Exhibit 99.1

OTCQX: GRWG 1 2019 Gateway Conference - September 4 th - 5 th growgeneration.com OTCQX: GRWG

OTCQX: GRWG 2 Safe Harbor Statement This presentation is being provided for information purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any of the Company’s securities . This presentation is not intended, nor should it be distributed, for advertising purposes, nor is it intended for broadcast or publication to the general public . Any such offer of the Company’s securities will only be made in compliance with applicable state and federal securities laws pursuant to a prospectus or an offering memorandum and related offering documents which will be provided to qualified prospective investors upon request . This presentation may include predictions, estimates or other information that might be considered forward - looking within the meaning of applicable securities laws . While these forward - looking statements represent our current judgments, they are subject to risks and uncertainties that could cause actual results to differ materially . You are cautioned not to place undue reliance on these forward - looking statements, which reflect our opinions only as of the date of this presentation . Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward - looking statements in light of new information or future events . When used herein, words such as "look forward," "believe," "continue," "building," or variations of such words and similar expressions are intended to identify forward - looking statements . Factors that could cause actual results to differ materially from those contemplated in any forward - looking statements made by us herein are often discussed in filings we make with the United States Securities and Exchange Commission, available at : www . sec . gov, and on our website, at : www . growgeneration . com . growgeneration.com

