other charges due hereunder, or otherwise defaults with respect to any provision of this lease, Lessor may use, apply or retain all or any portion of said deposit for the payment of any rent or other charge in default or for the payment of any other sum to which Lessor may suffer thereby. If Lessor so uses or applies all or any portion of said deposit, Lessee shall within ten (10) days after written demand therefore deposit cash with Lessor in an amount sufficient to restore said deposit to the full amount stated above and Lessee’s failure to do so shall be a breach of this lease. Lessor shall not be required to keep said deposit separate from Lessor’s general accounts. If Lessee performs all of Lessee’s obligations hereunder, said deposit or so much thereof as had not theretofore been applied by Lessor, shall be returned, without payment of interest for its use, to Lessee within fifteen (15) days after expiration of the lease term, or after Lessee has vacated the premises, whichever is later.

WAIVER OF SUBROGATION

32. Lessor and Lessee hereby release and waive for the duration of this lease and any extension or renewal thereof, their respective entire rights of recovery against each other, and/or their respective agents and invitees responsible for any losses to their respective property; Lessor and Lessee shall request that their respective insurer provide a waiver of subrogation and provided that such waiver and release shall apply only in the event such agreement does not prejudice the insurance afforded by such policies.

COMMERCIAL LEASE - PAGE 4

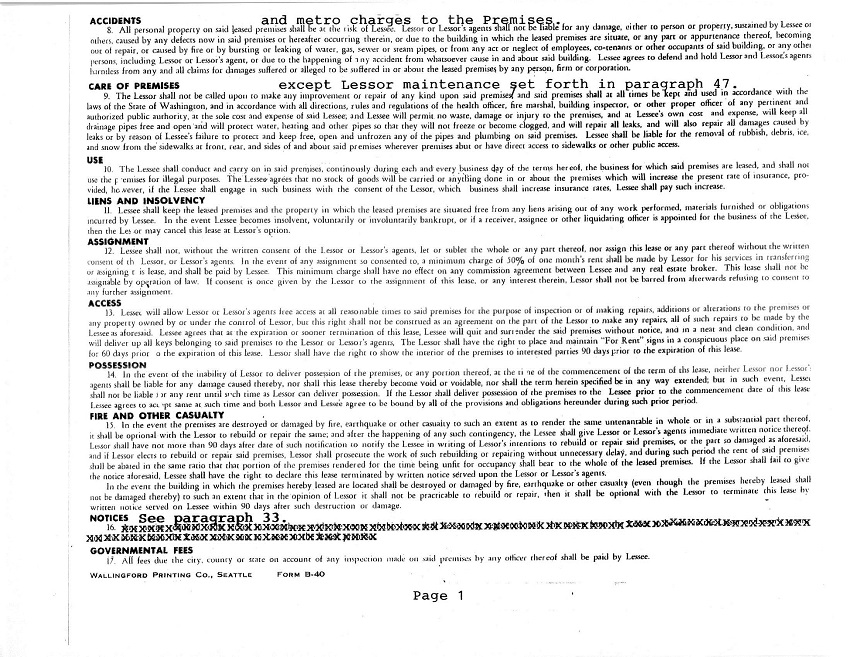

NOTICES

33. All notices given by the parties shall be in writing. Any notice required to be served in accordance with the terms of this Lease shall be sent by registered or certified mail, the notice from Lessee to be sent to Lessor at P.O. Box 31529, Seattle, WA 98103 and notice from Lessor to be sent to Lessee at 503 N. Main Street, Suite 740, Pueblo, CO 81003.

