Filed Pursuant to Rule 424(b)(5)

Registration No. 333-251174

PROSPECTUS SUPPLEMENT

(To Prospectus Dated December 7, 2020)

$150,000,000

Common Stock

$30.00 Per Share

We are offering for sale shares of common stock at a price of $30.00 per share. Our common stock is listed on The Nasdaq Capital Market under the symbol “GRWG.” On December 8, 2020, the last reported sale price of our common stock on The Nasdaq Capital Market was $34.17 per share.

Investing in our securities is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page S-7 of this prospectus supplement and in the documents incorporated by reference into this prospectus supplement for a discussion of information that should be considered in connection with an investment in our common stock.

In making your investment decision, you should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not, and the underwriters have not, authorized anyone to provide you with different information. If anyone provides you with different or additional information, you should not rely on it. We are offering to sell and seeking offers to buy the common stock only in places where sales are permitted. You should not assume that the information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus or in any free writing prospectus that we may provide you is accurate as of any date other than its respective date. Our business, financial condition, results of operation and prospects may have changed since those dates.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the prospectus to which it relates. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | 30.00 | $ | 150,000,000 | ||||

| Underwriting discounts and commissions (1) | $ | 1.65 | $ | 8,250,000 | ||||

| Proceeds to us, before expenses | $ | 28.35 | $ | 141,750,000 | ||||

| (1) | See “Underwriting” for additional information regarding underwriting compensation. |

We have granted the underwriters an option to purchase up to an additional 750,000 shares of common stock from us at the public offering price less the underwriting discounts and commissions, and on the same terms and conditions as set forth above, for 30 days after the date of this prospectus supplement.

We are an “emerging growth company” as defined by the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus supplement, the accompanying prospectus and future filings.

The underwriters expect to deliver the common stock to the investors in book-entry form through the facilities of The Depository Trust Company on or about December 11, 2020, subject to the satisfaction of customary closing conditions.

Joint Book-Running Managers

| Oppenheimer & Co. | Stifel |

Co-Managers |

||

| Craig-Hallum Capital Group | Ladenburg Thalmann | Lake Street |

The date of this prospectus supplement is December 8, 2020.

TABLE OF CONTENTS

Prospectus Supplement

| ABOUT THIS PROSPECTUS SUPPLEMENT | S-ii |

| PROSPECTUS SUPPLEMENT SUMMARY | S-1 |

| THE OFFERING | S-6 |

| RISK FACTORS | S-7 |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | S-13 |

| USE OF PROCEEDS | S-13 |

| DILUTION | S-14 |

| DIVIDEND POLICY | S-14 |

| UNDERWRITING | S-15 |

| LEGAL MATTERS | S-20 |

| EXPERTS | S-20 |

| INCORPORATION OF INFORMATION FILED WITH THE SEC | S-21 |

Prospectus

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and certain other matters, and also adds to and updates information contained or incorporated by reference in the accompanying prospectus. The second part, the accompanying prospectus, gives more general information about us and the common stock offered hereby, some of which may not apply to this offering. Generally, when we refer to the prospectus, we are referring to both parts of this document combined. To the extent the information set forth in this prospectus supplement or any document incorporated by reference herein varies from the information set forth or incorporated by reference in the accompanying prospectus, you should rely on the information contained or incorporated by reference in this prospectus supplement. If the information set forth in this prospectus supplement varies in any way from the information set forth in a document incorporated by reference herein, you should rely on the information in the more recent document.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus prospectus and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any common stock offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

It is important for you to read and consider all information contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference therein, in making your investment decision. You should rely only on the information contained in, or incorporated by reference in, this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus supplement and the accompanying prospectus. This prospectus supplement and the accompanying prospectus may only be used where it is legal to sell our common stock. You should not assume that the information that appears in this prospectus supplement, the accompanying prospectus and any document incorporated by reference is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects may have changed since the date of such information.

S-ii

The following summary highlights information contained elsewhere in this prospectus supplement and the accompanying prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus supplement and the accompanying prospectus, including the sections entitled “Risk Factors” before making an investment decision.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus supplement and the accompanying prospectus to “GrowGeneration,” the “Company,” “we,” “us” and “our” refer to GrowGeneration Corp., together with our wholly-owned subsidiaries (GrowGeneration Pueblo, Corp., GrowGeneration California Corp., Grow Generation Nevada Corp., GrowGeneration Washington Corp., GrowGeneration Rhode Island Corp., GrowGeneration Oklahoma Corp., GrowGeneration Canada, GrowGeneration HG Corp., GrowGeneration Hemp Corp., GGen Distribution Corp., GrowGeneration Michigan Corp., GrowGeneration New England Corp., GrowGeneration Florida Corp. and GrowGeneration Management Corp.) on a consolidated basis.

Our Company

General

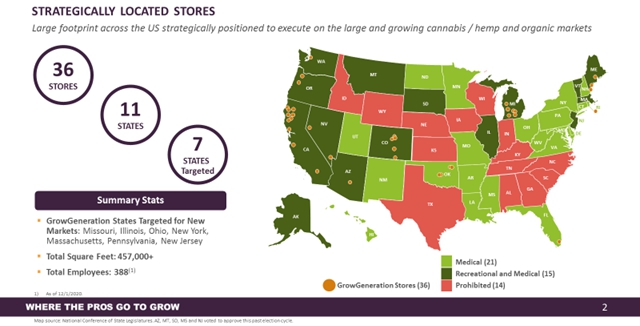

We believe we are the largest chain of stand-alone hydroponic garden centers by revenue and number of stores in the United States. We also believe we are a leading marketer and distributor of nutrients, growing media, advanced indoor and greenhouse lighting, ventilation systems and accessories for hydroponic gardening, based on management’s estimates. We have a diverse customer base, with commercial customers constituting the majority of our total sales. As of December 1, 2020, we own and operate a chain of 36 retail and commercial hydroponic/gardening centers in 11 U.S. states. We also operate an online e-commerce store, growgeneration.com. Our core strategy continues to focus on expanding our geographic reach across the United States through organic growth -- both by increasing same store sales and by opening new stores -- as well as inorganically via acquisitions.

Trends and Other Factors Impacting Our Performance

Acquisitions

We are an acquisitive company. Since 2014, we have acquired 34 stores and opened 16 new stores (with 14 closures and consolidations as described in the table below). We plan to continue to pursue acquisitions going forward. We actively evaluate and pursue acquisitions on an ongoing basis, and are focusing on Ohio, Illinois, Pennsylvania, New York, New Jersey, Massachusetts and Missouri as new markets where we plan to open new operations.