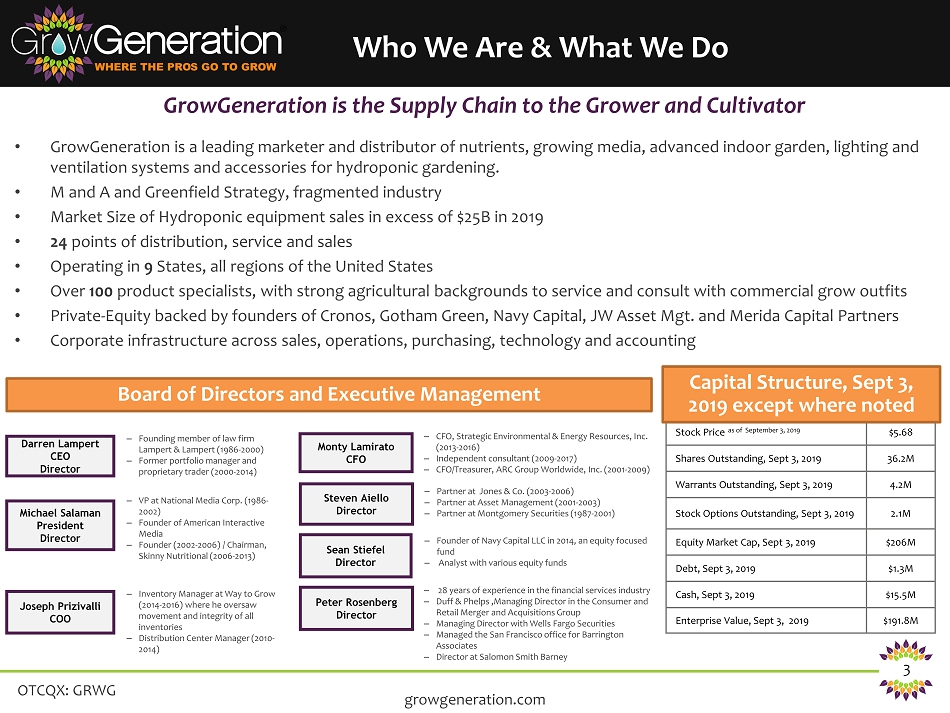

OTCQX: GRWG 3 • GrowGeneration is a leading marketer and distributor of nutrients, growing media, advanced indoor garden, lighting and ventilation systems and accessories for hydroponic gardening. • M and A and Greenfield Strategy, fragmented industry • Market Size of Hydroponic equipment sales in excess of $25B in 2019 • 24 points of distribution, service and sales • Operating in 9 States, all regions of the United States • Over 100 product specialists, with strong agricultural backgrounds to service and consult with commercial grow outfits • Private - Equity backed by founders of Cronos, Gotham Green, Navy Capital, JW Asset Mgt. and Merida Capital Partners • Corporate infrastructure across sales, operations, purchasing, technology and accounting GrowGeneration is the Supply Chain to the Grower and Cultivator growgeneration.com Stock Price as of September 3, 2019 $5.68 Shares Outstanding, Sept 3, 2019 36.2M Warrants Outstanding, Sept 3, 2019 4.2M Stock Options Outstanding, Sept 3, 2019 2.1M Equity Market Cap, Sept 3, 2019 $206M Debt, Sept 3, 2019 $1.3M Cash, Sept 3, 2019 $15.5M Enterprise Value, Sept 3, 2019 $191.8M Capital Structure, Sept 3, 2019 except where noted Board of Directors and Executive Management Darren Lampert CEO Director Michael Salaman President Director Joseph Prizivalli COO ‒ Founding member of law firm Lampert & Lampert (1986 - 2000) ‒ Former portfolio manager and proprietary trader (2000 - 2014) ‒ VP at National Media Corp. (1986 - 2002) ‒ Founder of American Interactive Media ‒ Founder (2002 - 2006) / Chairman, Skinny Nutritional (2006 - 2013) ‒ Inventory Manager at Way to Grow (2014 - 2016) where he oversaw movement and integrity of all inventories ‒ Distribution Center Manager (2010 - 2014) Steven Aiello Director Sean Stiefel Director ‒ Partner at Jones & Co. (2003 - 2006) ‒ Partner at Asset Management (2001 - 2003) ‒ Partner at Montgomery Securities (1987 - 2001) ‒ Founder of Navy Capital LLC in 2014, an equity focused fund ‒ Analyst with various equity funds Monty Lamirato CFO ‒ CFO, Strategic Environmental & Energy Resources, Inc. (2013 - 2016) ‒ Independent consultant (2009 - 2017) ‒ CFO/Treasurer, ARC Group Worldwide, Inc. (2001 - 2009) Peter Rosenberg Director ‒ 28 years of experience in the financial services industry ‒ Duff & Phelps ,Managing Director in the Consumer and Retail Merger and Acquisitions Group ‒ Managing Director with Wells Fargo Securities ‒ Managed the San Francisco office for Barrington Associates ‒ Director at Salomon Smith Barney Who We Are & What We Do