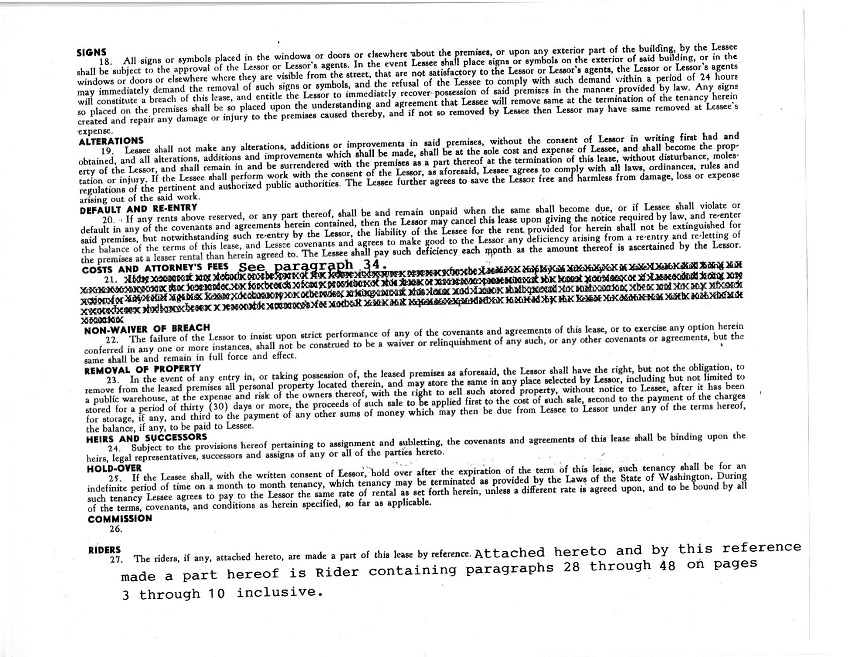

COSTS AND ATTORNEY FEES

34. In the event of any action at law or in equity between Lessor and Lessee to enforce any of the terms and provisions of the Lease and the rights hereunder, the unsuccessful party to such litigation agrees to and shall pay to the successful party all costs and expenses, including reasonable attorney fees, incurred therein by such successful party; and if such successful party shall recover judgment in such action or proceeding, such costs and expenses and attorney fees shall be included in and as a part of such judgment.

PERSONAL PROPERTY TAXES, LICENSE AND GOVERNMENTAL CHARGES

35. Lessee shall be liable for and shall pay throughout the term of this Lease, and any extension thereof, all license and excise fees and occupation taxes covering the business conducted on the leased premises, and all taxes on property of Lessee on the premises.

If any governmental authority under any present or future law effective at any time during the term of this lease, and any extension thereof, shall in any manner levy a tax on rentals under this Lease, or a tax in any form against Lessor because of or measured by income derived from the leasing or rental of the premises such tax shall be paid by Lessee, either directly or through Lessor, and in the event of Lessee’s failure to pay the same, Lessor shall have the same remedies as upon the failure to pay rent; provided, however, that Lessee shall not be liable to pay any net income taxes imposed upon Lessor.

SUBORDINATION

36. The Lessor reserves the right to mortgage, hypothecate, issue deeds of trust or other encumbrances affecting the demised property or premises; however, this Lease shall be subordinate to any such encumbrance. As long as the Lessee is not in default with any of the terms and conditions of this Lease, then this Lease shall continue to be in full force and effect not withstanding any breach of any terms or conditions of any mortgages, deeds of trust or other encumbrances with any third parties. Lessee agrees to execute a commercially reasonable subordination, non-disturbance and attornment agreement to evidence such subordination.

COMMERCIAL LEASE - PAGE 5

CONDEMNATION

37. In the event of the taking of the leased premises herein, or any material part of thereof, by condemnation or otherwise by any governmental, state or local authority, this lease shall be deemed canceled as of the time of taking possession by said authority and, if Lessee is not in default under any provisions of this lease on said date, the Lessor shall refund to Lessee any rent paid in advance for any period beyond the date of cancellation, including but not limited to any portion of the security deposit set forth in paragraph 31. which is not due Lessor for precancellation rents or otherwise. Lessee shall have no claim to nor shall Lessee be entitled to any portion of any award for damages to the land or buildings, or improvements and property covered by this lease. The provisions of this paragraph do not include any taking for a right of way for utilities and for minor street adjustments, Lessee and Lessor having agreed that neither of such events will materially interfere with the conduct of Lessee’s business.