The following table summarizes the stores we acquired, opened and consolidated since 2014:

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 12/1/2020 | ||||||||||||||||||||||

| Stores acquired | 4 | 2 | 2 | 8 | 7 | 11 | ||||||||||||||||||||||

| Stores opened | 2 | 4 | 4 | 1 | 4 | 1 | ||||||||||||||||||||||

| Stores closed/consolidated | (5 | ) | (6 | ) | (2 | ) | (1 | ) | ||||||||||||||||||||

| Net Stores added | 4 | 4 | 4 | 1 | 3 | 9 | 11 | |||||||||||||||||||||

| Cumulative stores | 4 | 8 | 12 | 13 | 16 | 25 | 36 | |||||||||||||||||||||

S-1

We have a strong acquisition track record within the hydroponic garden center space and believe we have developed a reputation for treating sellers and their staff in a fair manner. We believe our reputation and scale have positioned us as a buyer of choice for hydroponic garden centers operators who want to sell their businesses. Our strategy is to acquire stores at attractive EBITDA multiples and then grow same-store sales while benefitting from cost-reducing synergies.

Regulatory Environment

We sell hydroponic gardening products to end users that may use such products in new and emerging industries or segments, including the growing of cannabis. The demand for hydroponic gardening products depends on the uncertain growth of these industries or segments due to varying, inconsistent, and rapidly changing laws, regulations, administrative practices, enforcement approaches, judicial interpretations, and consumer perceptions. For example, certain countries and 36 U.S. states have adopted frameworks that authorize, regulate, and tax the cultivation, processing, sale, and use of cannabis for medicinal and/or non-medicinal use, while the U.S. Controlled Substances Act and the laws of other U.S. states prohibit growing cannabis. Demand for our products could be impacted by changes in the regulatory environment with respect to such industries and segments.

Operations

Our retail operations are driven by our high-quality products, value-add knowledgeable staff and fast distribution capabilities. As of December 1, 2020, we have a staff of approximately 388 employees, the majority of which are grow enthusiasts that we have branded “Grow Pros.” Our operations span over 457,000 square feet of retail and warehouse space. During COVID-19, we have been deemed an “essential” supplier to the agricultural industry and, as such, we remained open and continued our operations.

For the quarter ended September 30, 2020, our revenue was $55 million, which increased 153% from the same period of the prior year. For the nine months ended September 30, 2020, our revenues were $131.4 million, which increased 141.8% compared to the same period 2019. The increase for both the quarter ended September 30, 2020 and the nine months ended September 30, 2020 is attributable to both an increase in the number of stores and an increase in same store sales, which was 73% for the three months ended September 30, 2020 and 59% for the nine months ended September 30, 2020, respectively. The increase in same store sales is attributable to both an increase in commercial customers and walk in customers. For the quarter ended September 30, 2020, the Company performed well in all markets, most notably sales were up 288% in the Oklahoma market, 271% in the Michigan market, and 82% in the Maine market, all attributable to gaining more commercial and walk-in business in these growth markets. Income from store operations was $9.6 million for the third quarter of 2020, compared to $3.8 million for the third quarter 2019, an increase of 155%. Income from store operations was approximately $22.6 million for the nine months ended September 30, 2020, compared to approximately $8.6 million for the nine months ended September 30, 2019.

Adjusted EBITDA was $6.6 million for the quarter ended September 30, 2020 compared to $2 million for the same period in 2019, an increase of 230%. The Company is averaging 12,000 walk-in transactions per week.

We operate our business through the following sales channels:

| ● | Retail: 36 retail and commercial hydroponic/gardening centers focused on serving growers and cultivators. |

| ● | Commercial: Sales to commercial customers, including expert growers and cultivators, and provide them with advice from sales representatives with the requisite expertise (whom we brand as “Grow Pros”) to serve their specific needs. |

| ● | E-Commerce: Our existing e-commerce operation, growgeneration.com (previously HeavyGarden.com and GrowGen.Pro), is currently being developed and rebranded into an omni-channel sales approach to enable e-commerce at all of our locations. |

| ● | Distribution: The majority of our stores also function as warehouse, distribution and fulfillment centers for directing products to our store locations and to the retail, wholesale and mass hydroponic markets. |

Growth Strategy - Store Acquisitions and New Store Openings

Our growth strategy is to expand the number of our retail and commercial operations throughout the United States. The hydroponic retail landscape is fragmented, which we believe has allowed us to acquire the “best of breed” locations in the United States. In addition, we have a two-year roadmap to open a number of new locations in markets that we believe are underserved throughout the country. In addition to the 11 states where we are currently operating, we have identified Ohio, Illinois, Pennsylvania, New York, New Jersey, Massachusetts and Missouri as new markets where we plan to open new operations. In 2019, we opened and acquired ten locations and in the first quarter of 2020, we opened a second hydroponic/gardening center in Tulsa, Oklahoma, a 40,000 square feet store operation and fulfillment center, and acquired Healthy Harvest located outside of Miami, FL. On June 16, 2020, we acquired the assets of H2O Hydroponics LLC, a hydroponic garden center in Lansing, MI. In connection with this acquisition, we have consolidated and relocated our current West Lansing location into a newly built 14,000 square foot hydroponic garden center. On August 10, 2020 we acquired the assets of Benzakry Family Corp, d/b/a Emerald City Garden, in Concord, Ca. On October 12, 2020, the Company acquired the assets of Hydroponics Depot, LLC, a single store located in Phoenix, Arizona. On October 20, 2020, the Company acquired the assets of Big Green Tomato, a two-store chain in Battle Creek and Taylor, Michigan. On November 17, 2020, the Company acquired the assets of The GrowBiz, which we believe is the third largest chain of hydroponic garden centers in the United States, with four stores in California and one store in Oregon. In connection with the GrowBiz acquisition, Ross Haley, the founder of The GrowBiz and the former CEO of Hawthorne Gardening Company, a Division of Scott’s Miracle-Gro, joined the Company as a senior strategic advisor.

S-2

Commercial Sales Division

In 2019, we created a commercial division with a dedicated sales and support team to sell and service large commercial customers, who are primarily licensed growers of medicinal and non-medicinal cannabis. As of the third quarter of 2020, our commercial division services over 1,000 commercial accounts, who collectively contributed $32.7 million in revenue for the 9 months ended September 30, 2020 or approximately 25% of our total revenues of $131.4 million for the nine months ended September 30, 2020. We have identified over 14,000 licensed hemp and cannabis growers in the United States and believe there is significant room for us to expand our base of commercial customers.

E-Commerce Strategy

We are currently developing and rebranding our existing e-commerce operation, HeavyGarden.com and GrowGen.Pro, as growgeneration.com. This will be an omni-channel sales approach to enable e-commerce at all of our locations, providing our customers convenient ways to shop when and how they feel comfortable. This omni-channel approach will provide 24/7 availability of products and allow our customers to “Buy Online and Pick Up In Store.” Customers will be able to shop online in all product departments and access descriptions, reviews and pictures of our products. Our customers can order online and they can choose to either have their products delivered directly to their growing facility (usually within 48 hours) or they can pick up the products at one of our stores (usually within 24 hours). We believe that this omni-channel initiative will result in a more seamless, convenient shopping experience for our customers and will drive financial results.