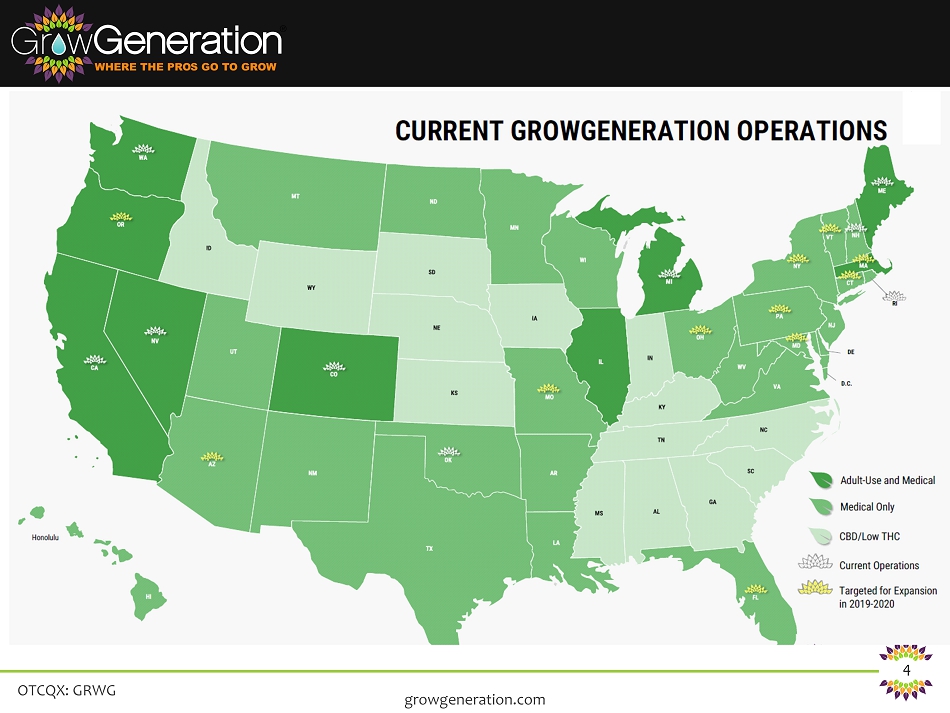

OTCQX: GRWG 4 Current GrowGeneration Operations growgeneration.com

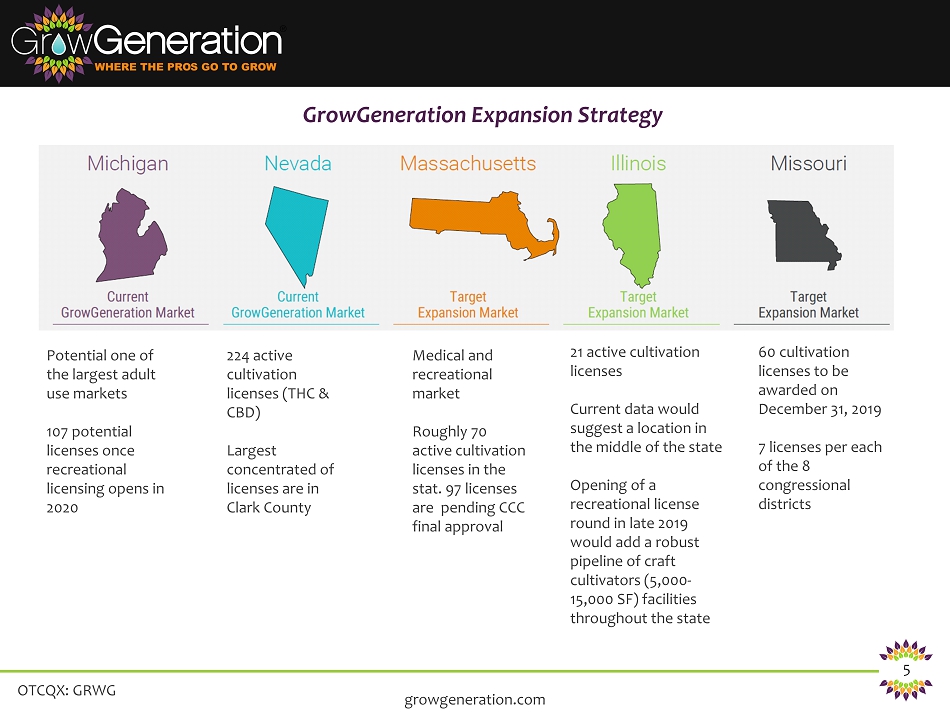

OTCQX: GRWG 5 GrowGeneration Expansion Strategy growgeneration.com Potential one of the largest adult use markets 107 potential licenses once recreational licensing opens in 2020 224 active cultivation licenses (THC & CBD) Largest concentrated of licenses are in Clark County Medical and recreational market Roughly 70 active cultivation licenses in the stat. 97 licenses are pending CCC final approval 21 active cultivation licenses Current data would suggest a location in the middle of the state Opening of a recreational license round in late 2019 would add a robust pipeline of craft cultivators (5,000 - 15,000 SF) facilities throughout the state 60 cultivation licenses to be awarded on December 31, 2019 7 licenses per each of the 8 congressional districts

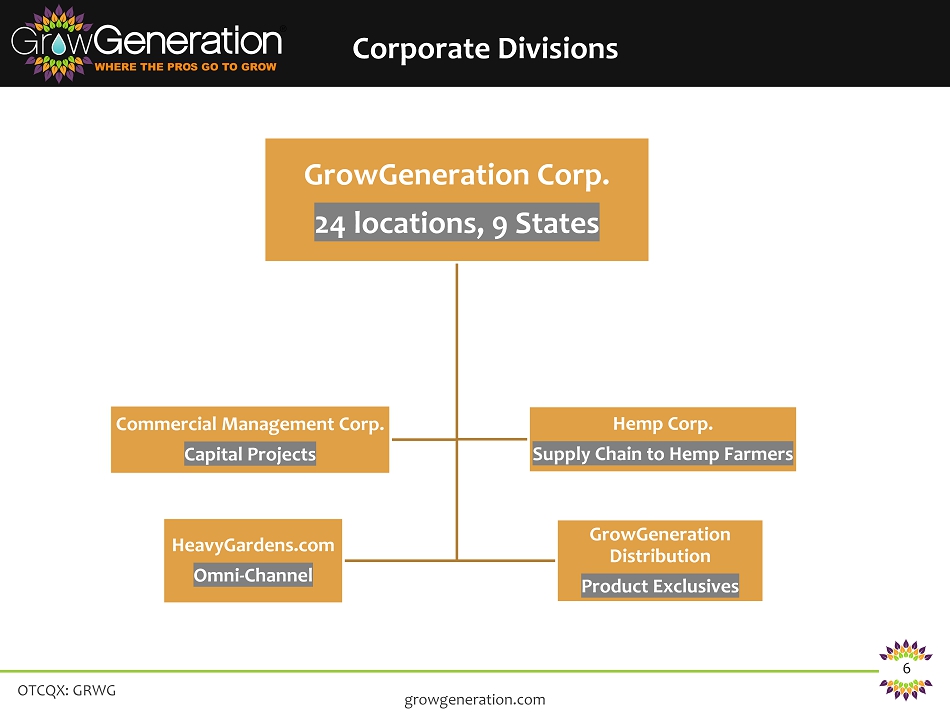

OTCQX: GRWG 6 growgeneration.com GrowGeneration Corp. 24 locations, 9 States HeavyGardens.com Omni - Channel Hemp Corp. Supply Chain to Hemp Farmers Commercial Management Corp. Capital Projects GrowGeneration Distribution Product Exclusives Corporate Divisions