HAZARDOUS WASTE AND MATERIALS

38. Lessee shall not dispose of or otherwise allow the release of any hazardous waste or materials in, on or under the premises, or any adjacent property, or in any improvements placed on the premises.

As used herein, the term “hazardous waste or materials” includes any substance, waste or material defined or designated as hazardous, toxic or dangerous (or any similar term) by any federal, state or local statute, regulation, rule or ordinance now or hereafter in effect. Lessee shall promptly comply with all statutes, regulations and ordinances, and with all orders, decrees or judgments of governmental authorities or courts having jurisdiction relating to the use, collection, treatment, disposal, storage, control, removal or cleanup of hazardous waste or materials in, on or under the premises or any adjacent property, or incorporated in any improvements, at Lessee expense.

After notice to Lessee and a reasonable opportunity for Lessee to effect such compliance, Lessor may, but is not obligated to, enter upon the premises and take such actions and incur such costs and expenses to effect such compliance as it deems advisable to protect its interest in the premises; provided, however, that that Lessor shall not be obligated to give Lessee notice and an opportunity to effect such compliance if (1) such delay might result in material adverse harm to Lessor or the premises, (2) Lessee has already had actual knowledge of the situation and a reasonable opportunity to effect such compliance, or (3) an emergency exists. Whether or not Lessee has actual knowledge or the release of hazardous waste or materials on the premises or any adjacent property as the result of Lessee’s use of premises, Lessee shall reimburse Lessor for the full amount of all costs and expenses incurred by Lessor in connection with such compliance activities, and such obligation shall continue even after the termination of this Lease and any extensions thereof. Lessee shall notify Lessor immediately of any release of any hazardous waste or materials on the premises.

COMMERCIAL LEASE - PAGE 6

Lessee agrees to indemnify and hold harmless lessor against any and all losses, liabilities, suits, obligations, fines, damages, judgments, penalties, claims, charges, cleanup costs, remedial actions, costs and expenses (including, without limitations, attorneys’ fees and disbursements) which may be imposed on, incurred or paid by, or asserted against Lessor or the premises by reason of, or in connection with (1) any misrepresentation, breach of warranty or other default by Lessee under this Lease, or (2) the acts or omissions of Lessee, or any sublessee or other person for whom Lessee would otherwise be liable, resulting in the release of any hazardous waste or materials on or about the Premises.

Lessor agrees to indemnify and hold harmless Lessee against any and all losses, liabilities, suits, obligations, fines, damages, judgments, penalties, claims, charges, cleanup costs, remedial actions, costs and expenses (including, without limitations, attorneys’ fees and disbursements) which may be imposed on, incurred or paid by, or asserted against Lessee or the premises by reason of, or in connection with (1) hazardous waste of materials that are present on the Premises as of the Commencement Date, or (2) the acts or omissions of Lessor, or Lessor’s employees, agents or contractors, resulting in the release of any hazardous waste or materials on or about the Premises.

ESTOPPELCERTIFICATE

39. Lessee shall, at any time upon not less than ten (10) days’ prior written notice from Lessor, execute, acknowledge and deliver to Lessor, as statement in writing certifying that this lease is unmodified and in full force and effect (or if modified, stating to nature of such modification and certifying that this lease, as so modified is in full force and effect), and the date to which the rental and other charges are paid in advance, if any; and acknowledging that there are not, to Lessee’s knowledge, any uncured defaults on the part of the Lessor hereunder, or specifying such defaults if any are claimed. Any such statement may be relied upon by prospective purchaser or encumbrancer of all or any portion of the real property of which the premises are a part.

ENTIRE AGREEMENT

40. This lease is the entire agreement of Lessor and Lessee and there are no promises, agreements, conditions, understandings, inducements, warranties, or representations, oral or written, expressed or implied, other than is expressly set forth in this lease. This lease shall not be modified in any manner except by instrument in writing and executed by the parties.

COMMERCIAL LEASE - PAGE 7

APPLICABLE LAW, FORUM AND CONSENT TO JURISDICTION

41. Except as herein specifically provided, this lease agreement shall be governed by and construed according to the laws of the State of Washington. In the event that any litigation may be filed between the parties respecting any matter of fact or law, the Lessee and Lessor agree that venue shall rest in the Superior Court of King County, Washington and by agreeing to this lease, the parties do hereby consent to personal and subject matter jurisdiction by the Superior Court of King County, Washington.