Distribution Channel

We have built a supply chain that currently spans 36 locations across 11 states. We intend to build several 20,000 square foot store operations that will serve as fulfillment service centers, in addition to serving the local retail and commercial customers. These stores and fulfillment centers will ship directly to a farm or home as well as to any commercial hydroponic store (including ours and others) in the United States. We have a fleet of trucks that allow us to deliver within the proximity of any of these locations.

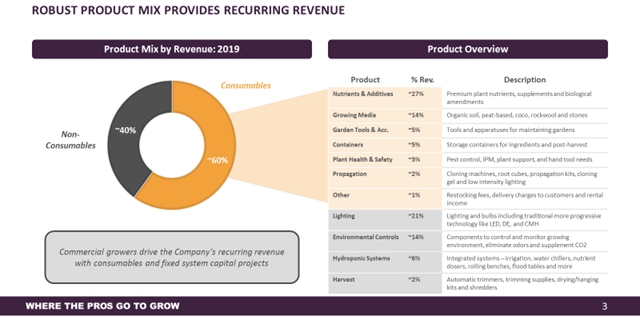

Products and Private Label Strategy

We sell a variety of products, including nutrients, growing media, advanced indoor and greenhouse lighting, ventilation systems, and accessories for hydroponic gardening, as well as other indoor and outdoor growing products. Our supply chain includes several thousand stock keeping units (“SKUs”) across 12 product departments. Many of our products are consumables leading to repeat orders by our customers. Consumable products are mainly nutrients and additives that feed the plants on a recurring basis. Our strategy is to supply products to two groups of customers: commercial growers and smaller growers that require a local center to fulfill their daily and weekly growing needs.

We are also actively developing a line of private label products that we intend to sell through our garden centers under brands we own or control. Our strategy is to deliver high-quality products at a lower cost, and higher margin to us. To further our private label strategy, we acquired various trademarks in March 2019 to aid in branding our ‘in house’ products to our customers. We introduced our first private labeled products under the Sunleaves brand in first quarter of 2020. Sales of our various private label products are over $1,000,000. This initial offering encompassed a broad variety of products ranging from trellis netting to plastic pots and organic nutrients. We intend to introduce additional private label products during 2020 and 2021. We believe that expanding our private label offerings will have a positive impact on our margins and profitability in the near term. We use various trademarks, trade names and service marks in our business, including Bluprint Controllers, Carbide, DuraBreeze, Elemental Solutions, GrowGeneration, GroXcess, GuardenWare, Harvester’s Edge, HeavyGardens, Ion, MixSure+, OptiLUME, Power Matrix, Smart Support, Sunleaves, Sunspot, The Fountain for Automation, VitaPlant, HYDROTHRIVE, and Where The Pros Go To Grow. For convenience, we may not include the SM, ® or ™ symbols, but such omission is not meant to indicate that we would not protect our intellectual property rights to the fullest extent allowed by law. Any other trademarks, trade names or service marks referred to in this filing are the property of their respective owners.

S-3

Markets

Our stores sell thousands of products, including nutrients, growing media, advanced indoor and greenhouse lighting, ventilation systems, and accessories for hydroponic gardening, as well as other indoor and outdoor growing products that serve multiple purposes and are designed and intended for growing a wide range of plants. Hydroponics is a specialized method of growing plants using mineral nutrient solutions in a water solvent, as opposed to soil. This method is typically used inside greenhouses to give growers the ability to better regulate and control nutrient delivery, light, air, water, humidity, pests, and temperature. Hydroponic growers benefit from these techniques by producing crops faster and with higher crop yields per acre as compared to traditional soil-based growers. Indoor growing techniques and hydroponic products are being utilized in new and emerging industries or segments, including the growing of cannabis and hemp. In addition, vertical farms producing organic fruits and vegetables are also beginning to utilize hydroponics due to a rising shortage of farmland as well as environmental vulnerabilities including drought, other severe weather conditions and insect pests.

According to a report by Markets and Markets on the hydroponics market, the global hydroponics system market is estimated to grow from an estimated $8 billion in 2019 to approximately $16 billion by 2025, at a compound annual growth rate of approximately 12%. In the U.S. hydroponics market, the legalization of cannabis for medicinal and non-medicinal use and increased number of licensed cultivation facilities are driving demand for hydroponic products. Currently there are comprehensive, publicly available medical marijuana/cannabis programs in 36 states and the District of Columbia, including 15 states that also permit recreational sales to adults. We believe that the growth in licensed cultivation facilities and the increase in organically grown produce will increase the demand for hydroponics products generally. Further, the current landscape of hydroponic gardening retail stores is very fragmented and presents opportunities for consolidation.

We have a diverse customer base, with commercial customers constituting the majority of our total sales. We cater to commercial and home cultivators growing specialty crops, including growing cannabis and hemp, along with organic herbs and leafy green vegetables. We believe that commercial growers choose to source their hydroponic gardening supplies from us because we understand their specific needs and employ sales representatives with the requisite expertise (whom we brand as “Grow Pros”) to serve expert growers and cultivators by helping them reduce any potential challenges in utilizing hydroponic products to grow their crops. Based on our customer profile, we believe that we are well positioned to benefit from growth of the overall hydroponic market. In addition, we believe that the highly fragmented hydroponics retail market and numerous single store operators present us with a significant opportunity to execute our roll-up strategy to expand and deepen our geographic footprint.

Competitive Advantages

As the largest chain of stand-alone hydroponic garden centers by revenue and number of stores in the United States based on management’s estimates, we believe that we have the following core competitive advantages over our competitors:

| ● | We offer a one-stop shopping experience to all types of growers by providing “selection, service, and solutions”; |

| ● | We provide end-to-end solutions for our commercial customers from capex build-out to consumables which nourish their plants; |

| ● | We have a knowledge-based sales team all of whom have horticultural experience; |

| ● | We offer the options to transact online, in store, or buy online and pick up; |

| ● | We consider ourselves to be a leader of the products we offer, from launching new technologies to the development of our private label products; and |

| ● | We have a professional team for mergers and acquisitions to acquire and open new locations and successfully add them to our company portfolio. |

S-4

Risks Associated with Our Business

Investing in our securities involves substantial risk. The risks described under the heading “Risk Factors” beginning on page S-7 of this prospectus supplement may cause us to not realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the more significant challenges include the following:

| ● | The COVID-19 pandemic and the efforts to mitigate its impact may have an adverse effect on our business, liquidity, results of operations, financial condition and price of our securities. |

| ● | We face competition that could prohibit us from developing or increasing our customer base. |

| ● | If we need additional capital to fund our operations, we may not be able to obtain sufficient capital and may be forced to limit the expansion of our operations. |

| ● | Our business depends substantially on the continuing efforts of our executive officers and our business may be severely disrupted if we lose their services. |

| ● | Certain of our products may be purchased for use in new and emerging industries or segments and/or be subject to varying, inconsistent, and rapidly changing laws, regulations, administrative practices, enforcement approaches, judicial interpretations, and consumer perceptions. |

| ● | Acquisitions, other strategic alliances and investments could experience operating difficulties, integration issues, require more capital and human resources than planned or experience other issue that could adversely impact our business and results of operations. |

| ● | Our ongoing investment in our new private label product line is inherently risky and could disrupt our ongoing businesses. |

| ● | If we are unable to effectively execute our e-commerce business, our reputation and operating results may be harmed. |

| ● | There are risks, including stock market volatility, inherent in owning our common stock. |

Corporate Information

We were incorporated under the laws of the State of Colorado in 2014.