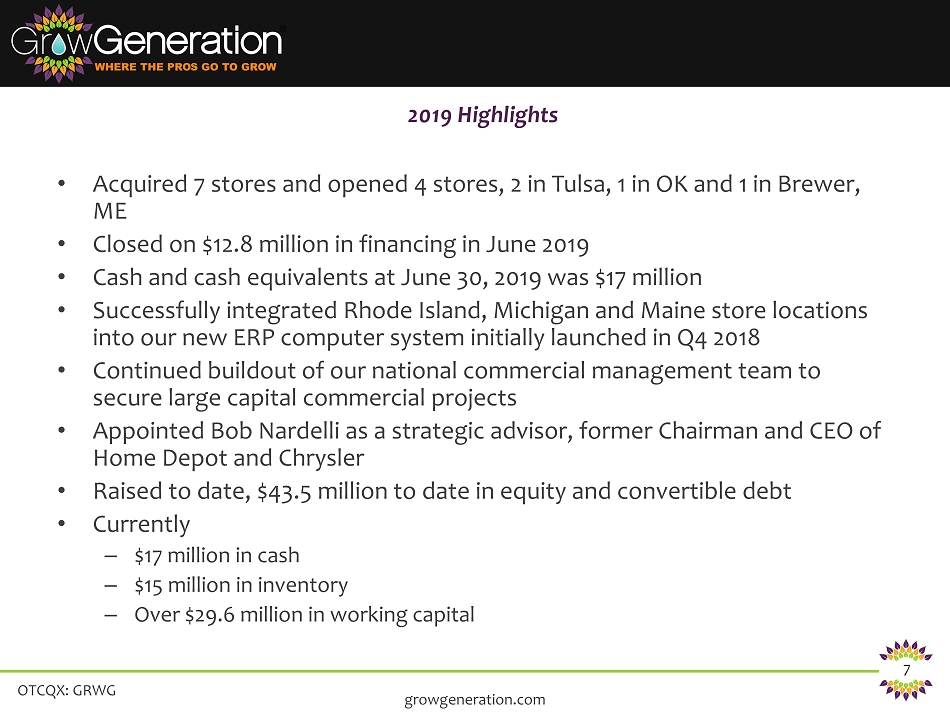

OTCQX: GRWG 7 • Acquired 7 stores and opened 4 stores, 2 in Tulsa, 1 in OK and 1 in Brewer, ME • Closed on $12.8 million in financing in June 2019 • Cash and cash equivalents at June 30, 2019 was $17 million • Successfully integrated Rhode Island, Michigan and Maine store locations into our new ERP computer system initially launched in Q4 2018 • Continued buildout of our national commercial management team to secure large capital commercial projects • Appointed Bob Nardelli as a strategic advisor, former Chairman and CEO of Home Depot and Chrysler • Raised to date, $43.5 million to date in equity and convertible debt • Currently – $17 million in cash – $15 million in inventory – Over $29.6 million in working capital 2019 Highlights growgeneration.com

