Exhibit 99.1

NASDAQ: GRWG 1 GrowGeneration Corp. Investor Presentation ICR Conference 2020 NASDAQ: GRWG

NASDAQ: GRWG 2 Safe Harbor Statement This presentation is being provided for information purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any of the Company’s securities . This presentation is not intended, nor should it be distributed, for advertising purposes, nor is it intended for broadcast or publication to the general public . Any such offer of the Company’s securities will only be made in compliance with applicable state and federal securities laws pursuant to a prospectus or an offering memorandum and related offering documents which will be provided to qualified prospective investors upon request . This presentation may include predictions, estimates or other information that might be considered forward - looking within the meaning of applicable securities laws . While these forward - looking statements represent our current judgments, they are subject to risks and uncertainties that could cause actual results to differ materially . You are cautioned not to place undue reliance on these forward - looking statements, which reflect our opinions only as of the date of this presentation . Please keep in mind that we are not obligating ourselves to revise or publicly release the results of any revision to these forward - looking statements in light of new information or future events . When used herein, words such as "look forward," "believe," "continue," "building," or variations of such words and similar expressions are intended to identify forward - looking statements . Factors that could cause actual results to differ materially from those contemplated in any forward - looking statements made by us herein are often discussed in filings we make with the United States Securities and Exchange Commission, available at : www . sec . gov, and on our website, at : www . growgeneration . com . growgeneration.com

NASDAQ: GRWG 3 • Largest hydroponic and organic product/solutions provider • National Footprint - 26 sales/service centers in 9 states • Expertise - Deep knowledge base with in - house professionals • Full - service product, solutions – from builds to ongoing grows • Diverse Customer Base – Large commercial multi - state operators, regional, local and home growers 75% of business is commercial • Omnichannel – growing direct to grower platform – growgen.pro GrowGeneration is the Supply Chain to the Growers and Cultivators growgeneration.com Who We Are & What We Do

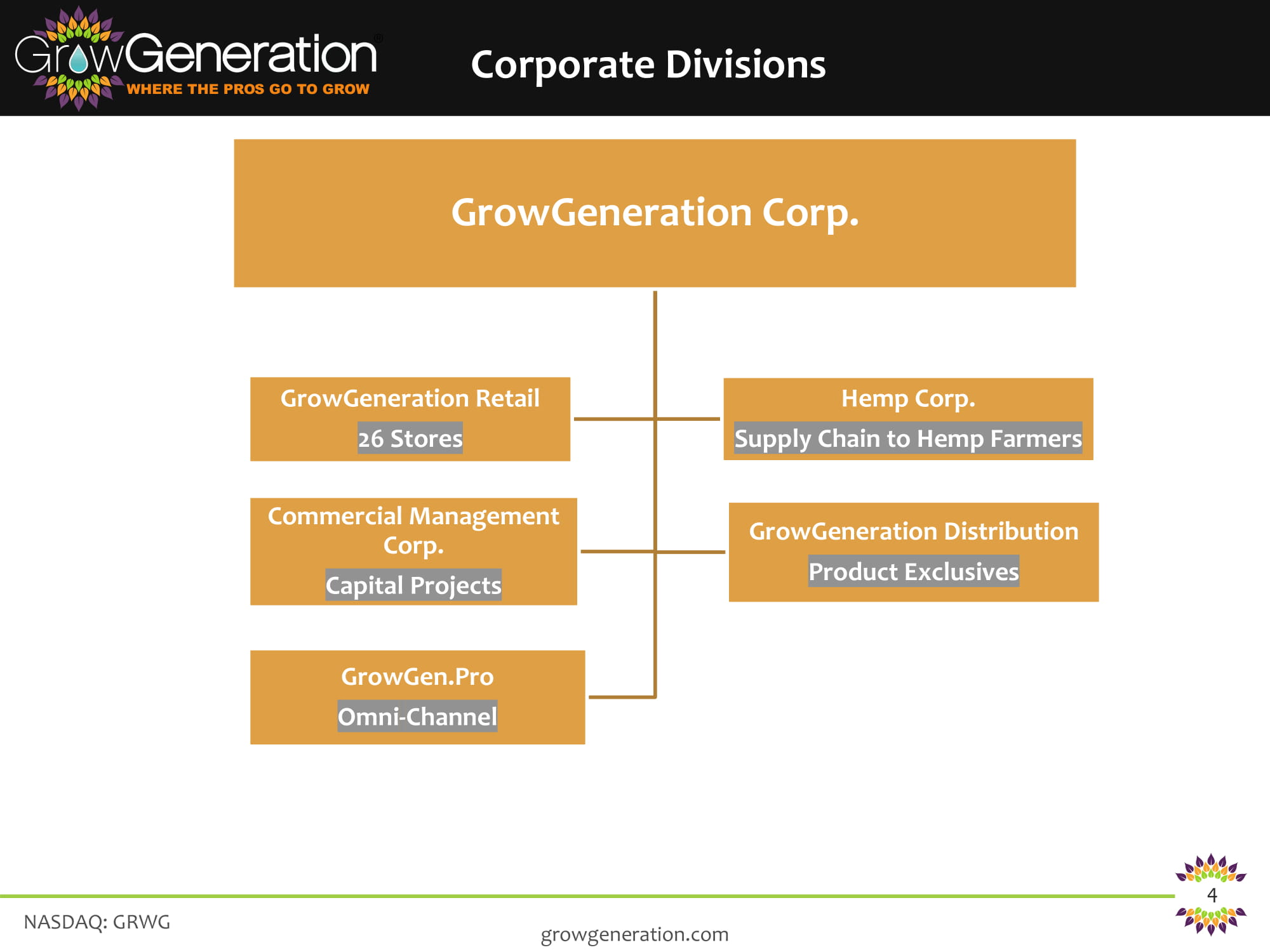

NASDAQ: GRWG 4 growgeneration.com GrowGeneration Corp. GrowGen.Pro Omni - Channel Hemp Corp. Supply Chain to Hemp Farmers Commercial Management Corp. Capital Projects GrowGeneration Distribution Product Exclusives GrowGeneration Retail 26 Stores Corporate Divisions

NASDAQ: GRWG 5 growgeneration.com Livonia, MI GrowGeneration Locations

NASDAQ: GRWG 6 growgeneration.com Oklahoma City, OK Denver, CO GrowGeneration Locations Pueblo, CO