Our principal executive office is located at 930 W 7th Ave, Suite A, Denver, CO 80204, and our telephone number is (800) 935-8420. Our website address is www.GrowGeneration.com. Information on our website is not incorporated by reference and is not a part of this prospectus supplement.

On December 2, 2019, the Company was approved to commence trading its common stock on The Nasdaq Capital Market under the ticker symbol of “GRWG.” Prior to that date, the Company’s stock traded on the OTCQX Best Market since October 10, 2017, prior to which it traded on the OTCQB Market since November 11, 2016.

Implications of Being an Emerging Growth Company and Smaller Reporting Company

We are an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012 (JOBS Act). For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in this prospectus supplement and our periodic reports and proxy statements and exemptions from the requirements of holding nonbinding advisory votes on executive compensation and stockholder approval of any golden parachute payments not previously approved. We could be an emerging growth company up to December 31, 2021, although circumstances could cause us to lose that status earlier, including if the market value of our common stock held by non-affiliates exceeds $700 million as of any June 30 before that time or if we have total annual gross revenue of $1.07 billion or more during any fiscal year before that time, in which cases we would no longer be an emerging growth company as of the following December 31 or, if we issue more than $1.07 billion in non-convertible debt during any three-year period before that time, we would cease to be an emerging growth company immediately. Even after we no longer qualify as an emerging growth company, we may still qualify as a “smaller reporting company” which would allow us to take advantage of many of the same exemptions from disclosure requirements, including reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements. Additionally, even if we no longer qualify as an emerging growth company, as long as we are neither a “large accelerated filer” nor an “accelerated filer,” we would not be required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act.

We cannot predict if investors will find our securities less attractive because we may rely on these exemptions, which could result in a less active trading market for our securities and increased volatility in the price of our securities.

Finally, we are a “smaller reporting company” (and may continue to qualify as such even after we no longer qualify as an emerging growth company) and accordingly may provide less public disclosure than larger public companies, including the inclusion of only two years of audited financial statements and only two years of management’s discussion and analysis of financial condition and results of operations disclosure. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

S-5

The following summary of the offering contains basic information about the offering and the common stock and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of the common stock, please refer to the section of the accompanying prospectus titled “Description of Capital Stock.”

| Issuer | GrowGeneration Corp., a Colorado corporation | |

| Common Stock to be Offered by Us | 5,000,000 shares of common stock. | |

| Common Stock Outstanding After Offering | 53,412,292 shares of common stock, based on 48,412,292 shares of common stock outstanding as of September 30, 2020 and excludes: (i) a total of 2,389,016 shares of our common stock issuable upon exercise of warrants; and (ii) a total of 2,102,170 shares of our common stock issuable upon exercise of options. | |

| Underwriters’ Option to Purchase Additional Shares | We have granted the underwriters the option to purchase up to an additional 750,000 shares of our common stock. The underwriters can exercise this option at any time within 30 days after the date of this prospectus supplement. | |

| Use of Proceeds | We intend to use the net proceeds from this offering primarily to expand our network of hydroponic/garden centers through organic growth and acquisitions, for general corporate purposes and pursuing strategic opportunities which may be presented to us from time to time. See “Use of Proceeds” beginning on page S-13 of this prospectus supplement. | |

| Risk Factors | Investing in our common stock involves a high degree of risk. Please refer to “Risk Factors” in this prospectus supplement, “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, which is incorporated by reference herein, and other information included or incorporated by reference in this prospectus supplement or the accompanying prospectus for a discussion of factors you should carefully consider before investing in shares of our common stock. | |

| Market and Trading Symbol for the Common Stock | Our common stock is traded on The Nasdaq Capital Market under the ticker symbol “GRWG.” |

S-6

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below and all of the other information contained in this prospectus supplement, the prospectus and in any free writing prospectuses prepared by or on behalf of us or to which we have referred you, before deciding whether to invest in our securities. If any of the possible events described below actually occur, our business, business prospects, cash flow, results of operations or financial condition could be harmed. In this case, the trading price of our common stock could decline, and you might lose all or part of your investment.

The following is a discussion of the risk factors that we believe are material to us at this time. These risks and uncertainties are not the only ones facing us and there may be additional matters that we are unaware of or that we currently consider immaterial. All of these could adversely affect our business, results of operations, financial condition and cash flows.

Risks Related to Our Business

The COVID-19 pandemic and the efforts to mitigate its impact may have an adverse effect on our business, liquidity, results of operations, financial condition and price of our securities.

The pandemic involving the novel strain of coronavirus, or COVID-19, and the measures taken to combat it, may have certain an adverse effect on our business. Public health authorities and governments at local, national and international levels have announced various measures to respond to this pandemic. Some measures that directly or indirectly impact our business include:

| ● | voluntary or mandatory quarantines; |

| ● | restrictions on travel; and |

| ● | limiting gatherings of people in public places. |

Although we have been deemed an “essential” business by state and local authorities in the areas in which we operate, we have undertaken the following measures in an effort to mitigate the spread of COVID-19 including limiting store business hours, and encouraging employees to work remotely if possible. We also have enacted our business continuity plans, including implementing procedures requiring employees working remotely where possible which may make maintaining our normal level of corporate operations, quality controls and internal controls difficult. Moreover, the COVID-19 pandemic has caused temporary or long-term disruptions in our supply chains and/or delays in the delivery of our inventory. Further, the COVID-19 pandemic and mitigation efforts have also adversely affected our customers’ financial condition, resulting in reduced spending for the products we sell.

As events are rapidly changing, we do not know how long the COVID-19 pandemic and the measures that have been introduced to respond to it will disrupt our operations or the full extent of that disruption. Further, once we are able to restart normal business hours and operations doing so may take time and will involve costs and uncertainty. We also cannot predict how long the effects of COVID-19 and the efforts to contain it will continue to impact our business after the pandemic is under control. Governments could take additional restrictive measures to combat the pandemic that could further impact our business or the economy in the geographies in which we operate. It is also possible that the impact of the pandemic and response on our suppliers, customers and markets will persist for some time after governments ease their restrictions. These measures have negatively impacted, and may continue to impact, our business and financial condition as the responses to control COVID-19 continue.