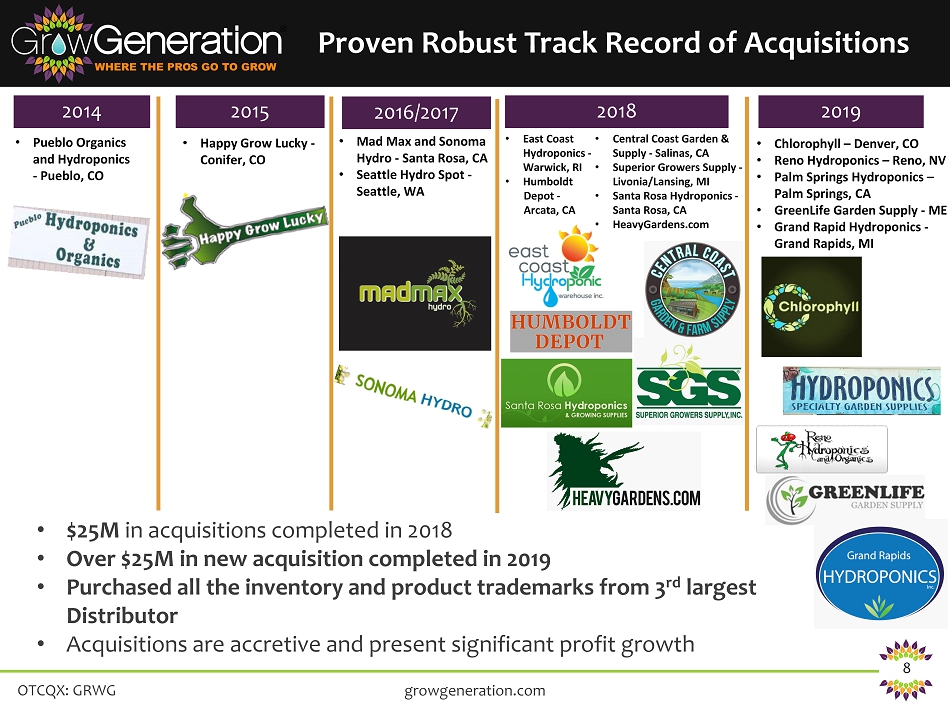

OTCQX: GRWG 8 growgeneration.com 2016/2017 2015 2014 2018 • $25M in acquisitions completed in 2018 • Over $25M in new acquisition completed in 2019 • Purchased all the inventory and product trademarks from 3 rd largest Distributor • Acquisitions are accretive and present significant profit growth • East Coast Hydroponics - Warwick, RI • Humboldt Depot - Arcata, CA • Mad Max and Sonoma Hydro - Santa Rosa, CA • Seattle Hydro Spot - Seattle, WA • Happy Grow Lucky - Conifer, CO • Pueblo Organics and Hydroponics - Pueblo, CO 2019 • Chlorophyll – Denver, CO • Reno Hydroponics – Reno, NV • Palm Springs Hydroponics – Palm Springs, CA • GreenLife Garden Supply - ME • Grand Rapid Hydroponics - Grand Rapids, MI • Central Coast Garden & Supply - Salinas, CA • Superior Growers Supply - Livonia/Lansing, MI • Santa Rosa Hydroponics - Santa Rosa, CA • HeavyGardens.com Proven Robust Track Record of Acquisitions

OTCQX: GRWG 9 growgeneration.com Oklahoma City, OK Santa Rosa, CA GrowGeneration Locations

OTCQX: GRWG 10 growgeneration.com Livonia, MI GrowGeneration Locations

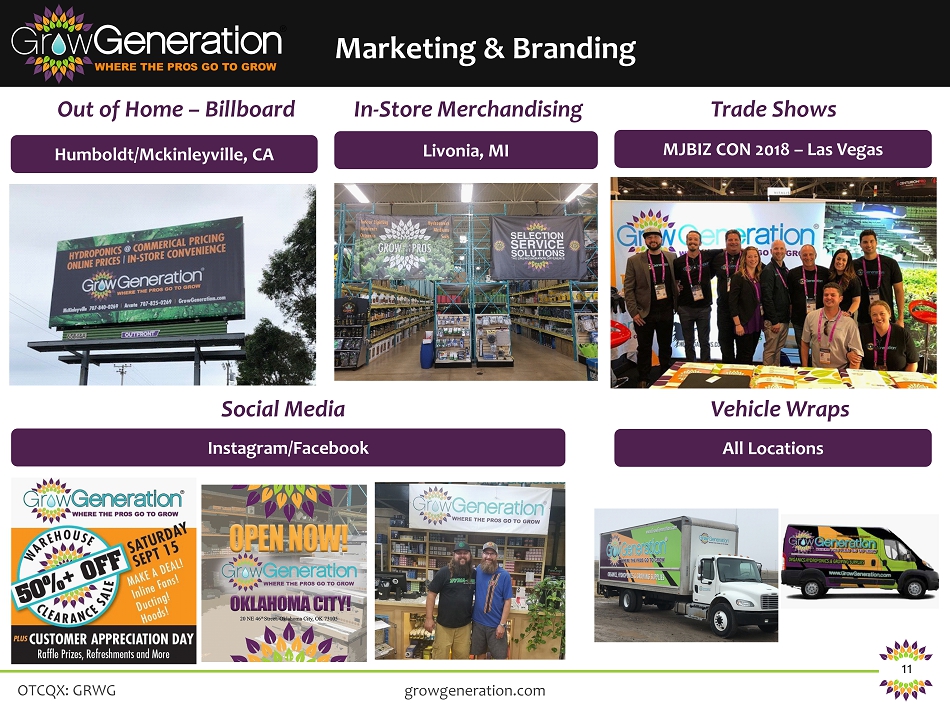

OTCQX: GRWG 11 growgeneration.com Humboldt/Mckinleyville, CA Out of Home – Billboard In - Store Merchandising Livonia, MI Vehicle Wraps Trade Shows MJBIZ CON 2018 – Las Vegas Social Media Instagram/Facebook All Locations Marketing & Branding