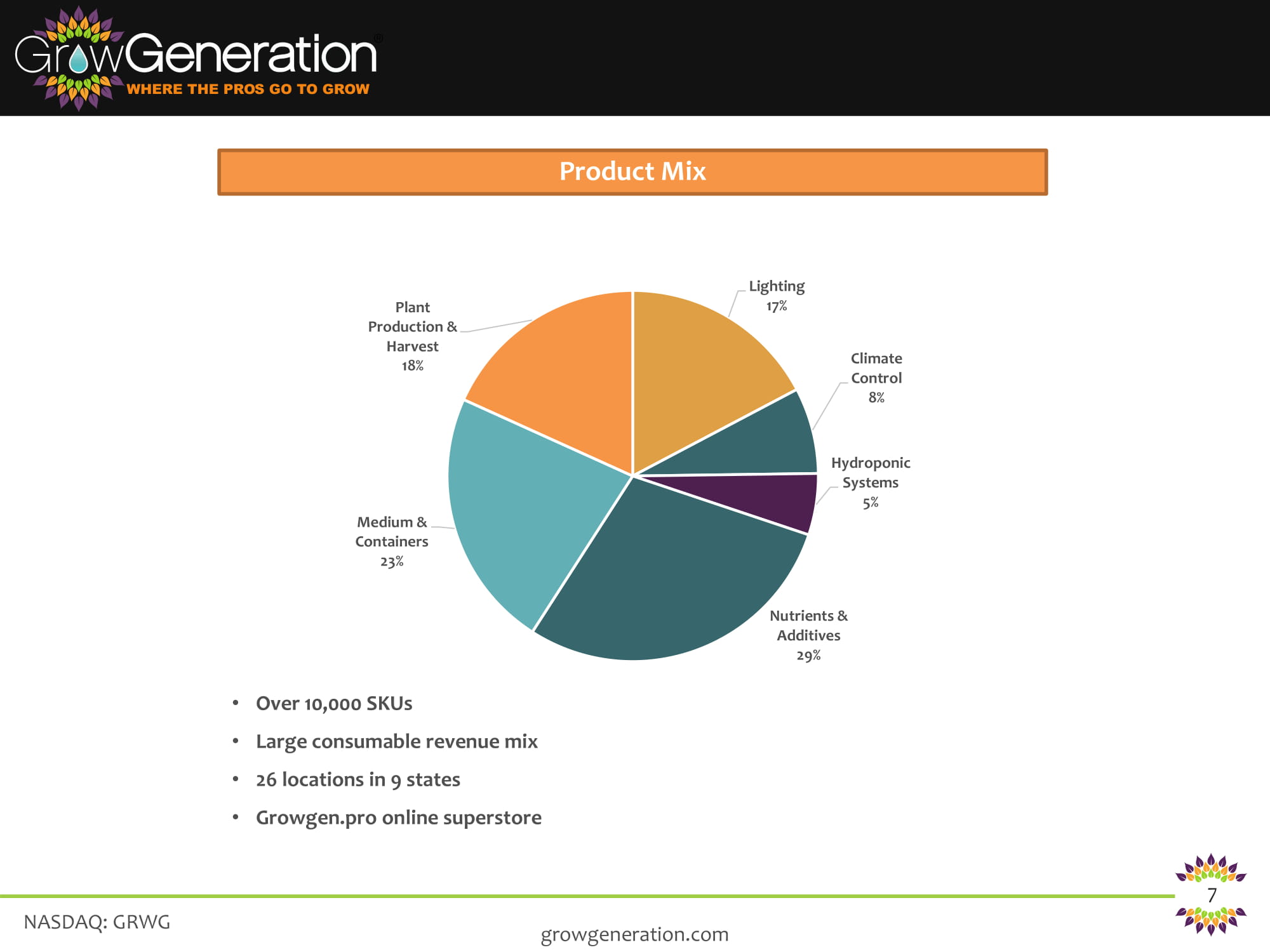

NASDAQ: GRWG 7 growgeneration.com • Over 10,000 SKUs • Large consumable revenue mix • 26 locations in 9 states • Growgen.pro online superstore Lighting 17% Climate Control 8% Hydroponic Systems 5% Nutrients & Additives 29% Medium & Containers 23% Plant Production & Harvest 18% Product Mix

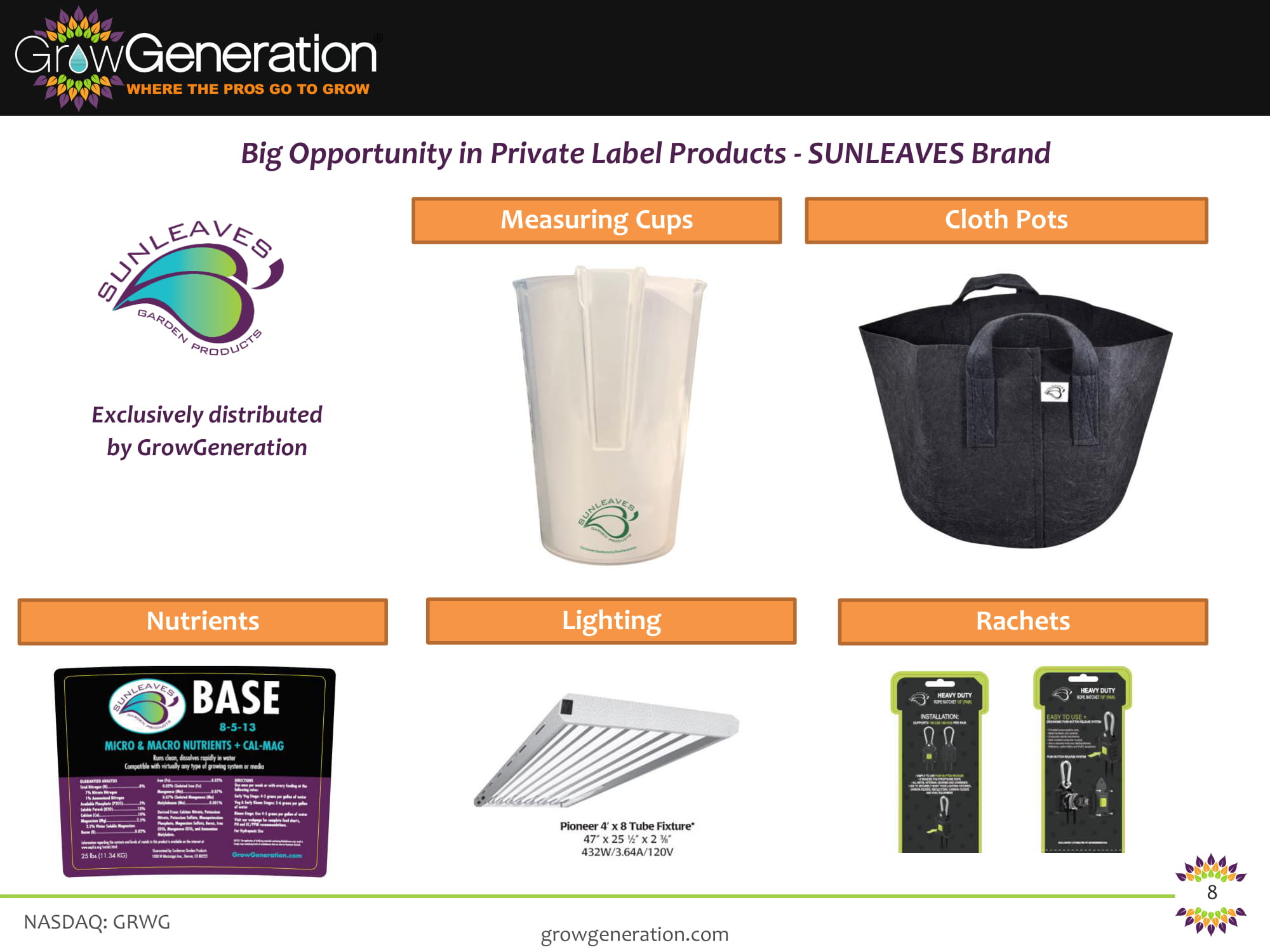

NASDAQ: GRWG 8 Big Opportunity in Private Label Products - SUNLEAVES Brand growgeneration.com Rachets Cloth Pots Measuring Cups Exclusively distributed by GrowGeneration Nutrients Lighting