Many of our suppliers are experiencing operational difficulties as a result of COVID-19, which in turn may have an adverse effect on our ability to provide products to our customers.

The measures being taken to combat the pandemic are impacting our suppliers and may destabilize our supply chain. For example, manufacturing plants have closed and work at others curtailed in many places where we source our products. Some of our suppliers have had to temporarily close a facility for disinfecting after employees tested positive for COVID-19, and others have faced staffing shortages from employees who are sick or apprehensive about coming to work. Further, the ability of our suppliers to ship their goods to us has become difficult as transportation networks and distribution facilities have had reduced capacity and have been dealing with changes in the types of goods being shipped.

Currently the difficulties experienced by our suppliers have not yet impacted our ability to products to our customers and we do not significantly depend on any one supplier; however, if this continues, it may negatively affect our inventory and delayed the delivery of merchandise to our stores and customers, which in turn will adversely affect our revenues and results of operations. If the difficulties experienced by our suppliers continue, we cannot guarantee that we will be able to locate alternative sources of supply for our merchandise on acceptable terms, or at all. If we are unable to adequately purchase appropriate amounts of inventory, our business and results of operations may be materially and adversely affected.

S-7

Economic conditions could adversely affect our business.

Uncertain global economic conditions, in particular in light of the COVID-19 pandemic, could adversely affect our business. Negative global economic trends, such as decreased consumer and business spending, high unemployment levels and declining consumer and business confidence, pose challenges to our business and could result in declining revenues, profitability and cash flow. Although we continue to devote significant resources to support our brands, unfavorable economic conditions may negatively affect demand for our products.

We face intense competition that could prohibit us from developing or increasing our customer base.

The specialty gardening and hydroponic product industry is highly competitive. We may compete with companies that have greater capital resources and facilities. More established gardening companies with much greater financial resources which do not currently compete with us may be able to easily adapt their existing operations to sales of hydroponic growing equipment. Our competitors may also introduce new hydroponic growing equipment, and manufacturers may sell equipment direct to consumers. Due to this competition, there is no assurance that we will not encounter difficulties in increasing revenues and maintaining and/or increasing market share. In addition, increased competition may lead to reduced prices and/or margins for products we sell.

If we need additional capital to fund the expansion of our operations, we may not be able to obtain sufficient capital on terms favorable to us and may be forced to limit the expansion of our operations.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund the future expansion of our operations without additional capital investments. There can be no assurance that additional capital will be available to us on terms favorable to us. If we cannot obtain sufficient capital to fund our expansion, we may be forced to limit the scope of our acquisitions and new store openings.

Our business depends substantially on the continuing efforts of our executive officers and our business may be severely disrupted if we lose their services.

Our future success depends substantially on the continued services of our executive officers, especially our Chief Executive Officer, Darren Lampert, our President, Michael Salaman, our Chief Financial Officer, Monty Lamirato, and our Chief Operating Officer, Tony Sullivan. We do not maintain key man life insurance on any of our executive officers and directors. If one or more of our executive officers are unable or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. The loss of any of our officers could cause our business to be disrupted, and we may incur additional expenses to recruit and retain new officers.

Litigation may adversely affect our business, financial condition and results of operations.

From time to time in the normal course of our business operations, we may become subject to litigation that may result in liability material to our financial statements as a whole or may negatively affect our operating results if changes to our business operation are required. The cost to defend such litigation may be significant and may require a diversion of our resources. There also may be adverse publicity associated with litigation that could negatively affect customer perception of our business, regardless of whether the allegations are valid or whether we are ultimately found liable. As a result, litigation may adversely affect our business, financial condition and results of operations. Since inception, the Company has not been a party to any material litigation.

Certain of our products may be purchased for use in new and emerging industries or segments and/or be subject to varying, inconsistent, and rapidly changing laws, regulations, administrative practices, enforcement approaches, judicial interpretations, and consumer perceptions.

We sell hydroponic gardening products that end users may purchase for use in new and emerging industries or segments, including the growing of cannabis, that may not grow or achieve market acceptance in a manner that we can predict. The demand for these products depends on the uncertain growth of these industries or segments.

In addition, we sell products that end users may purchase for use in industries or segments, including the growing of cannabis, that are subject to varying, inconsistent, and rapidly changing laws, regulations, administrative practices, enforcement approaches, judicial interpretations, and consumer perceptions. For example, certain countries and 36 U.S. states have adopted frameworks that authorize, regulate, and tax the cultivation, processing, sale, and use of cannabis for medicinal and/or non-medicinal use, while the U.S. Controlled Substances Act and the laws of other U.S. states prohibit growing cannabis.

S-8

Our hydroponic gardening products are multi-purpose products designed and intended for growing a wide range of plants and are generally purchased from retailers by end users who may grow any variety of plants, including cannabis. Although the demand for our products may be negatively impacted depending on how laws, regulations, administrative practices, enforcement approaches, judicial interpretations, and consumer perceptions develop, we cannot reasonably predict the nature of such developments or the effect, if any, that such developments could have on our business.

Acquisitions, other strategic alliances and investments could result in operating difficulties, dilution, and other harmful consequences that may adversely impact our business and results of operations.

Acquisitions are an important element of our overall corporate strategy and use of capital, and these transactions could be material to our financial condition and results of operations. We expect to continue to evaluate and enter into discussions regarding a wide array of potential acquisitions and strategic transactions. The areas where we may face risks in connection with acquisitions include, but are not limited to, the failure to successfully further develop the acquired business, the implementation or remediation of controls, procedures and policies at the acquired business, the transition of operations, users and customers onto our existing platforms, and cultural challenges associated with integrating employees from the acquired business into our organization, and retention of employees from the businesses we acquire. Our failure to address these risks or other problems encountered in connection with our acquisitions could cause us to fail to realize the anticipated benefits of such acquisitions, investments or alliances, incur unanticipated liabilities, and harm our business generally.

Our acquisitions could also result in dilutive issuances of our equity securities, the incurrence of debt, contingent liabilities or amortization expenses, or impairment of goodwill and purchased long-lived assets, and restructuring charges, any of which could harm our financial condition or results of operations and cash flows. Also, the anticipated benefits and synergies of many of our acquisitions may not materialize.

Our ongoing investment in our new private label product line is inherently risky and could disrupt our ongoing businesses.

We have invested and expect to continue to invest in our new private label product line. Such endeavors may involve significant risks and uncertainties, including insufficient revenues to offset liabilities assumed and expenses associated with this new investment, inadequate return of capital on our investment, and unidentified issues not discovered in our assessment of such strategy and offerings. As we have only recently implemented our private label business, no assurance can be given that such strategy and offerings will be successful and will not adversely affect our reputation, financial condition, and operating results.