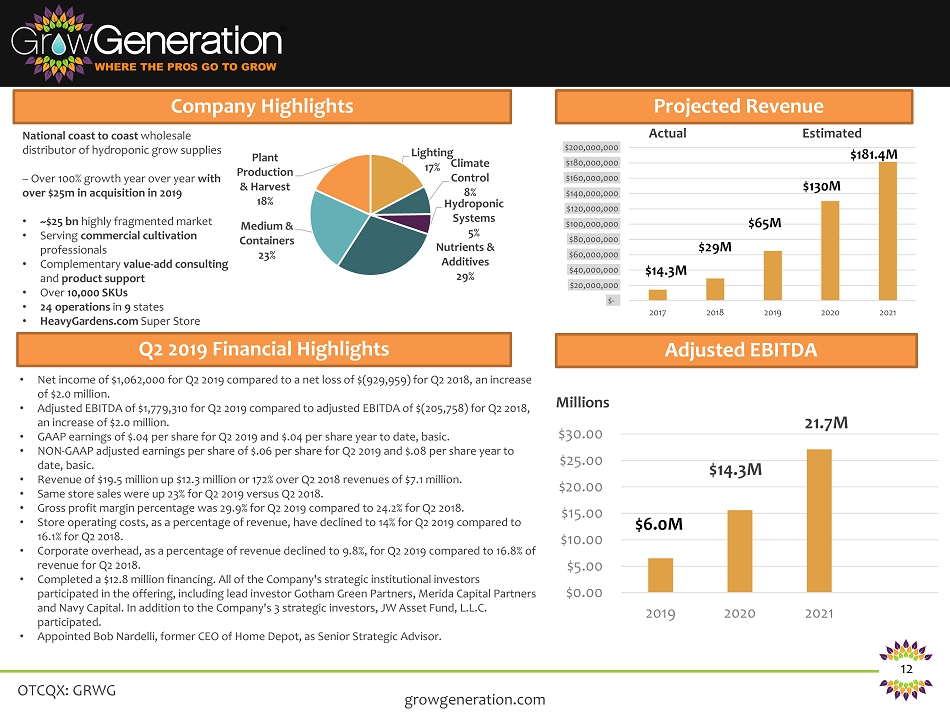

OTCQX: GRWG 12 growgeneration.com National coast to coast wholesale distributor of hydroponic grow supplies – Over 100% growth year over year with over $25m in acquisition in 2019 • ~$25 bn highly fragmented market • Serving commercial cultivation professionals • Complementary value - add consulting and product support • Over 10,000 SKUs • 24 operations in 9 states • HeavyGardens.com Super Store Lighting 17% Climate Control 8% Hydroponic Systems 5% Nutrients & Additives 29% Medium & Containers 23% Plant Production & Harvest 18% $- $20,000,000 $40,000,000 $60,000,000 $80,000,000 $100,000,000 $120,000,000 $140,000,000 $160,000,000 $180,000,000 $200,000,000 2017 2018 2019 2020 2021 $14.3M $29M $65M $130M $181.4M Projected Revenue Company Highlights Adjusted EBITDA $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 2019 2020 2021 21.7M $14.3M $6.0M Q2 2019 Financial Highlights • Net income of $1,062,000 for Q2 2019 compared to a net loss of $(929,959) for Q2 2018, an increase of $2.0 million. • Adjusted EBITDA of $1,779,310 for Q2 2019 compared to adjusted EBITDA of $(205,758) for Q2 2018, an increase of $2.0 million. • GAAP earnings of $.04 per share for Q2 2019 and $.04 per share year to date, basic. • NON - GAAP adjusted earnings per share of $.06 per share for Q2 2019 and $.08 per share year to date, basic. • Revenue of $19.5 million up $12.3 million or 172% over Q2 2018 revenues of $7.1 million. • Same store sales were up 23% for Q2 2019 versus Q2 2018. • Gross profit margin percentage was 29.9% for Q2 2019 compared to 24.2% for Q2 2018. • Store operating costs, as a percentage of revenue, have declined to 14% for Q2 2019 compared to 16.1% for Q2 2018. • Corporate overhead, as a percentage of revenue declined to 9.8%, for Q2 2019 compared to 16.8% of revenue for Q2 2018. • Completed a $12.8 million financing. All of the Company's strategic institutional investors participated in the offering, including lead investor Gotham Green Partners, Merida Capital Partners and Navy Capital. In addition to the Company's 3 strategic investors, JW Asset Fund, L.L.C. participated. • Appointed Bob Nardelli, former CEO of Home Depot, as Senior Strategic Advisor. Actual Estimated Millions