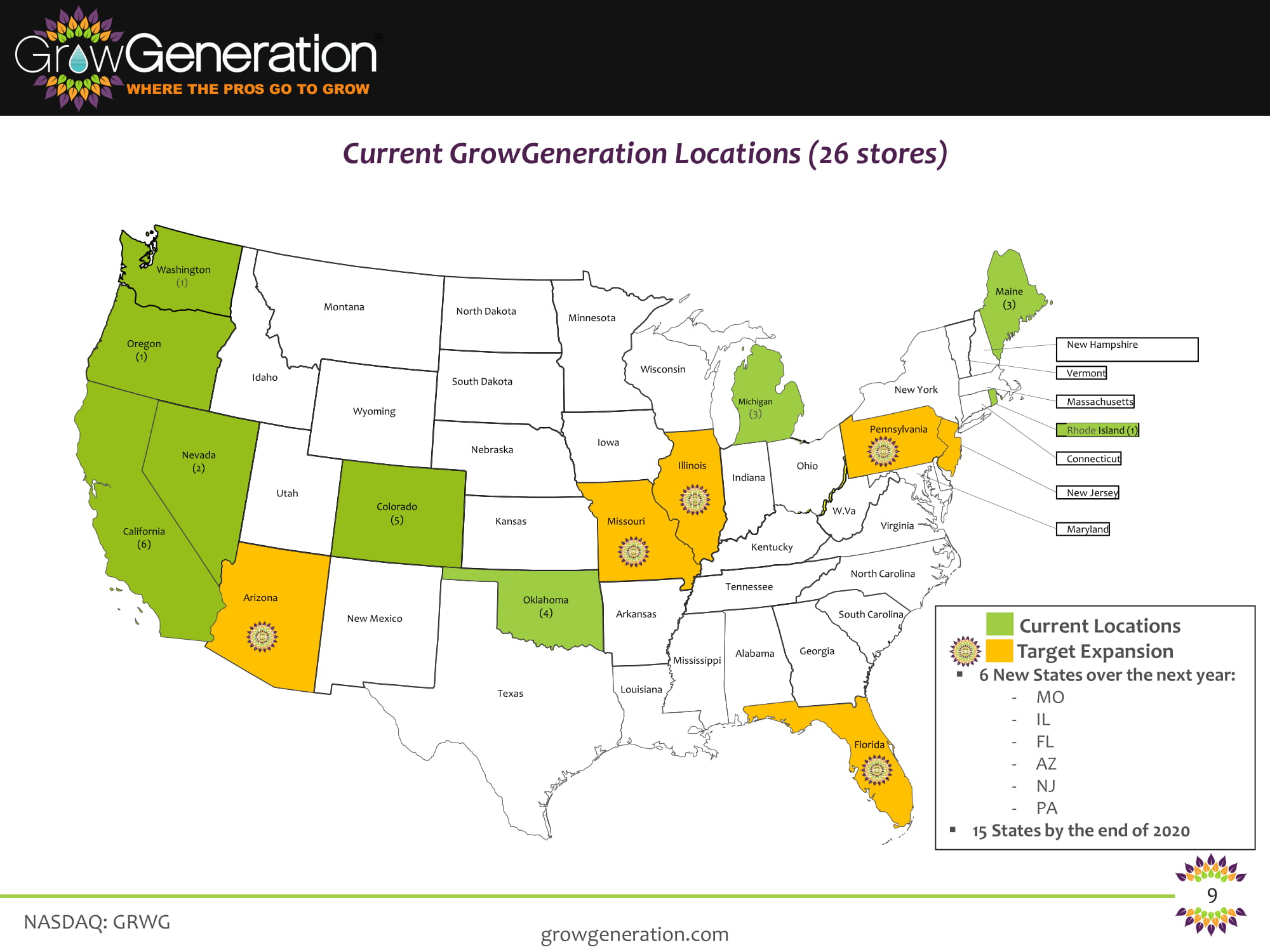

NASDAQ: GRWG 9 Current GrowGeneration Locations (26 stores) growgeneration.com Alabama Arizona Arkansas California (6) Colorado (5) Florida Georgia Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine (3) Massachusetts Michigan (3) Minnesota Mississippi Missouri Montana Nebraska Nevada (2) New Hampshire New Mexico New York North Carolina North Dakota Ohio Oklahoma (4) Oregon (1) Pennsylvania South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington (1) W.Va Wisconsin Wyoming Connecticut Maryland Rhode Island (1) Current Locations Target Expansion ▪ 6 New States over the next year: - MO - IL - FL - AZ - NJ - PA ▪ 15 States by the end of 2020 New Jersey

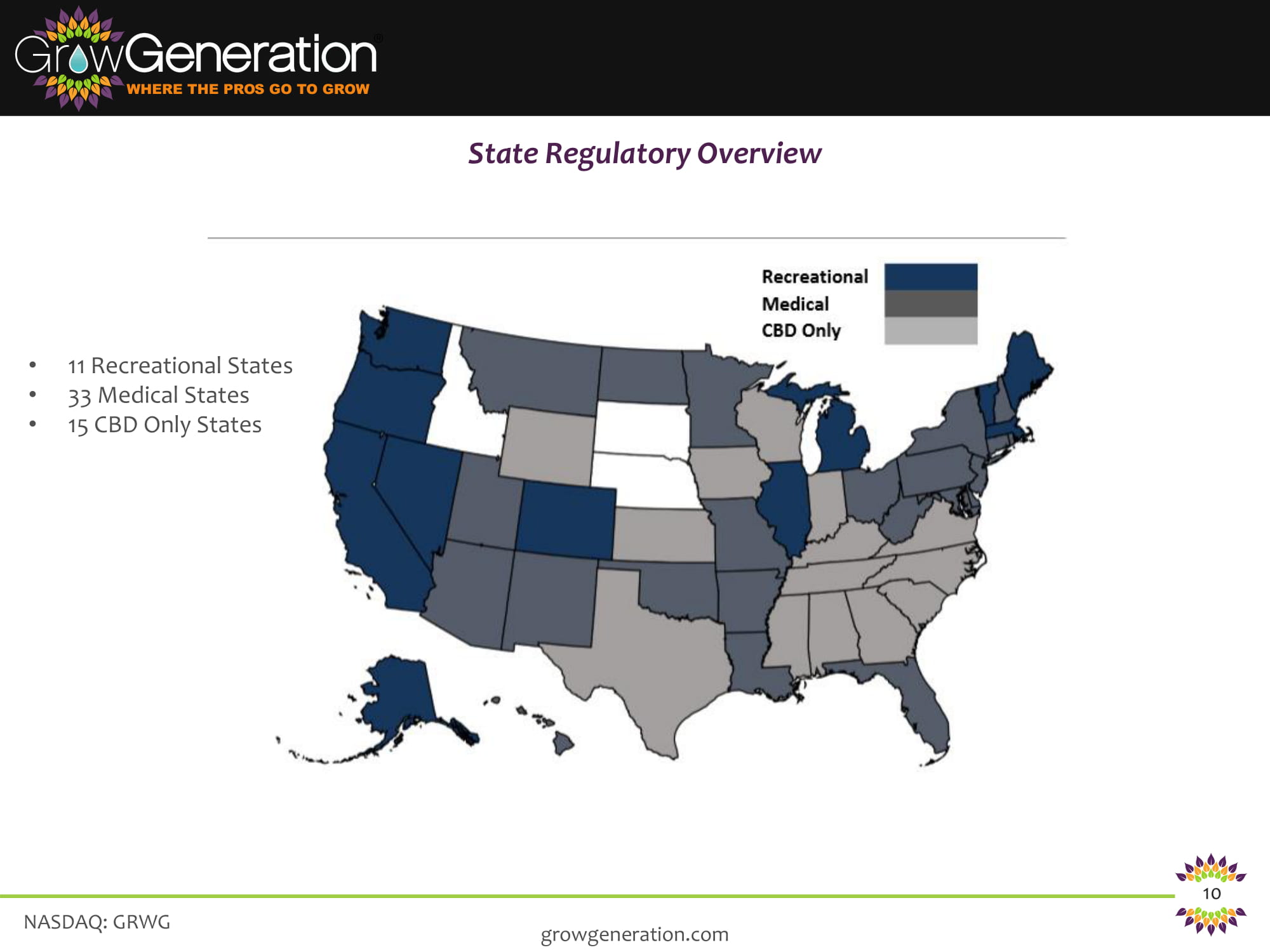

NASDAQ: GRWG 10 State Regulatory Overview growgeneration.com • 11 Recreational States • 33 Medical States • 15 CBD Only States

NASDAQ: GRWG 11 growgeneration.com Humboldt, CA Out of Home – Billboard In - Store Merchandising Livonia, MI Vehicle Wraps Trade Shows MJBIZ CON 2019 – Las Vegas Social Media Instagram/Facebook All Locations Marketing & Branding

NASDAQ: GRWG 12 GrowPro Website – WWW.GrowGen.Pro growgeneration.com Omni channel approach that seeks to provide customers with a seamless online shopping experience

