UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934

| ☒ | Filed by the Registrant |

| ☐ | Filed by a Party other than the Registrant |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Section 240.14a-12 |

GROWGENERATION, CORP.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

GROWGENERATION, CORP.

930 W 7th Ave, Suite A

Denver, Colorado 80204

(800) 935-8420

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 24, 2021

To the Stockholders of GrowGeneration, Corp.:

The 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of GrowGeneration, Corp., a Colorado corporation (the “Company”), will be held on Thursday, June 24, 2021 at 4:00 p.m., Eastern Daylight Time. Due to the public health concerns relating to COVID-19, it will be a virtual meeting. Stockholders may attend the Annual Meeting, vote and submit their questions during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/GRWG2021. Prior to the Annual Meeting, you will be able to vote over the Internet, by phone or by mail.

The Annual Meeting will be for the following purposes:

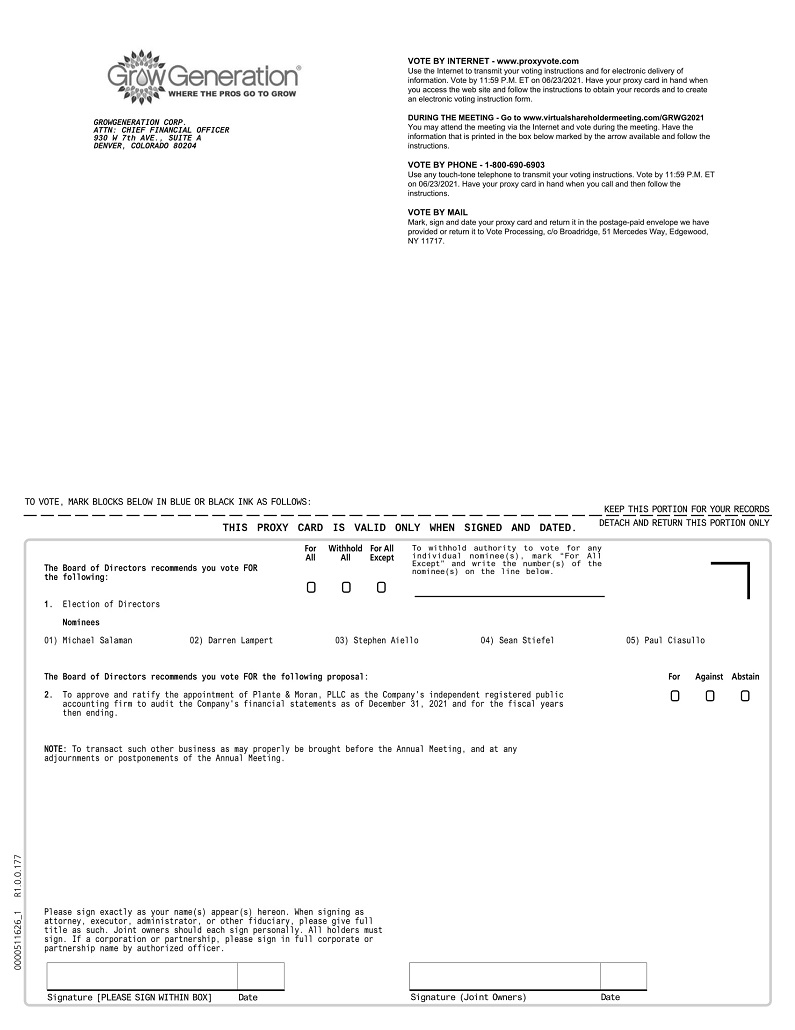

| 1. | To elect five (5) directors to the Board of Directors of the Company to serve until the Company’s 2022 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified; |

| 2. | To approve and ratify the appointment of Plante & Moran, PLLC as the Company’s independent registered public accounting firm to audit the Company’s financial statements as of December 31, 2021 and for the fiscal year then ending; and |

| 3. | To transact such other business as may properly be brought before the Annual Meeting, and at any adjournments or postponements of the Annual Meeting. |

Holders of record of the Company’s Common Stock at the close of business on April 21, 2021 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements of the Annual Meeting. In the event that there are insufficient shares present in person or represented by proxy at the Annual Meeting in order to obtain a quorum, the Annual Meeting may be adjourned or postponed in order to permit further solicitation of proxies.