If we are unable to effectively execute our e-commerce business, our reputation and operating results may be harmed.

We sell certain of our products over the Internet through our online store, which represents a small but growing percentage of our overall net sales. The success of our e-commerce business depends on our investment in this platform, consumer preferences and buying trends relating to e-commerce, and our ability to both maintain the continuous operation of our online store and our fulfillment operations and provide a shopping experience that will generate orders and return visits to our online store.

We are also vulnerable to certain additional risks and uncertainties associated with our e-commerce business, including: changes in required technology interfaces; website downtime and other technical failures; costs and technical issues associated with website software, systems and technology investments and upgrades; data and system security; system failures, disruptions and breaches and the costs to address and remedy such failures, disruptions or breaches; computer viruses; and changes in and compliance with applicable federal and state regulations. In addition, our efforts to remain competitive with technology trends, including the use of new or improved technology, creative user interfaces and other e-commerce marketing tools such as paid search and mobile applications, among others, may increase our costs and may not increase sales or attract consumers. Our failure to successfully respond to these risks and uncertainties might adversely affect the sales of our e-commerce business, as well as damage our reputation and brands.

In addition, the success of our e-commerce business and the satisfaction of our consumers depend on their timely receipt of our products or to be able to pick up their desired products from one of our garden centers. The efficient delivery and/or pick up of our products requires that our garden and distribution centers have adequate capacity to support the current level of e-commerce operations and any anticipated increased levels that may occur as a result of the growth of our e-commerce business. If we encounter difficulties with our garden and distribution centers, or if any garden and distribution centers shut down for any reason, including as a result of fire or other natural disaster or pursuant to implementation of expanded stay-at-home orders or other restrictions due to the current COVID-19 pandemic, we could face shortages of inventory, resulting in out of stock conditions in our online store, and we could incur significantly higher costs and longer lead times associated with distributing our products to our consumers and experience dissatisfaction from our consumers. Any of these issues could have a material adverse effect on our business and harm our reputation.

S-9

Our reliance on a limited base of suppliers on certain of our products may result in disruptions to our supply chain and business and adversely affect our financial results.

We rely on a limited number of suppliers for certain of our hydroponic products and other supplies. If we are unable to maintain supplier arrangements and relationships, if we are unable to contract with suppliers at the quantity and quality levels needed for our business, if any of our key suppliers becomes insolvent or experience other financial distress or if any of our key suppliers is negatively impacted by COVID-19, including with respect to staffing and shipping of products, we could experience disruptions in our supply chain, which could have a material adverse effect on our financial condition, results of operations and cash flows

Our operations may be impaired if our information technology systems fail to perform adequately or if we are the subject of a data breach or cyber-attack.

We rely on information technology systems in order to conduct business, including communicating with employees and our key commercial customers, ordering and managing materials from suppliers, shipping products to customers and analyzing and reporting results of operations. While we have taken steps to ensure the security of our information technology systems, our systems may nevertheless be vulnerable to computer viruses, security breaches and other disruptions from unauthorized users. If our information technology systems are damaged or cease to function properly for an extended period of time, whether as a result of a significant cyber incident or otherwise, our ability to communicate internally as well as with our retail customers could be significantly impaired, which may adversely impact our business.

Additionally, in the normal course of our business, we collect, store and transmit proprietary and confidential information regarding our customers, employees, suppliers and others, including personally identifiable information. An operational failure or breach of security from increasingly sophisticated cyber threats could lead to loss, misuse or unauthorized disclosure of this information about our employees or customers, which may result in regulatory or other legal proceedings, and have a material adverse effect on our business and reputation. We also may not have the resources or technical sophistication to anticipate or prevent rapidly-evolving types of cyber-attacks. Any such attacks or precautionary measures taken to prevent anticipated attacks may result in increasing costs, including costs for additional technologies, training and third party consultants. The losses incurred from a breach of data security and operational failures as well as the precautionary measures required to address this evolving risk may adversely impact our financial condition, results of operations and cash flows.

We have identified a material weakness in our internal control over financial reporting and may experience material weaknesses in the future or otherwise fail to maintain an effective system of internal controls in the future, as a result of which, we may not be able to accurately report our financial condition or results of operations which may adversely affect investor confidence in us and, as a result, the value of our common stock.

Effective internal controls over financial reporting are necessary for us to provide reliable financial reports. If we cannot maintain effective controls and reliable financial reports, our business and operating results could be harmed. Our management has conducted an evaluation of the effectiveness of our internal control over financial reporting as of September 30, 2020, and concluded that our internal control over financial reporting were not effective as of September 30, 2020 due to a material weakness relating to proper accounting and valuation of equity instruments recorded within share-based compensation expense. Management has evaluated remediation plans for the deficiency and has implemented changes to address the material weakness identified, including engaging an independent third party consultant to review all documents and schedules related to equity and share-based compensation prepared by the Chief Financial Officer, as well as other high-level accounting treatment, tax accrual and purchase price allocation.

We cannot assure you that there will not be material weaknesses or significant deficiencies in our internal control over financial reporting in the future. Any failure to maintain internal control over financial reporting could severely inhibit our ability to accurately report our financial condition or results of operations. The effectiveness of our controls and procedures may be limited by a variety of factors, including:

| ● | Faulty human judgment and simple errors, omissions or mistakes; | |

| ● | Fraudulent action of an individual or collusion of two or more people; | |

| ● | Inappropriate management override of procedures; and | |

| ● | The possibility that any enhancements to controls and procedures may still not be adequate to assure timely and accurate financial control. |

S-10

Our management and independent registered public accounting firm did not perform an evaluation of our internal control over financial reporting during any period in accordance with the provisions of Sarbanes-Oxley Act. Had we performed an evaluation and had our independent registered public accounting firm performed an audit of our internal control over financial reporting in accordance with the provisions of Sarbanes-Oxley Act, additional control deficiencies amounting to material weaknesses may have been identified. If we fail to remedy any material weakness, our financial statements may be inaccurate, our access to the capital markets may be restricted and the trading price of our common stock may suffer.

The COVID-19 pandemic may have the effect of heightening many of the other risks described in this ’‘Risk Factors’’ section.

To the extent the COVID-19 pandemic may adversely affect our business and financial results, it may also have the effect of heightening many of the other risks described in this ’‘Risk Factors’’ section, or other risks which we may not be currently aware of.

Risks Related to Our Common Stock

There are risks, including stock market volatility, inherent in owning our common stock.

The market price and volume of our common stock have been, and may continue to be, subject to significant fluctuations. These fluctuations may arise from general stock market conditions, the impact of risk factors described herein on our results of operations and financial position, or a change in opinion in the market regarding our business prospects or other factors, many of which may be outside our immediate control.

The shares of our common stock may experience substantial dilution by exercises of outstanding warrants and options.