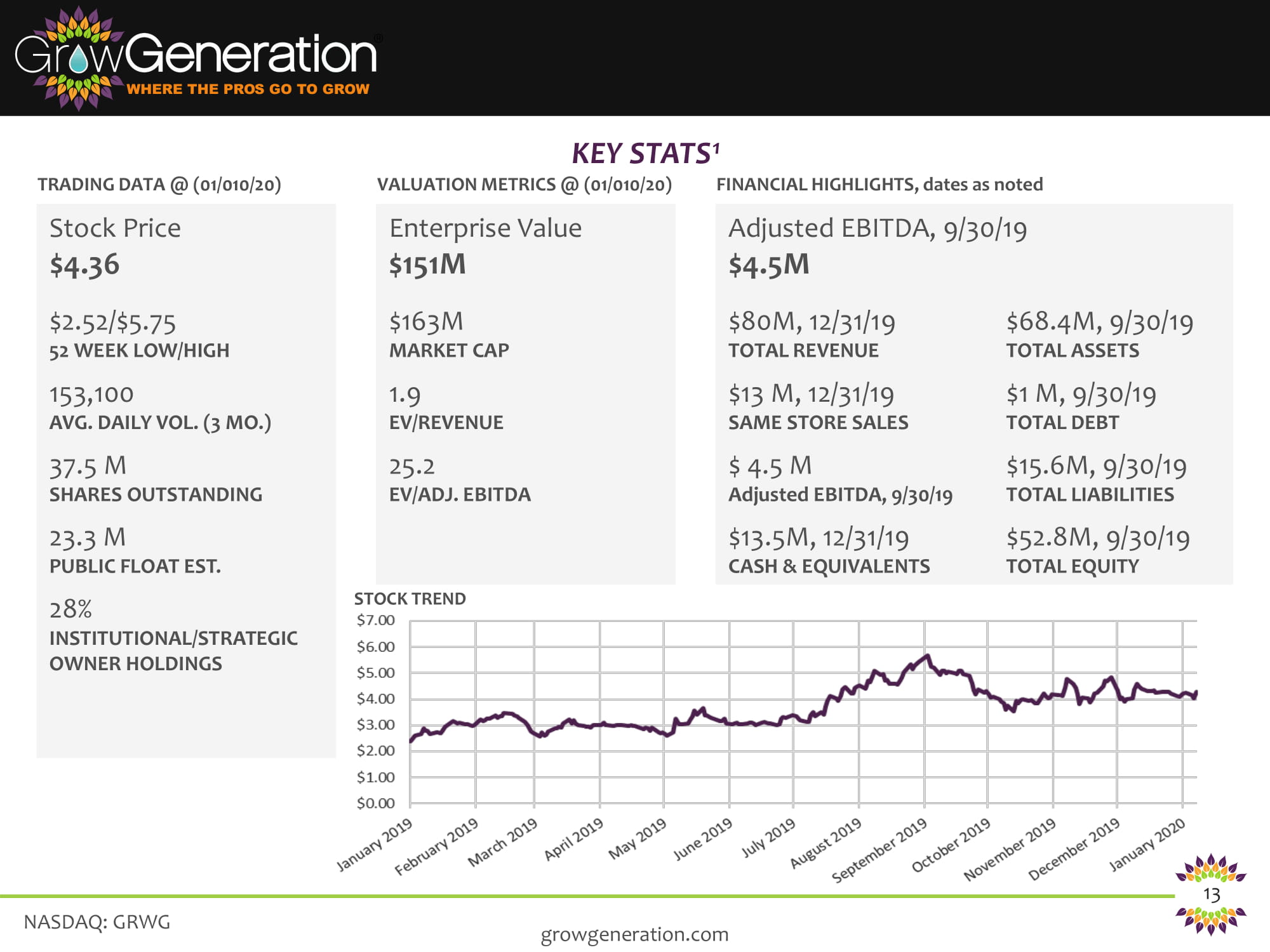

NASDAQ: GRWG 13 KEY STATS¹ growgeneration.com TRADING DATA @ (01/010/20) VALUATION METRICS @ (01/010/20) Adjusted EBITDA, 9/30/19 $4.5M $80M, 12/31/19 TOTAL REVENUE $68.4M, 9/30/19 TOTAL ASSETS $13 M, 12/31/19 SAME STORE SALES $1 M, 9/30/19 TOTAL DEBT $ 4.5 M Adjusted EBITDA, 9/30/19 $15.6M, 9/30/19 TOTAL LIABILITIES $13.5M, 12/31/19 CASH & EQUIVALENTS $52.8M, 9/30/19 TOTAL EQUITY FINANCIAL HIGHLIGHTS, dates as noted STOCK TREND Stock Price $4.36 $2.52/$5.75 52 WEEK LOW/HIGH 153,100 AVG. DAILY VOL. (3 MO.) 37.5 M SHARES OUTSTANDING 23.3 M PUBLIC FLOAT EST. 28% INSTITUTIONAL/STRATEGIC OWNER HOLDINGS Enterprise Value $151M $163M MARKET CAP 1.9 EV/REVENUE 25.2 EV/ADJ. EBITDA

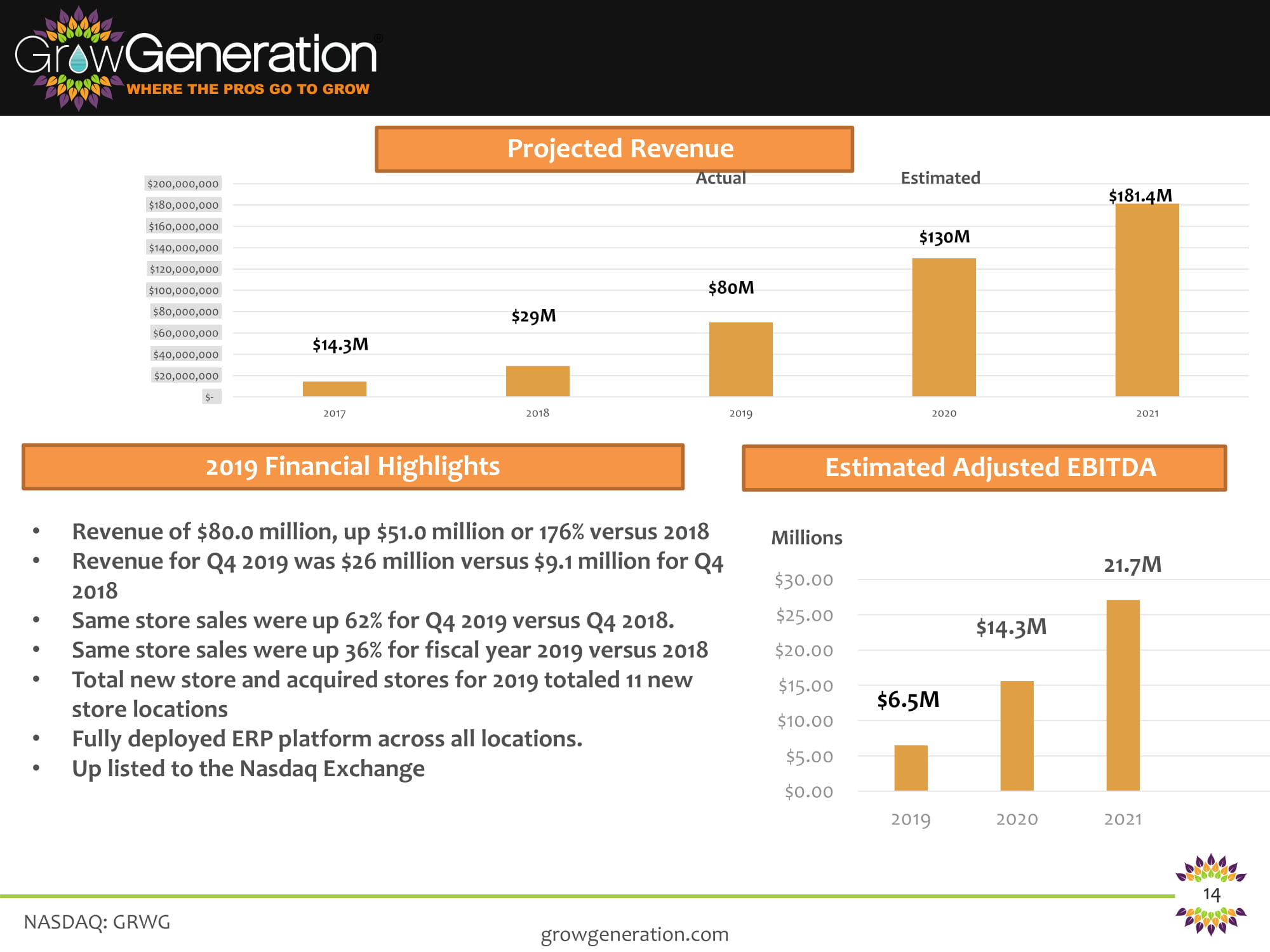

NASDAQ: GRWG 14 growgeneration.com $- $20,000,000 $40,000,000 $60,000,000 $80,000,000 $100,000,000 $120,000,000 $140,000,000 $160,000,000 $180,000,000 $200,000,000 2017 2018 2019 2020 2021 $14.3M $29M $80M $130M $181.4M Projected Revenue Estimated Adjusted EBITDA $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 2019 2020 2021 21.7M $14.3M $6.5M 2019 Financial Highlights Actual Estimated Millions • Revenue of $80.0 million, up $51.0 million or 176% versus 2018 • Revenue for Q4 2019 was $26 million versus $9.1 million for Q4 2018 • Same store sales were up 62% for Q4 2019 versus Q4 2018. • Same store sales were up 36% for fiscal year 2019 versus 2018 • Total new store and acquired stores for 2019 totaled 11 new store locations • Fully deployed ERP platform across all locations. • Up listed to the Nasdaq Exchange