ALL STOCKHOLDERS AS OF APRIL 21, 2021 ARE CORDIALLY INVITED TO ATTEND THE MEETING. HOWEVER, EVEN IF YOU PLAN TO ATTEND THE MEETING, PLEASE VOTE YOUR SHARES OVER THE INTERNET, BY TELEPHONE OR BY MAIL SO THAT YOUR SHARES WILL BE REPRESENTED WHETHER OR NOT YOU ARE ABLE TO ATTEND THE MEETING. THE PROMPT RETURN OF PROXIES WILL SAVE US THE EXPENSE OF FURTHER REQUESTS FOR PROXIES TO ENSURE A QUORUM AT THE MEETING. VOTING OVER THE INTERNET, BY TELEPHONE OR BY MAILING A PROXY CARD WILL NOT LIMIT YOUR RIGHT TO ATTEND THE ANNUAL MEETING AND VOTE YOUR SHARES IN PERSON.

By Order of the Board of Directors,

|

|

| Darren Lampert, Chief Executive Officer | |

| Denver, CO | |

| April 30, 2021 |

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING OF STOCKHOLDERS TO BE HELD ON THURSDAY, JUNE 24, 2021

The Notice of the 2021 Annual Meeting of Stockholders, the Proxy Statement, and the Annual Report for Fiscal Year ended December 31, 2020 are available on the Internet at www.proxyvote.com. Please have your 16-digit control number in hand when accessing this website. |

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 24, 2021

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Why did I receive this proxy?

The Board of Directors of GrowGeneration, Corp. (“GrowGeneration” or the “Company”) is furnishing this Proxy Statement to solicit proxies on its behalf to be voted at the 2021 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) or at any adjournment or postponement thereof. The Annual Meeting is scheduled to be held on Thursday, June 24, 2021 at 4:00 p.m., Eastern Daylight Time, virtually at www.virtualshareholdermeeting.com/GRWG2021. This Proxy Statement summarizes the information you need to know to vote by proxy or in person at the Annual Meeting. You do not need to attend the Annual Meeting in person in order to vote. Prior to the Annual Meeting, you will be able to vote over the Internet, by phone or by mail.

When is this Proxy Statement first being sent or given to stockholders?

We will begin mailing the Notice of the 2021 Annual Meeting of Stockholders (the “Notice”) on or about April 30, 2021 to holders of record of the Company’s common stock, par value $0.001 per share (the “Common Stock”) as of the close of business on April 21, 2021 (the “Record Date”). As indicated in the Notice, this Proxy Statement and other materials are available on the Internet at www.proxyvote.com. Stockholders may request to receive a full package of the proxy materials by following the instructions included in the Notice.

Who is entitled to vote at the Annual Meeting?

Holders of record of GrowGeneration’s Common Stock at the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting. On the Record Date, there were 58,430,212 shares of Common Stock issued and outstanding.

What is the quorum for the meeting?

The presence, in person or by proxy, of one-third of the outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes (described below) will be counted as present for purposes of determining the presence of a quorum at the meeting but will not be counted as present for any other purpose. No business may be conducted at the Annual Meeting if a quorum is not present. If less than one-third of outstanding shares of Common Stock entitled to vote are represented at the Annual Meeting, a majority of the shares so represented may adjourn the Annual Meeting to another date, time or place. Notice need not be given of the new date, time or place if announced at the meeting before an adjournment is taken, unless a new record date is fixed for the Annual Meeting (in which case a notice of the adjourned meeting will be given to each stockholder of record entitled to vote at the meeting).