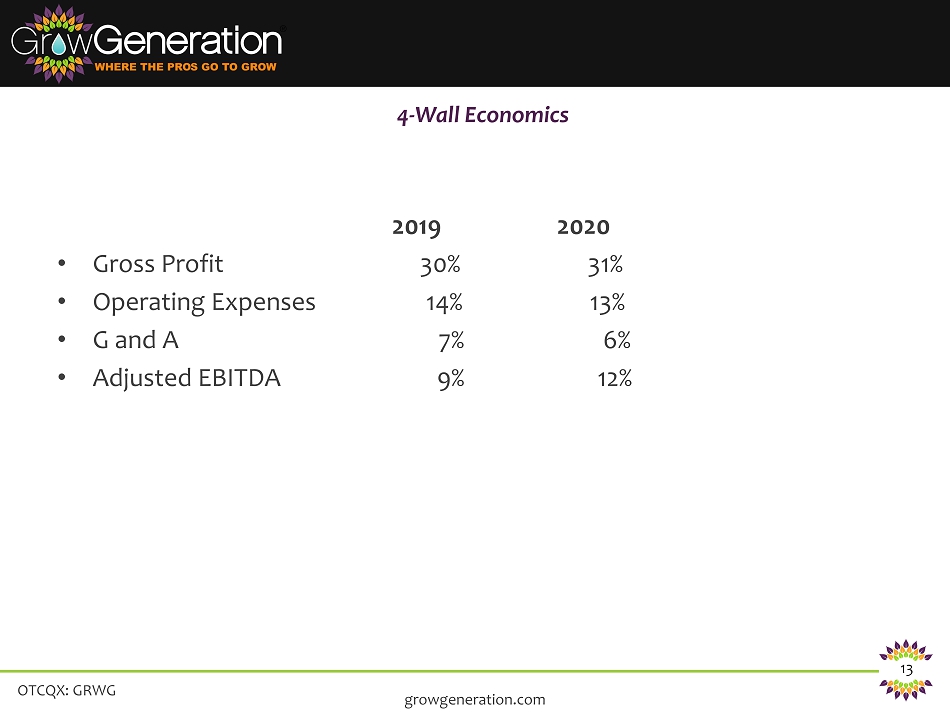

OTCQX: GRWG 13 2019 2020 • Gross Profit 30% 31% • Operating Expenses 14% 13% • G and A 7% 6% • Adjusted EBITDA 9% 12% 4 - Wall Economics growgeneration.com

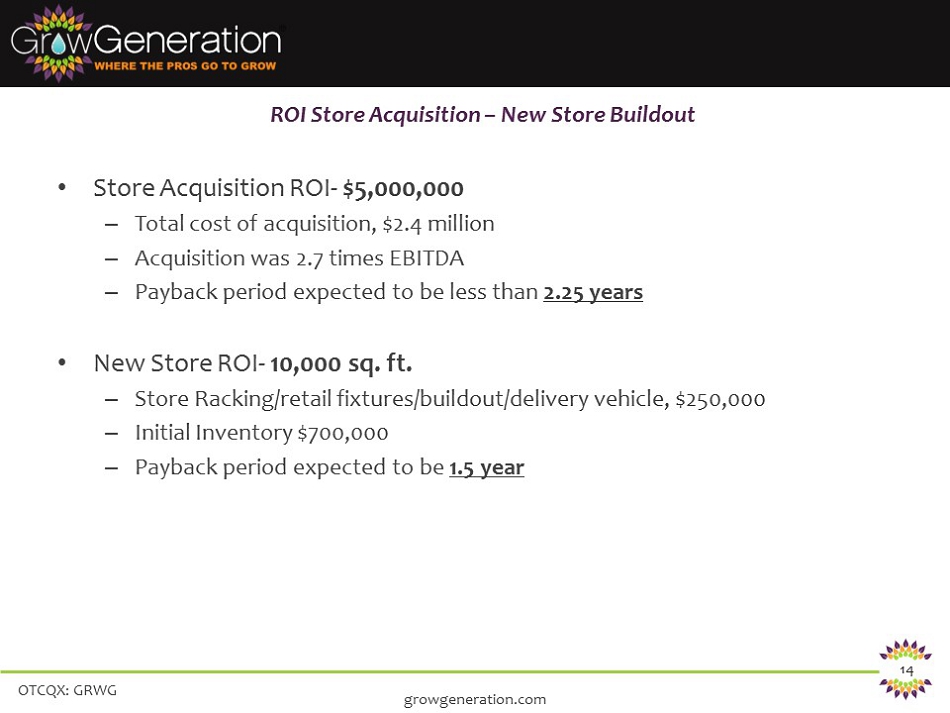

OTCQX: GRWG 14 • Store Acquisition ROI - $5,000,000 – Total cost of acquisition, $2.4 million – Acquisition was 2.7 times EBITDA – Payback period expected to be less than 2.25 years • New Store ROI - 10,000 sq. ft. – Store Racking/retail fixtures/buildout/delivery vehicle, $250,000 – Initial Inventory $700,000 – Payback period expected to be 1.5 year ROI Store Acquisition – New Store Buildout growgeneration.com