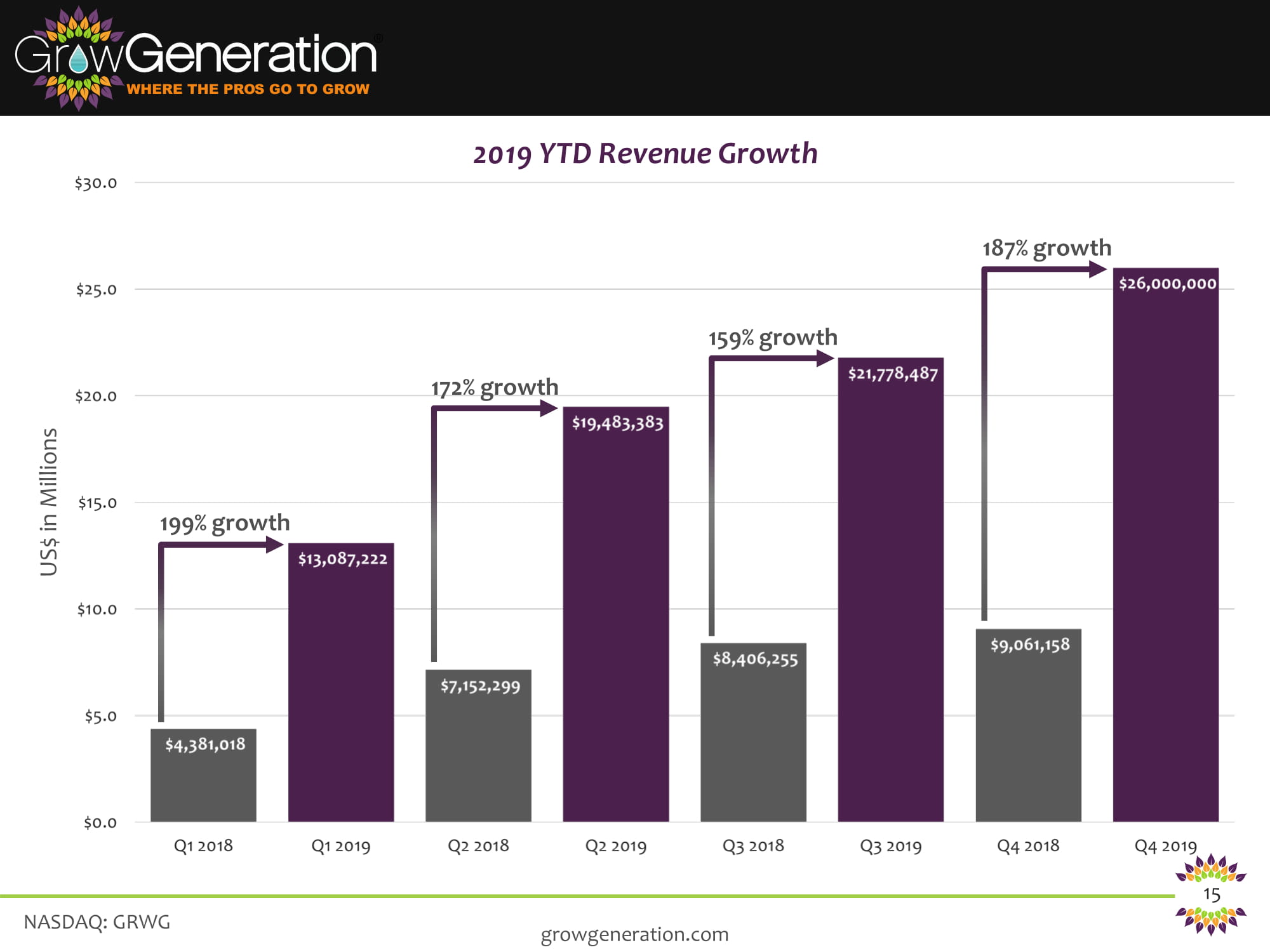

NASDAQ: GRWG 15 2019 YTD Revenue Growth growgeneration.com 199% growth 172% growth 159% growth US$ in Millions 187% growth

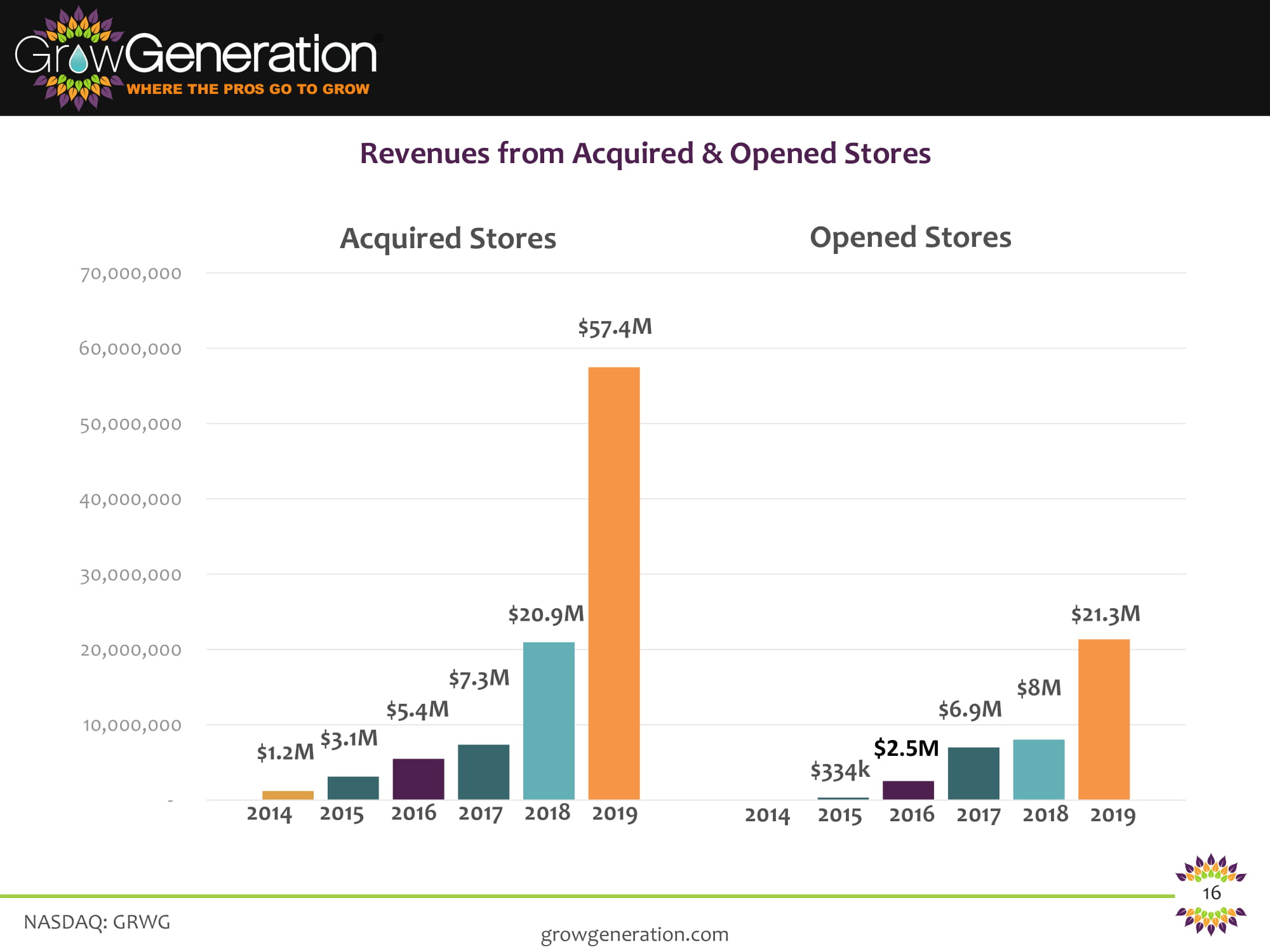

NASDAQ: GRWG 16 Revenues from Acquired & Opened Stores growgeneration.com - 10,000,000 20,000,000 30,000,000 40,000,000 50,000,000 60,000,000 70,000,000 $334k $6.9M $8M $21.3M $2.5M $1.2M $3.1M $7.3M $20.9M $5.4M $57.4M 2014 2015 2016 2017 2018 2019 2014 2015 2016 2017 2018 2019 Acquired Stores Opened Stores