How can I attend the meeting?

The Annual Meeting will be a completely virtual meeting due to the ongoing public health impact of the COVID-19 pandemic. This decision was made in light of the protocols that federal, state, and local governments have imposed or may impose in the near future and taking into account the health and safety of our shareholders, directors, members of management and employees. Conducting a virtual meeting will also allow shareholders whose travel may be restricted due to COVID-19 to partake in the meeting.

To attend and participate in the virtual Annual Meeting, please visit www.virtualshareholdermeeting.com/GRWG2021 and have available the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompanied your proxy materials.

Online access to the audio webcast will open 15 minutes prior to the start of the meeting to allow time for shareholders to log in and test the computer audio system.

Even if you plan to attend the Annual Meeting, the Company recommends that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Annual Meeting.

1

How many votes do I have?

Each share of Common Stock entitles its owner to one vote on all matters brought before the Annual Meeting.

How do stockholders vote?

If you are a holder of shares of our common stock as of the Record Date, either as a record holder (meaning your shares are registered in your name) or a beneficial owner in “street name” (meaning your shares are held through a broker, bank or other financial institution), you may vote or submit a proxy:

1. Over the Internet — If you have Internet access, you may go to at www.proxyvote.com and complete the electronic proxy card. You must specify how you want your shares voted, or your vote will not be registered and you will receive an error message. Your shares will be voted according to your instructions.

2. By Telephone — You may authorize the voting of your shares by calling 1-800-690-6903. You must specify how you want your shares voted, or your vote will not be registered and you will receive an error message. Your shares will be voted according to your instructions.

3. By Mail — If you have chosen to receive a full package of proxy materials which include a proxy card, you may mail the proxy card by following the instructions set forth in the proxy card. You may use the postage prepaid envelope provided in the package to mail the proxy card. Your shares will be voted according to your instructions. If you sign your proxy card but do not specify how you want your shares voted, they will be voted in accordance with the recommendations of the Board. Unsigned proxy cards will not be voted.

4. In Person at the Meeting — If you attend the virtual Annual Meeting in person, you may vote your shares electronically at the Annual Meeting.

What am I voting on?

At the Annual Meeting, GrowGeneration’s stockholders will be asked:

| 1. | To elect Michael Salaman, Darren Lampert, Stephen Aiello, Sean Stiefel and Paul Ciasullo to the Board of Directors of the Company to serve until the Company’s 2022 Annual Meeting of Stockholders or until their respective successors are duly elected and qualified; |

| 2. | To approve and ratify the appointment of Plante & Moran, PLLC (“Plante & Moran”) as the Company’s independent registered public accounting firm to audit the Company’s financial statements as of December 31, 2021 and for the fiscal year then ending; and |

| 3. | To transact such other business as may properly be brought before the Annual Meeting, and at any adjournments or postponements of the Annual Meeting. |

2

What vote is required for the proposals?

Proposal 1 – Election of Directors

If a quorum is present, directors will be elected pursuant to the affirmative vote of a plurality of the shares of Common Stock present in person or represented by proxy at the Annual Meeting. This means that the five nominees who receive the most affirmative votes will be elected to the Board of Directors.

Proposal 2 – Approval and Ratification of Plante & Moran as the Company’s Independent Auditor for the 2021 Fiscal Year

If a quorum is present, the approval and ratification of the appointment of Plante & Moran as the Company’s independent registered public accounting firm for the 2021 fiscal year will require the number of votes cast in favor of the proposal to exceed the number of votes cast against the proposal.

How are abstentions and broker “non-votes” treated?

Abstentions

Pursuant to Colorado law, abstentions are counted as present for purposes of determining the number of shares of Common Stock present in person or represented by proxy and entitled to vote at the Annual Meeting. Abstentions will have no effect on Proposal 1 – the election of the five director nominees named in this Proxy Statement, as this proposal is decided by a plurality of the votes cast. Abstentions will also have no effect on Proposal 2 since only votes “For” or “Against” a nominee will be counted for these proposals.