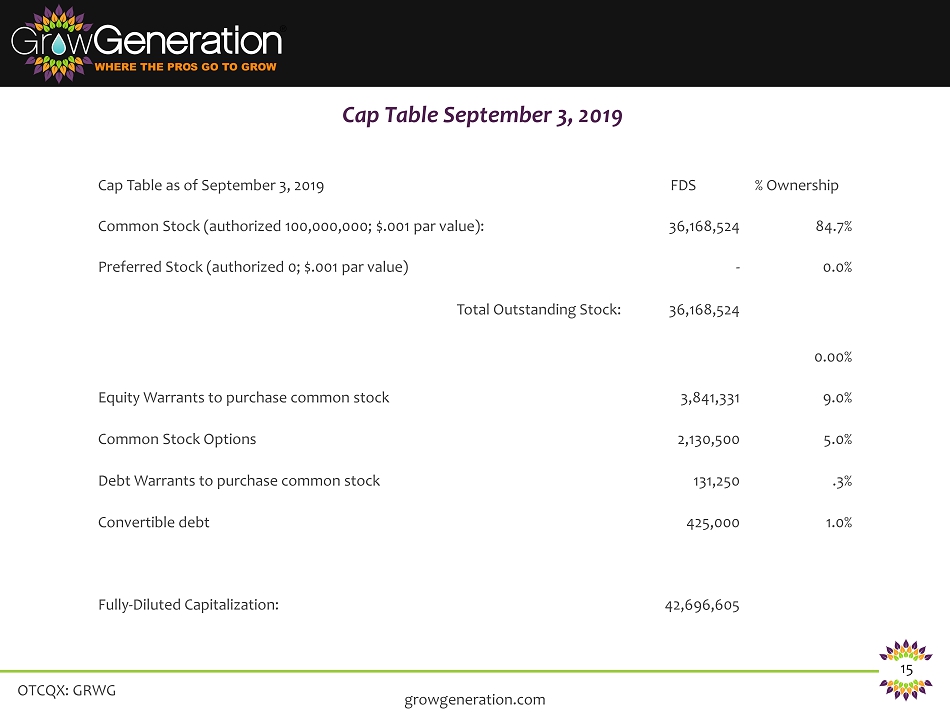

OTCQX: GRWG 15 Cap Table September 3, 2019 growgeneration.com Cap Table as of September 3, 2019 FDS % Ownership Common Stock (authorized 100,000,000; $.001 par value): 36,168,524 84.7% Preferred Stock (authorized 0; $.001 par value) - 0.0% Total Outstanding Stock: 36,168,524 0.00% Equity Warrants to purchase common stock 3,841,331 9.0% Common Stock Options 2,130,500 5.0% Debt Warrants to purchase common stock 131,250 .3% Convertible debt 425,000 1.0% Fully - Diluted Capitalization: 42,696,605

OTCQX: GRWG 16 • Store acquisitions closed to date, over $25M in revenue • Demonstrated ability to open new stores in new markets in 45 - 60 days (organic growth) • Strong pipeline of over $50M of M and A • 3 New locations plan to open in Q4 • Annualized purchasing power of over $50M resulting in increased margins • Operating profits increasing at the store level, as store operating expenses continue to decline, to less than 15% of revenue in 2019 • Selling, general and administrative expenses continue to decline as a percentage of revenue to less than 4% in 2019. Current corporate infrastructure allows us to fully integrate an acquisition immediately and eliminate duplicative cost from the target acquisitions previous P&L. • Proprietary and exclusive products, adding greater margins • Guidance at $65 - 70M/Adjusted Earnings $6.0M Fueling Growth: Plan to $250M+ Revenue growgeneration.com Key Performance Executables for 2019

OTCQX: GRWG 17 Company Contact Darren Lampert , Chief Executive Officer Michael Salaman , President GrowGeneration Corp., Denver, CO Tel 800.935.8420 | darren@growgeneration.com growgeneration.com Contacts