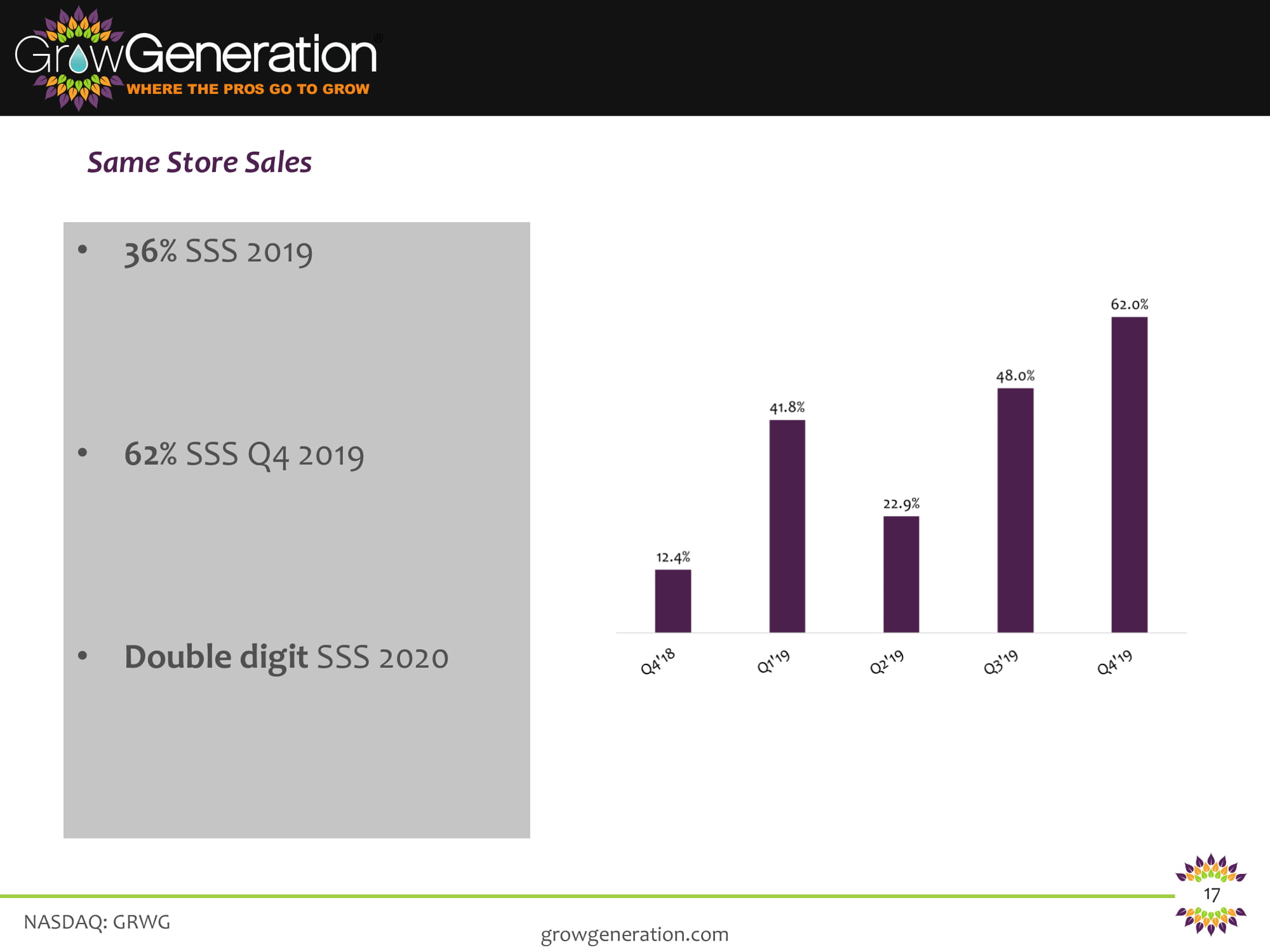

NASDAQ: GRWG 17 Same Store Sales growgeneration.com • 36% SSS 2019 • 62% SSS Q4 2019 • Double digit SSS 2020

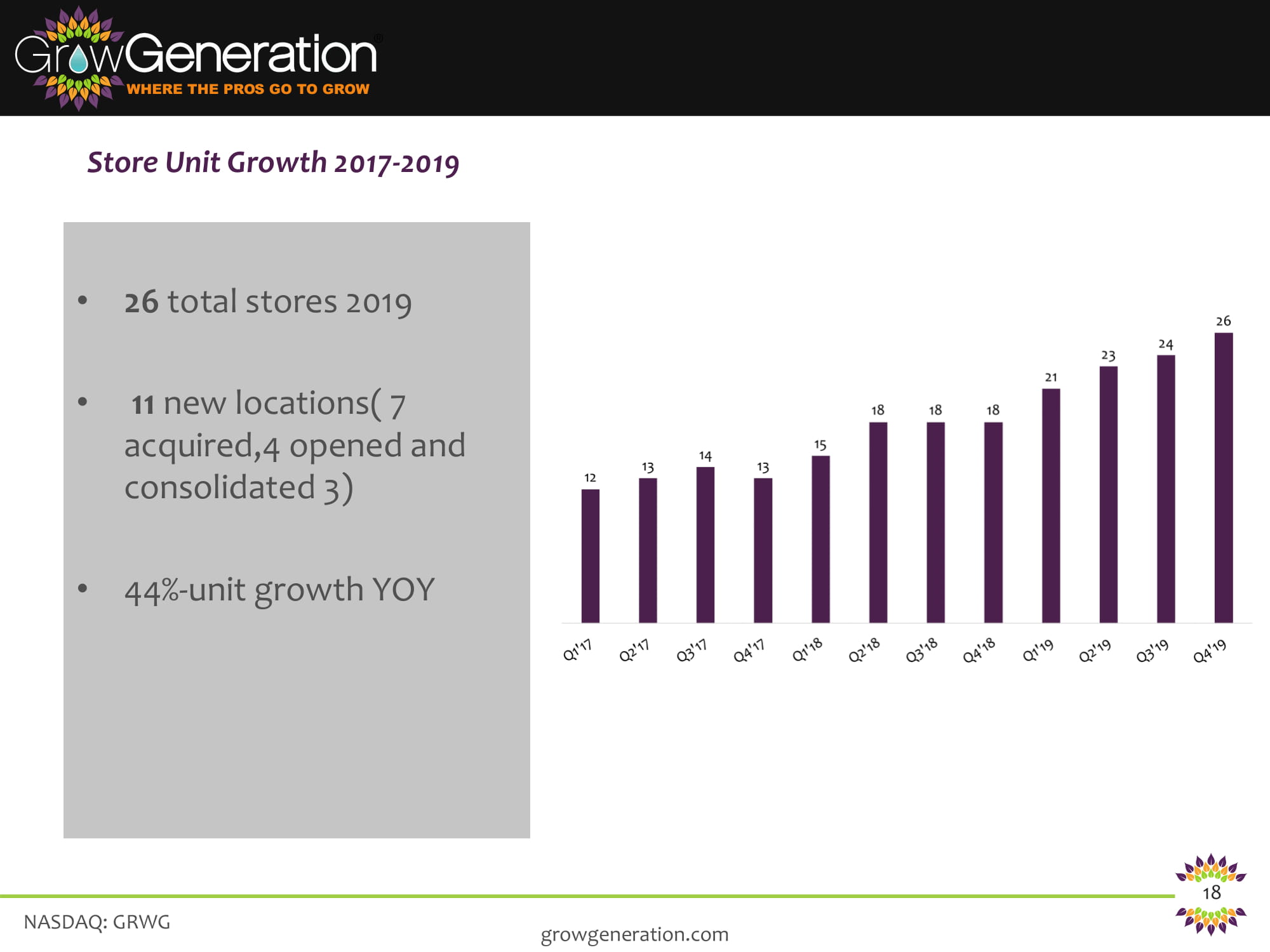

NASDAQ: GRWG 18 Store Unit Growth 2017 - 2019 growgeneration.com • 26 total stores 2019 • 11 new locations( 7 acquired,4 opened and consolidated 3) • 44% - unit growth YOY