USE OF PREMISES

42. Lessee has made its own determination of zoning and land use requirements and are satisfied that the leased premises may be used for the purposes intended by Lessee and such use will be consistent with the present zoning and land use classification of the premises described herein. Should Lessee’s use of the building require any special permits and/or change of use permit by the City of Seattle or any other governmental agency, it shall be the responsibility of the Lessee to obtain such permit(s).

LATE CHARGE

43. Any rental payments received seven (7) or more days after the beginning date of each rental period will be subject to a service charge of $165.00.

ADDITIONAL ITEMS REGARDING LESSEE’S CARE OF PREMISES

44. Lessee agrees to do the following items which include, but are not limited to:

A. GRAFFITI REMOVAL: Lessee agrees to paint out any graffiti that is painted on the premises described herein. This work shall comply and be completed within City of Seattle’s regulations regarding graffiti removal.

B. LANDSCAPING MAINTENANCE: Lessee agrees to be responsible for the maintenance and care of all landscaping on premises.

RENTAL SCHEDULE

45. Lessee shall pay base monthly rent in accordance with the following rent schedule:

May 1, 2017 through April 30, 2018:

THREE THOUSAND THREE HUNDRED AND NO/100 DOLLARS ($3,300.00) PER MONTH;

COMMERCIAL LEASE - PAGE 8

May 1, 2018 through April 30, 2019:

THREE THOUSAND FIVE HUNDRED AND NO/100 DOLLARS ($3,500.00) PER MONTH;

May 1, 2019 through April 30, 2020:

THREE THOUSAND SIX HUNDRED TWENTY FIVE AND NO/100 DOLLARS ($3,625.00) PER MONTH.

OPTION TO EXTEND LEASE

46. Lessor hereby grants to Lessee the right to extend the lease term for an additional period of three (3) years upon the following terms and conditions:

a) Lessee shall give written notice to Lessor of Lessee’s exercise of said option to extend in the manner and form provided in Paragraph 33. of the Lease, no later than November 1, 2019.

b) Said option to extend herein granted shall be of no force or effect, and any attempt by the Lessee to exercise it shall be a nullity if the Lessee is in default in the payment of rent or in the performance of any other obligation imposed upon the Lessee by this lease, at or after the time of giving notice of the exercise of such option.

c) The extended lease term shall be for the period commencing May 1, 2020 and ending April 30, 2023.

d) All the terms, covenants and provisions of this commercial Lease shall apply to the extended lease term, except Lessee shall pay base monthly rent for the extended lease term in accordance with the following rent schedule:

May 1, 2020 through April 30, 2021:

THREE THOUSAND SEVEN HUNDRED FORTY AND NO/100 DOLLARS ($3,740.00) PER MONTH;

May 1, 2021 through April 30, 2022:

THREE THOUSAND EIGHT HUNDRED SIXTY AND NO/100 DOLLARS ($3,860.00) PER MONTH;

May 1, 2022 through April 30, 2023:

FOUR THOUSAND AND NO/100 DOLLARS ($4,000.00) PER MONTH.

LESSOR MAINTENANCE AND REPAIR RESPONSIBILITIES

47. Lessor shall maintain in good condition and repair the exterior walls, roof and foundation to subject building of which the leased premises are a part at Lessor’s expense, provided that; if Lessee or its employees, agents, contractors or invitees is responsible for causing the damage, it shall be the responsibility of the Lessee to repair the damage.

AGENCY DISCLOSURE

48. Lessor and Lessee herein acknowledge that Barry M. Hawley and Brett Hawley, Hawley Realty Inc. has provided them with a pamphlet on the Law of Real Estate Agency as required by the law. In this transaction Barry M. Hawley and Brett Hawley, Hawley Realty Inc. represents the Lessor. Lessee had no representation in this real estate transaction. Each party signing this document confirms that prior oral and/or written disclosure of agency was given to them in this transaction.