Broker “non-votes”

Broker non-votes occur when a beneficial owner of shares held in street name does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” such as ratification of the independent auditing firm, but may not vote those shares with respect to “non-routine” matters, such as election of directors.

Pursuant to Colorado law, broker non-votes will be counted as present for purposes of determining the presence of a quorum at the meeting but will not be counted as present for any other purpose. As a result, broker non-votes will not have any effect on the approval of the proposals contained in this Proxy Statement.

What happens if I submit or return my proxy card without voting?

If you properly submit your proxy via the Internet or mail, the shares it represents will be voted at the Annual Meeting in accordance with your directions. If you properly submit your proxy with no direction, the proxy will be voted “FOR” the proposals as recommended by the Board of Directors.

Can I change my vote after I have voted?

If you have submitted a proxy pursuant to this solicitation, you may revoke such proxy at any time prior to its exercise by:

| ● | written notice delivered to Chief Financial Officer of GrowGeneration, Corp., 930 W 7th Ave, Suite A, Denver, Colorado 80204; |

| ● | executing and delivering a proxy with a later date; |

| ● | submitting an Internet or telephone vote with a later date; or |

| ● | attending the Annual Meeting and voting in person. |

With respect to Internet and telephone votes, the last vote transmitted will be the vote counted. Attendance at the Annual Meeting will not, in itself, constitute revocation of a proxy.

3

Will anyone contact me regarding this vote?

No arrangements or contracts have been made with any proxy solicitors as of the date of this Proxy Statement. However, the Company may retain a proxy solicitor if it appears reasonably likely that it may not obtain a quorum to conduct the Annual Meeting. In addition, the Company’s directors, officers and employees may solicit proxies in person and by telephone or facsimile; however, these persons will not receive any additional compensation for any such solicitation efforts.

Brokerage firms, nominees, custodians and fiduciaries also may be requested to forward proxy materials to the beneficial owners of shares held as of the Record Date by them.

Who has paid for this proxy solicitation?

All expenses incurred in connection with the solicitation of proxies, including the printing and mailing of this Proxy Statement, will be borne by the Company.

How do I obtain a list of GrowGeneration’s stockholders?

A list of GrowGeneration’s stockholders as of the Record Date for the Annual Meeting will be available for inspection at the Annual Meeting and at GrowGeneration’s corporate headquarters, located at 930 W 7th Ave, Suite A, Denver, Colorado 80204, during normal business hours during the 10-day period immediately prior to the Annual Meeting.

How do I submit a proposal for the 2022 Annual Meeting of Stockholders?

For a stockholder proposal to be considered for inclusion in GrowGeneration’s 2022 Annual Meeting of Stockholders, it must be submitted in writing together with proof of stock ownership and received by GrowGeneration’s Chief Financial Officer no later than January 1, 2022.

[remainder of page intentionally left blank]

4

PROPOSAL NO. 1: ELECTION OF DIRECTORS

The Board of Directors has nominated Michael Salaman, Darren Lampert, Stephen Aiello, Sean Stiefel and Paul Ciasullo to stand for election to the Board of Directors of GrowGeneration, each to hold office until the 2022 Annual Meeting of Stockholders and until their respective successors are elected and qualified. All of the director nominees are incumbent directors.

If elected, the nominees for director will serve until the 2022 Annual Meeting of Stockholders, or until their respective successors are duly elected and qualified. Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement.

Set forth below is biographical information for each person nominated for election to the Board of Directors, including a description of the experience, qualifications, attributes and skills that led to the conclusion that the person should serve as a director of the Company, in light of the Company’s business strategy, prospects and structure. The Company has no reason to believe that any of these nominees will refuse or be unable to serve as a director if elected; however, if any of the nominees refuses or is unable to serve, each proxy that does not direct otherwise will be voted for a substitute nominee designated by the Board of Directors.