NASDAQ: GRWG 19 0 5 10 15 20 25 30 35 40 45 Missouri (2) Illinois (2) Arizona (1) California (LA) (2) Florida (2) Pennysvania (2) New Jersey (2) New Store Growth Plan 2020 - 2021 growgeneration.com *Projected Number of New GrowGeneration Stores (26 stores to date) *28 *31 *31 *33 *37 *35 *39 - 13 new locations over the next 12 months - Average revenue per store - $4M - Same Store Sales will grow by an estimated 20% annually Q1 2020 Q2 2021 Q2 2020 Q3/Q4 2020

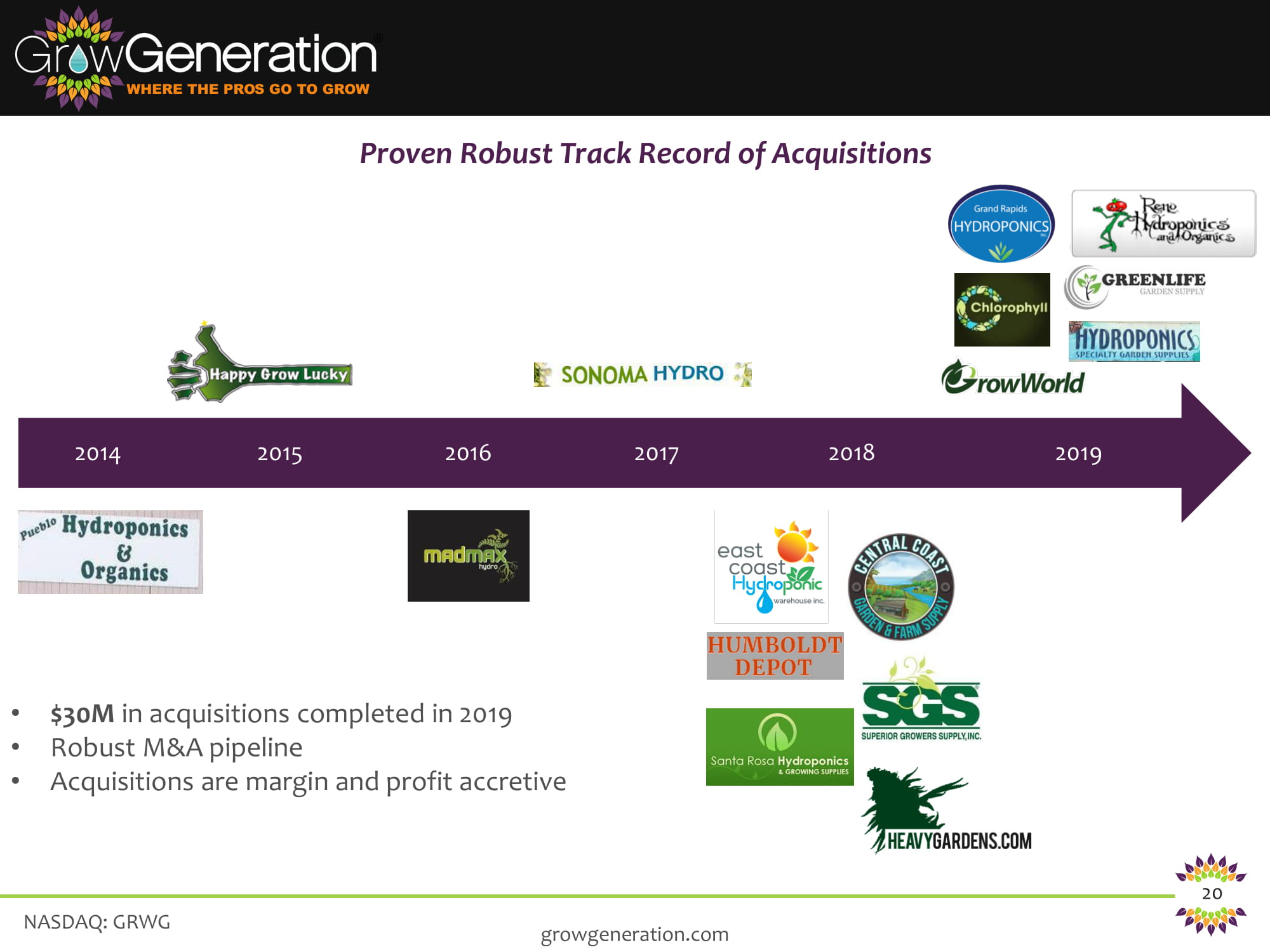

NASDAQ: GRWG 20 Proven Robust Track Record of Acquisitions growgeneration.com 2019 2018 2017 2016 2015 2014 • $30M in acquisitions completed in 2019 • Robust M&A pipeline • Acquisitions are margin and profit accretive

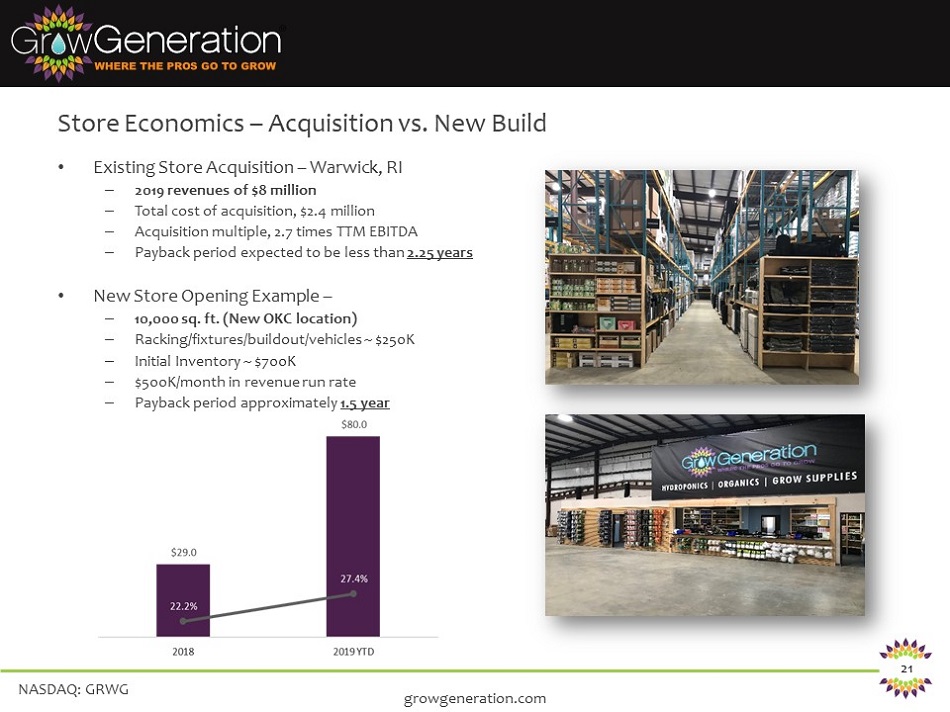

NASDAQ: GRWG 21 • Existing Store Acquisition – Warwick, RI – 2019 revenues of $8 million – Total cost of acquisition, $2.4 million – Acquisition multiple, 2.7 times TTM EBITDA – Payback period expected to be less than 2.25 years • New Store Opening Example – – 10,000 sq. ft. (New OKC location) – Racking/fixtures/buildout/vehicles ~ $250K – Initial Inventory ~ $700K – $500K/month in revenue run rate – Payback period approximately 1.5 year Store Economics – Acquisition vs. New Build growgeneration.com