COMMERCIAL LEASE - PAGE 9

| STATE OF WASHINGTON | ) |

| ) ss. | |

| COUNTY OF KING | ) |

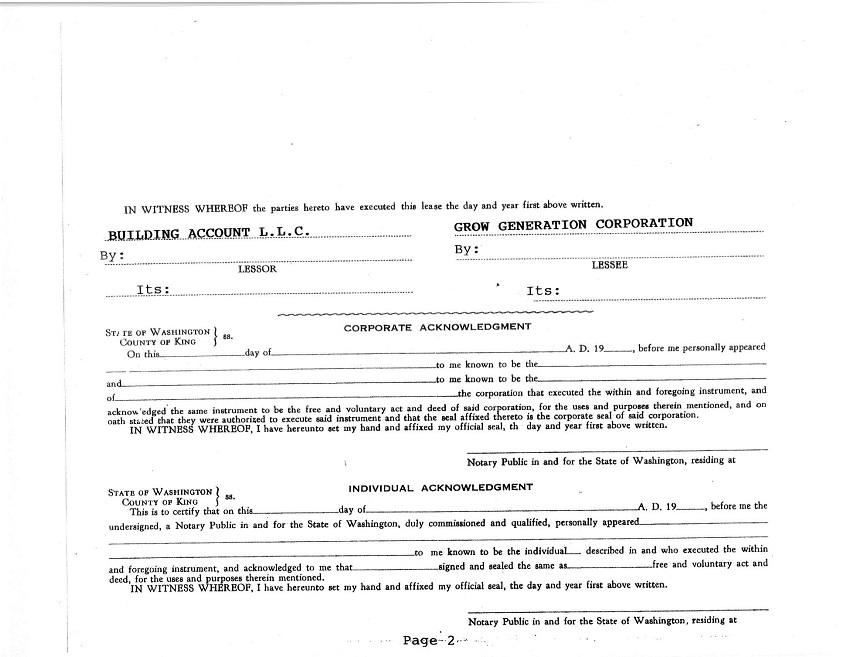

This is to certify that on this _____ day of May, 2017, before me the undersigned, a Notary Public in and for the State of Washington, duly commissioned and qualified, personally appeared________________________________ to me known to be the_______________________ of GROW GENERATION CORPORATION, the corporation that executed the within and foregoing instrument, and acknowledged the same instrument to be the free and voluntary act and deed of said corporation, for the uses and purposes therein mentioned, and on oath stated that he was authorized to execute said instrument.

IN WITNESS WHEREOF, I have hereunto set my hand and affixed my official seal, the day and year first above written.

| Print name of Notary Public | |

| Notary Public in and for the State of | |

| Washington, residing at ___________. | |

| My commission expires _____________. |

| STATE OF WASHINGTON | ) |

| ) ss. | |

| COUNTY OF KING | ) |

This is to certify that on this _____ day of May, 2017, before me the undersigned, a Notary Public in and for the State of Washington, duly commissioned and qualified, personally appeared_________________________________ , managing member of BUILDING ACCOUNT L.L.C., to me known to be the individual described in and who executed the within and foregoing instrument on behalf of BUILDING ACCOUNT L.L.C. and acknowledged to me that he signed and sealed the same as his free and voluntary act and deed, for the uses and purposes therein mentioned and that he have the authority to do so.

IN WITNESS WHEREOF, I have hereunto set my hand and affixed my official seal, the day and year first above written

| Print name of Notary Public | |

| Notary Public in and for the State of | |

| Washington, residing at _________. | |

| My commission expires: __________. |

COMMERCIAL LEASE - PAGE 10

EXHIBIT “A”

The westerly portion of that warehouse building measuring approximately 44 feet by 72 feet in depth (approximately 3,168 square feet) situated upon the following legally described real estate:

Lots 7 and 8, Block 164, Gilman Park, records of King County Washington, together with parking to the north of the westerly 44 feet of above described building.

Commonly known as 917 NW 49th Street, Seattle, WA 98107.

COMMERCIAL LEASE - PAGE 11