Nominees for Director

| Name | Age | |

| Darren Lampert | 60 | |

| Michael Salaman | 58 | |

| Stephen Aiello | 60 | |

| Sean Stiefel | 33 | |

| Paul F. Ciasullo, Jr. | 62 |

Darren Lampert has been our Chief Executive Officer and a Director since our inception in 2014. Mr. Lampert began his career in 1986 as a founding member of the law firm of Lampert and Lampert (1986-1999), where he concentrated on securities litigation, NASD (now FINRA) compliance and arbitration and corporate finance matters. Mr. Lampert has represented clients in actions and investigations brought before government agencies and self-regulatory bodies. Mr. Lampert spent 15 years working as a portfolio manager and proprietary trader at Schonfeld Securities (1999-2005), Schottenfeld Group (2007) and Incremental Capital (2008-2010). From 2010 to 2014, Mr. Lampert was a private investor. Mr. Lampert graduated in 1982 with a Bachelor of Science degree in business administration from Ithaca College. Mr. Lampert received a JD from Bridgeport University School of Law in 1985. Mr. Lampert was admitted to practice law in New York in 1986 and is also admitted to practice before the United States District Courts for the Southern and Eastern Districts of New York.

Michael Salaman has been our President and a Director since our inception. Mr. Salaman served as the Chairman of Skinny Nutritional Corp. from January 2002 to March 2014 and as Chief Executive Officer and President of Skinny Nutritional Corp. from June 2010 to March 2014. He also served as Chief Executive Officer of Skinny Nutritional Corp. Skinny Nutritional Corp. filed for Chapter 11 Bankruptcy protection in 2013 and the assets were sold to a private equity firm in March 2014. Mr. Salaman has over 20 years’ experience in the area of start-ups, new product development, distribution and marketing. Mr. Salaman began his business career as Vice President of Business Development for National Media Corp., an infomercial marketing company in the United States from 1985-1993. From 1995-2001, Mr. Salaman started a Digital Media company called American Interactive Media, Inc., a developer of Web TV set-top boxes and ISP services. In 2002, Mr. Salaman became the principal officer of that entity and directed its operations as a marketing and distribution company and in 2005 focused its efforts in the enhanced water business. Mr. Salaman received a Bachelor of Business Administration degree in business from Temple University in 1986.

Stephen Aiello has been a Director of the Company since May 2014. Mr. Aiello began his career in 1984 as a research associate at Prudential Bache Securities. From 1986 to 2001, Mr. Aiello worked as an institutional sales trader and manager of the trading desk at Montgomery Securities. From 2001 to 2003, Mr. Aiello was a founding partner of a long-short hedge fund, 033 Asset Management, where he was the head trader. From 2003 to 2008, Mr. Aiello was a partner at Jones and Associates where he built out their northern California institutional trading operation. Presently Mr. Aiello is an individual investor with a focus on the cannabis industry. Mr. Aiello graduated in 1984 from Ithaca College with a B.A. degree in Psychology, and graduated from Fordham University in 1990 with an MBA in Finance.

5

Sean Stiefel has been a Director of the Company since January 2018. Mr. Stiefel founded Navy Capital LLC in 2014, where he is currently a Portfolio Manager and is responsible for all aspects of stock selection, investment due diligence and portfolio construction. Mr. Stiefel launched the Navy Capital Green Fund, LP in 2017 as a global public equity focused cannabis dedicated fund. Navy Capital has been involved in cannabis related investing since early 2016. Prior to founding Navy Capital, Mr. Stiefel was a research analyst and trader for Northwoods Capital Management Partners, a global equity fund with a fundamental value and special situations investment strategy. Mr. Stiefel had previously served as an associate within an equity long/short fund at Millennium Partners, and he began his career as an equities trading analyst for Barclays Capital. He is a graduate of the University of Southern California’s Marshall school of Business.