As of September 30, 2020, we had a total of 2,389,016 shares of our common stock issuable upon exercise of warrants, and a total of 2,102,170 shares of our common stock issuable upon exercise of options. The exercise of such outstanding options and warrants will result in substantial dilution of your investment. In addition, our shareholders may experience additional dilution if we issue common stock in the future. Any of such dilution may have adverse effect on the price of our common stock.

We are an emerging growth company and a smaller reporting company within the meaning of the Securities Act, and if we take advantage of certain exemptions from disclosure requirements available to “emerging growth companies” or “smaller reporting companies,” this could make our securities less attractive to investors and may make it more difficult to compare our performance with other public companies.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and, for as long as we continue to be an “emerging growth company,” we intend to take advantage of certain exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We could be an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1.07 billion in non-convertible debt during the preceding three year period.

For as long as we remain an “emerging growth company” as defined in the JOBS Act, we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies.”

S-11

Additionally, we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of the fiscal year in which (1) the market value of our ordinary shares held by non-affiliates exceeds $250 million as of the prior June 30, or (2) our annual revenues exceeded $100 million during such completed fiscal year and the market value of our ordinary shares held by non-affiliates exceeds $700 million as of the prior June 30. To the extent we take advantage of such reduced disclosure obligations, it may also make comparison of our financial statements with other public companies difficult or impossible.

After we are no longer an “emerging growth company,” we expect to incur additional management time and cost to comply with the more stringent reporting requirements applicable to companies that are deemed accelerated filers or large accelerated filers, including complying with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act.

We cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Risks Related to This Offering

If you purchase our securities in this offering, you may incur immediate and substantial dilution in the book value of your shares. You will experience further dilution if we issue additional equity or equity-linked securities in the future.

The public offering price per share of our common stock may be substantially higher than the net tangible book value per share of our common stock immediately prior to the offering. After giving effect to the sale of 5,000,000 shares of our common stock in this offering, at the public offering price of $30.00 per share, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, purchasers of our common stock in this offering will incur immediate dilution of $25.68 per share in the net tangible book value of the common stock they acquire. For a further description of the dilution that investors in this offering may experience, see “Dilution.”

If we issue additional shares of common stock (including pursuant to the exercise of outstanding stock options or warrants), or securities convertible into or exchangeable or exercisable for shares of common stock, our stockholders, including investors who purchase shares of common stock in this offering, will experience additional dilution, and any such issuances may result in downward pressure on the price of our common stock. We also cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders.

We have broad discretion in the use of the net proceeds we receive from this offering.

Our management will have broad discretion in the application of the net proceeds we receive in this offering, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether our management is using the net proceeds appropriately. Because of the number and variability of factors that will determine our use of our net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. Pending their use, we may invest our net proceeds from this offering in short-term, investment-grade, interest-bearing securities. These investments may not yield a favorable return to our stockholders.

S-12

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, including the documents incorporated herein by reference, contains forward-looking information about us that is intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts. These statements can be identified by the use of forward-looking terminology such as “believe,” “expect,” “may,” “will,” “should,” “project,” “plan,” “seek,” “intend,” or “anticipate” or the negative thereof or comparable terminology, and include discussions of strategy, financial projections and estimates and their underlying assumptions, statements regarding plans, objectives, expectations or consequences of announced transactions, and statements about the future performance, operations, products and services of GrowGeneration and its subsidiaries.

Discussions containing forward-looking statements may be found, among other places, in this prospectus supplement, the accompanying prospectus, our most recent Annual Report on Form 10-K, our most recent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC, as well as any similar statements contained in future Current Reports on Form 8-K, Quarterly Reports on Form 10-Q or Annual Reports on Form 10-K, which are hereby incorporated by reference upon their subsequent filing with the SEC. These forward-looking statements are or will be, as applicable, based largely on our expectations and projections about future events and future trends affecting our business. You should not rely on our forward-looking statements as statements of historical fact or as guarantees or assurances of future performance because the matters they describe are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond our control, that could cause actual results to differ materially from those anticipated in the forward-looking statements.

We qualify all our forward-looking statements by these cautionary statements. These forward-looking statements speak only as of the date of this prospectus supplement, the date of the accompanying prospectus or the date of the document incorporated by reference. Except as required by applicable laws or regulations, we do not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. When considering these forward-looking statements, you should keep in mind these risks, uncertainties and other cautionary statements made in this prospectus supplement and the accompanying prospectus. You should not place undue reliance on any forward-looking statement. You should refer to our periodic and current reports filed with the SEC for specific risks that could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. See “Where You Can Find More Information” below

We estimate that the net proceeds to us from this offering will be approximately $141,250,000, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. If the underwriters exercise their option to purchase additional shares in full, we estimate that our net proceeds will be approximately $162,512,500, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds from this offering primarily to expand our network of hydroponic/garden centers through organic growth and acquisitions, and for general corporate purposes and pursuing strategic opportunities which may be presented to us from time to time. The timing and amount of our actual expenditures will be based on many factors, including cash flows from operations and the anticipated growth of our business. We have not yet determined the amount of net proceeds to be used specifically for any particular purpose or the timing of these expenditures. Accordingly, our management will have significant discretion and flexibility in applying the net proceeds from the sale of these securities. Pending their use, we intend to invest the net proceeds to us from this offering in short-term, investment-grade, interest-bearing instruments.

We believe that the net proceeds from this offering, together with our existing cash, cash equivalents and investments, will enable us to fund our operations, acquisitions and new store openings through at least the next 12 months. We have based this estimate on assumptions that may prove to be wrong, and we could use our available capital resources sooner than we expect.

S-13

If you invest in this offering, your ownership interest will be diluted to the extent of the difference between the public offering price per share of our common stock and the as adjusted net tangible book value per share of our common stock immediately after the closing of this offering.

Our net tangible book value as of September 30, 2020 was approximately $89.5 million, or $1.85 per share. Net tangible book value per share is determined by dividing our total tangible assets, less total liabilities, by the number of shares of our common stock outstanding as of September 30, 2020. Dilution with respect to net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of common stock in this offering and the net tangible book value per share of our common stock immediately after this offering.

After giving effect to the sale of 5,000,000 shares of our common stock in this offering at the public offering price of $30.00 per share, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, and assuming no exercise of the underwriters’ over-allotment option in full, our as adjusted net tangible book value as of September 30, 2020, would have been approximately $230,725,672, or $4.32 per share. This represents an immediate increase in net tangible book value of $2.47 per share to existing stockholders. Investors purchasing our common stock in this offering will have paid $25.68 more than the as adjusted net tangible book value per share after this offering. The following table illustrates this on a per share basis:

| Public offering price per share | $ | 30.00 | ||||||

| Net tangible book value per share as of September 30, 2020 | $ | 1.85 | ||||||

| Increase per share attributable to new investors | $ | 2.47 | ||||||

| As adjusted net tangible book value per share after this offering | $ | 4.32 | ||||||

| As adjusted net tangible book value per share to investors purchasing shares in this offering | $ | 4.32 | ||||||

| Dilution in net tangible book value per share to new investors | $ | 25.68 | ||||||

| Dilution as a percentage of purchase price in the offering | 86 | % |

If the underwriters exercise their over-allotment option in full in this offering, the as adjusted net tangible book value after the offering would be $4.65 per share, the increase in as adjusted net tangible book value per share to existing stockholders would be $2.80 per share and the dilution per share to new investors would be $25.35 per share.