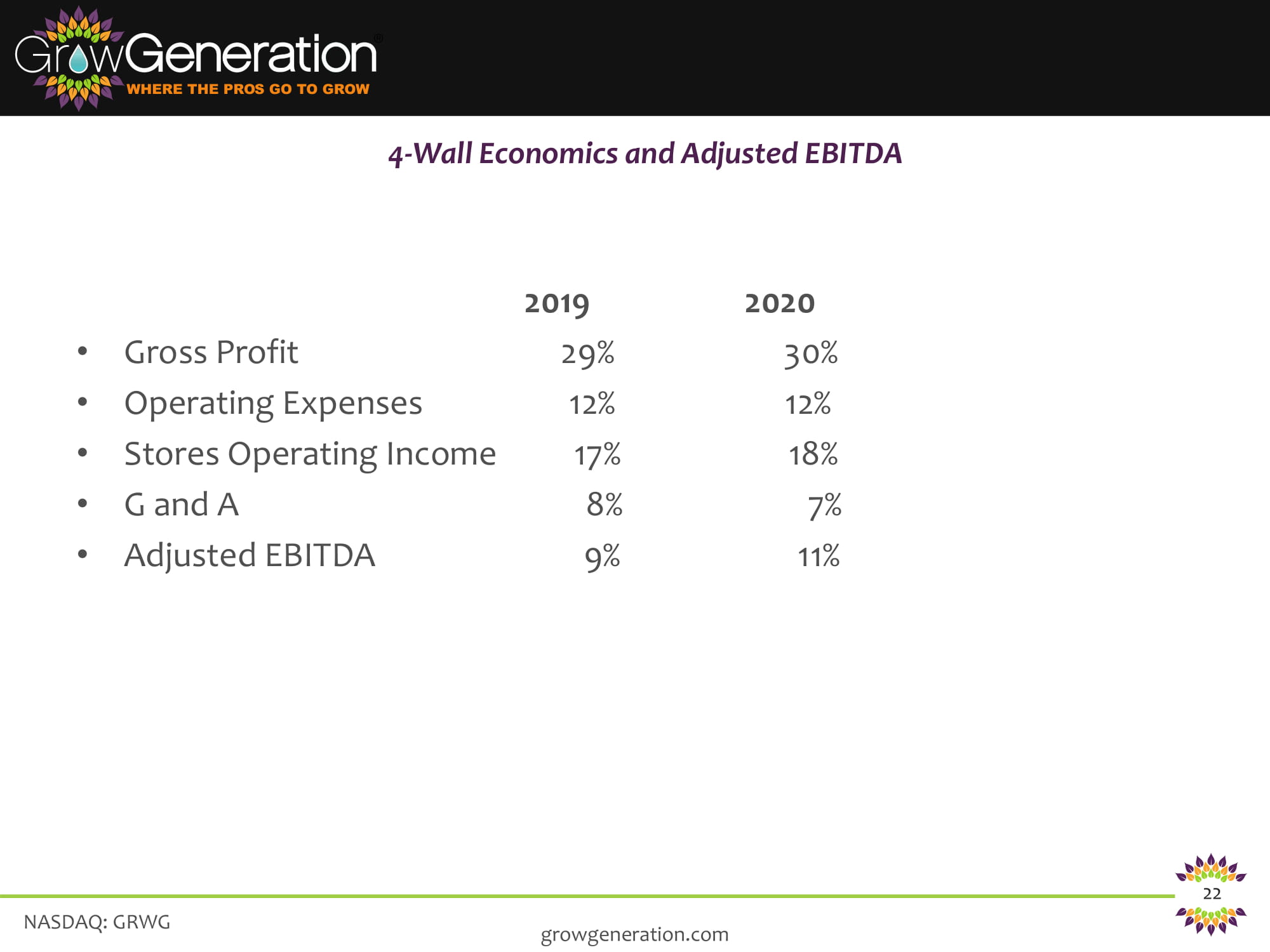

NASDAQ: GRWG 22 2019 2020 • Gross Profit 29% 30% • Operating Expenses 12% 12% • Stores Operating Income 17% 18% • G and A 8% 7% • Adjusted EBITDA 9% 11% 4 - Wall Economics and Adjusted EBITDA growgeneration.com

NASDAQ: GRWG 23 Seasoned Management Team & Board of Directors growgeneration.com Darren Lampert CEO Director Michael Salaman President Director Tony Sullivan COO ‒ Founding member of law firm Lampert & Lampert (1986 - 2000) ‒ Former portfolio manager and proprietary trader (2000 - 2014) ‒ VP at National Media Corp. (1986 - 2002) ‒ Founder of American Interactive Media ‒ Founder (2002 - 2006) / Chairman, Skinny Nutritional (2006 - 2013) Steven Aiello Director Sean Stiefel Director ‒ Founder of Navy Capital LLC in 2014, an equity focused fund ‒ Analyst with various equity funds Monty Lamirato CFO ‒ CFO, Strategic Environmental & Energy Resources, Inc. (2013 - 2016) ‒ Independent consultant (2009 - 2017) ‒ CFO/Treasurer, ARC Group Worldwide, Inc. (2001 - 2009) Peter Rosenberg Director • Private - Equity backed by founders of Cronos, Gotham Green, Navy Capital, JW Asset Merida Capital Partners • Bob Nardelli, Senior strategic advisor, former CEO Home Depot ‒ Founding member of law firm Lampert & Lampert (1986 - 2000) ‒ Former portfolio manager and proprietary trader (2000 - 2014) ‒ VP at National Media Corp. (1986 - 2002) ‒ Founder of American Interactive Media ‒ Founder (2002 - 2006) / Chairman, Skinny Nutritional (2006 - 2013) ‒ 20+ years at Foot Locker Inc. ‒ Executive Vice President and Chief Operating Officer of Forman Mills ‒ Senior Vice President Operations for Dollar Express ‒ Senior Vice President, Chief Operating Officer Aimee Linens ‒ CFO, Strategic Environmental & Energy Resources, Inc. (2013 - 2016) ‒ Independent consultant (2009 - 2017) ‒ CFO/Treasurer, ARC Group Worldwide, Inc. (2001 - 2009) ‒ Partner at Jones & Co. (2003 - 2006) ‒ Partner at Asset Management (2001 - 2003) ‒ Partner at Montgomery Securities (1987 - 2001) ‒ Founder of Navy Capital LLC in 2014, an equity focused fund ‒ Analyst with various equity funds ‒ 28 years of experience in the financial services industry ‒ Duff & Phelps ,Managing Director in the Consumer and Retail Merger and Acquisitions Group ‒ Managing Director with Wells Fargo Securities ‒ Managed the San Francisco office for Barrington Associates ‒ Director at Salomon Smith Barney

NASDAQ: GRWG 24 • Store acquisitions over $30M in revenue in 2019,same target for 2020 • Open 13 new stores in 6 new markets (organic growth) • 2019 Revenue $80M up from $29M in 2018, continue same growth trajectory • SSS for 4 th Q UP 62%,SSS for 2019 up 36%, double digit growth in 2020 • Commercial sales approaching $5M per quarter, goal is to increase to $30M • Ecommerce sales up reached $5M in 2019, $10M IN 2020 • Omni channel, order online, pick up in store • Proprietary and exclusive products 10 % of overall purchases in 2020 Fueling Growth: Plan to $250M+ Revenue growgeneration.com Key Performance Executables for 2020 - 2021

NASDAQ: GRWG 25 Company Contact Darren Lampert , Chief Executive Officer Michael Salaman , President GrowGeneration Corp., Denver, CO Tel 800.935.8420 | darren@growgeneration.com growgeneration.com Contacts