Paul Ciasullo has been a Director of the Company since May 2020. He has also been a board member of Leafline Labs, LLC since 2018, which is a provider, manufacturer and distributor of medical cannabis in Minnesota. In 2010, Mr. Ciasullo founded Wallstreet Research Solutions, LLC, which provided sales, marketing and customer account services primarily in partnership with and to build a fixed income research firm specializing in bond and loan covenants called Covenant Review, LLC (with which he had been working to build the business since 2007). Covenant Review and Wallstreet Research Solutions merged and later re-branded as Fulcrum Financial Data LLC and Mr Ciasullo acted as President of Global Marketing and Sales and was a board member from 2014 to 2018 when the company was sold to Fitch Ratings Services. While working with Covenant Review, Mr. Ciasullo built a sales force in the U.S. and London including assimilation of the purchase of a UK company Capital Structure Ltd where he was also on the Board. From 2005 to 2006, Mr. Ciasullo was a Managing Director at Soleil Securities Group Inc., responsible for developing a strategy for bringing alternative research such as industry knowledge into a stock research environment. In 2000, Mr. Ciasullo was a founder of and acted as President of CreditSights, Inc., an institutional investment research firm specializing in fixed income research for institutional investors where, until 2004, he built a global salesforce after overseeing the design and build of the original website which was amongst the first in the industry to deliver research over the internet. Prior to that, Mr Ciasullo held a number of Managing Director positions as head of trading at large brokerage firms. Mr. Ciasullo graduated from Brown University in 1981 with a Bachelor of Arts in Economics and International Relations.

The Board of Directors recommends that you vote “FOR” the election of each of the nominees named above.

6

CORPORATE GOVERNANCE

General

The Company’s bylaws provide that the size of the Board of Directors shall be determined from time to time by resolution of the Board of Directors but shall not consist of less than one director nor more than ten. The Board of Directors currently has five members: Michael Salaman, Darren Lampert, Stephen Aiello, Sean Stiefel and Paul Ciasullo.

Director Compensation

In addition to stock options, non-employee directors of the Company receive compensation of $2,000 per month for services rendered as a director.

Board Leadership Structure and Role in Risk Oversight

The Board of Directors’ primary responsibility is to seek to maximize long-term shareholder value. The Board of Directors selects management of the Company, monitors management and performance of the Company, and provides advice and counsel to management. Among other things, the Board of Directors regularly reviews the Company’s business strategy and approves its budget. In fulfilling the Board of Directors’ responsibilities, non-employee directors have full access to management, external auditors and outside advisers.

Board’s Oversight during the Pandemic

The risk landscape associated with the COVID-19 pandemic and management’s strategic handling of such risks have been, and continue to be, regularly discussed with the full Board as well as each of the Board committees, as appropriate. Over the course of 2020, management regularly updated the directors on the pandemic’s impact to the Company’s business and the strategic, operational and financial risks associated with the pandemic. Discussions with the Board and its committees have covered a wide array of topics, including business continuity, customer health and safety, technology and cybersecurity, specific impacts of the pandemic in the geographic markets we serve and demand for our products. Management continues to monitor the risks and potential impact to the Company’s business and strategies and continues to discuss these impacts with the full Board on a regular basis.

Director Independence

The Company currently maintains a board of directors that is composed of a majority of “independent” directors within the meaning of the rules of Nasdaq Capital Market.