Except as otherwise indicated herein, the number of shares of our common stock to be outstanding after this offering is based on 48,412,292 shares of common stock outstanding as of September 30, 2020 and excludes: (i) a total of 2,389,016 shares of our common stock issuable upon exercise of warrants; and (ii) a total of 2,102,170 shares of our common stock issuable upon exercise of options.

To the extent that any outstanding options or warrants are exercised, new options, warrants or restricted stock units are issued under our stock-based compensation plans, or new shares of preferred stock are issued, or we issue additional shares of common stock in the future, there will be further dilution to investors participating in this offering.

We have never declared or paid cash dividends on our capital stock. We currently intend to retain all available funds and any future earnings, if any, to fund the development and expansion of our business and we do not anticipate paying any cash dividends in the foreseeable future. Any future determination related to dividend policy will be made at the discretion of our Board of Directors and will depend upon, among other factors, our results of operations, financial condition, capital requirements, tax considerations, legal or contractual restrictions, business prospects, the requirements of current or then-existing debt instruments, general economic conditions and other factors our Board of Directors may deem relevant.

S-14

We entered into an underwriting agreement with the underwriters named below on December 8, 2020. Oppenheimer & Co. Inc. and Stifel, Nicolaus & Company, Incorporated are acting as the joint book-running managers, Oppenheimer & Co. Inc. is acting as the representative of the underwriters, and Craig-Hallum Capital Group LLC, Ladenburg Thalmann & Co. Inc., and Lake Street Capital Markets, LLC, are acting as co-managers. The underwriting agreement provides for the purchase of a specific number of shares of common stock by each of the underwriters. The underwriters’ obligations are several, which means that each underwriter is required to purchase a specified number of shares of common stock but is not responsible for the commitment of any other underwriter to purchase shares of common stock. Subject to the terms and conditions of the underwriting agreement, each underwriter has severally agreed to purchase the number of shares of common stock set forth opposite its name below:

| Underwriter | Number of Shares of Common Stock | |||

| Oppenheimer & Co. Inc. | 2,799,950 | |||

| Stifel, Nicolaus & Company, Incorporated | 1,790,960 | |||

| Craig-Hallum Capital Group LLC | 136,364 | |||

| Ladenburg Thalmann & Co. Inc. | 136,363 | |||

| Lake Street Capital Markets, LLC | 136,363 | |||

| Total | 5,000,000 | |||

Subject to the terms and conditions set forth in the underwriting agreement, the underwriters have agreed to purchase all of the shares offered by this prospectus supplement (other than those covered by the option described below), if any are purchased.

The shares of common stock offered hereby are expected to be ready for delivery on or about December 11, 2020 against payment in immediately available funds.

The underwriters are offering the shares of common stock subject to various conditions and may reject all or part of any order. The representative of the underwriters has advised us that the underwriters propose initially to offer the shares of common stock to the public at the public offering price set forth on the cover page of this prospectus supplement and to dealers at a price less a concession not in excess of $0.9000 per share of common stock to brokers and dealers. After the shares of common stock are released for sale to the public, the representative may change the offering price, the concession, and other selling terms at various times.

We have granted the underwriters an option to purchase additional shares. This option, which is exercisable for up to 30 days after the date of this prospectus supplement, permits the underwriters to purchase a maximum of additional shares of common stock from us. If the underwriters exercise all or part of this option, they will purchase shares of common stock covered by the option at the public offering price that appears on the cover page of this prospectus supplement, less the underwriting discounts and commissions. The underwriters have severally agreed that, to the extent the option is exercised, they will each purchase a number of additional shares proportionate to such underwriter’s initial amount reflected in the foregoing table. If this option is exercised in full, the total price to public will be $172,500,000, and the total proceeds to us, before expenses, will be $163,012,500.

The following table provides information regarding the amount of the discounts and commissions to be paid to the underwriters by us, before expenses:

| Per Share of Common Stock |

Total Without Exercise of Underwriters’ Option |

Total With Full Exercise of Underwriters’ Option |

||||||||||

| Public offering price | $ | 30.00 | $ | 150,000,000 | $ | 172,500,000 | ||||||

| Underwriting discounts and commissions (1) | $ | 1.65 | $ | 8,250,000 | $ | 9,487,500 | ||||||

| Proceeds, before expenses, to us | $ | 28.35 | $ | 141,750,000 | $ | 163,012,500 | ||||||

| (1) | We have agreed to pay the underwriters a commission of 5.0% of the gross proceeds of this offering. In addition, the Company has agreed to award discretionary incentive compensation of an additional 0.5% of the gross proceeds of this offering to the book-running managers. |

S-15

We estimate that our total expenses of the offering, excluding the estimated underwriting discounts and commissions and certain advisory fees underwriters will pay to Alliance Global Partners Corp. and Roth Capital Partners, LLC, our independent financial advisors, will be approximately $500,000. We have agreed to reimburse the underwriters for all reasonable out-of-pocket costs and expenses incident to the performance of the obligations of the representative under the underwriting agreement (including, without limitation, the fees and expenses of the underwriters’ outside attorneys), provided that such costs and expenses shall not exceed $200,000 without our approval (such approval not to be unreasonably withheld, conditioned or delayed).

We have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act of 1933, as amended.

We have agreed to a 90-day “lock-up,” during which, without the prior written consent of Oppenheimer & Co. Inc., we shall not issue, sell or register with the Securities and Exchange Commission (the “SEC”) (other than on Form S-8 or on any successor form), or otherwise dispose of, directly or indirectly, any of our equity securities (or any securities convertible into, exercisable for or exchangeable for our equity securities), except for (i) the issuance of the shares of common stock offered pursuant to this prospectus supplement, (ii) the issuance of shares of common stock or securities convertible into or exercisable or exchangeable for shares of common stock, to an unaffiliated third-party on an arm’s-length basis, representing in the aggregate no more than 10% of our issued and outstanding shares of common stock as of the date of this prospectus supplement, which may be issued only in connection with the acquisition of a business or assets, so long as recipients of such securities agree to be bound by a lock-up agreement, and (iii) the issuance of shares of common stock pursuant to our existing stock option or bonus plan as described in the registration statement of which this prospectus supplement forms a part.