The Board of Directors examines the independence of the directors annually. For a director to be considered independent, the Board of Directors must determine that the director does not have any relationship with the Company or any of its affiliates, either directly or as a partner, shareholder or officer of an organization that has such a relationship which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

A director will not be considered independent if, among other things, the director has:

| ● | Been employed by the Company or its affiliates at any time in the current year or during the past three years; |

| ● | Accepted any payments from the Company or its affiliates in excess of $120,000 during any period of twelve consecutive months within the preceding three years (except for board services, retirement plan benefits, or non-discretionary compensation); |

| ● | An immediate family member who is, or has been in the past three years, employed by the Company or its affiliates as an executive officer; |

| ● | Been a partner, controlling shareholder or an executive officer of any “for profit” business to which the Company made or from which it received, payments (other than those which arise solely from investments in the Company’s securities) that exceed 5% of the entity’s or the Company’s consolidated gross revenues for that year, or $200,000, whichever is more, in any of the preceding three years; |

| ● | Been employed as an executive officer of another entity where any of the Company’s executive officers serve on that entity’s compensation committee; or |

| ● | Been, or has a family member been, employed as a partner or employee of the Company’s outside auditors in any of the receding three years. |

7

Board Meetings

During the fiscal year ended December 31, 2020, the Board of Directors held 17 meetings, including meetings conducted by teleconference. No director attended less than 75% of all board meetings and all meetings of the committees on which they served during the fiscal year ended December 31, 2020.

All current Board members and all nominees for election to the Board of Directors are encouraged to attend the virtual Annual Meeting.

Board Committees

Audit Committee

The Company’s Audit Committee is comprised of, Paul Ciasullo (Chairman), Stephen Aiello and Sean Stiefel as of the date of this Proxy Statement. The Board has determined that all of Messrs. Ciasullo, Aiello and Stiefel and are independent directors. Both Messrs. Ciasullo and Aiello qualify as an “audit committee financial expert” within the meaning of the rules of the SEC. The Board has adopted an Audit Committee Charter, which was filed as Exhibit 99.1 to the Company’s Annual Report on Form 10-K for year ended December 31, 2019 (“2019 10-K”).

During the fiscal year ended December 31, 2020, the Audit Committee held 4 meetings, including meetings conducted by teleconference.

The purpose of the Audit Committee is to perform and to assist the Board of Directors in fulfilling its oversight responsibility relating to (i) the Company’s financial statements and financial reporting process and the Company’s systems of internal accounting and financial controls; (ii) the integrity of the Company’s financial statements; (iii) the appointment, retention and performance of the internal auditors, if applicable; (iv) the annual independent audit of the Company’s financial statements, the engagement of the independent auditors and the evaluation of the independent auditors’ qualifications, independence and performance; (v) the compliance by the Company with legal and regulatory requirements, including the Company’s disclosure controls and procedures; and (vi) the evaluation of management’s process to assess and manage the Company’s enterprise risk issues.

Compensation Committee

The Company’s Compensation Committee is comprised of Stephen Aiello and Paul Ciasullo as of the date of this Proxy Statement. The Board has adopted a Compensation Committee Charter, which was filed as Exhibit 99.2 to the 2019 10-K.

During the fiscal year ended December 31, 2020, the Compensation Committee held 2 meetings, including meetings conducted by teleconference.

The purpose of the Compensation Committee is to review, determine and approve all forms of compensation to be provided to the Company’s executive officers and any equity compensation to be provided to all employees, and monitor the performance of the Company’s executive officers.

8

Nominating and Corporate Governance Committee

The Company’s Nominating and Corporate Governance Committee is comprised of Stephen Aiello and Paul Ciasullo as of the date of this Proxy Statement. The Board has adopted a Nominating and Corporate Governance Committee Charter, which was filed as Exhibit 99.3 to the 2019 10-K.

During the fiscal year ended December 31, 2020, the Nominating and Corporate Governance Committee held no meetings.

The purpose of the Nominating and Corporate Governance Committee is to (i) oversee all aspects of the Company’s corporate governance functions on behalf of the Board; (ii) make recommendations to the Board of Directors regarding corporate governance issues; (iii) identify, review and evaluate candidates to serve as directors of the Company consistent with criteria approved by the Board of Directors and review and evaluate incumbent directors; (iv) serve as a focal point for communication between such candidates, non-committee directors and the Company’s management; (v) select or recommend to the Board of Directors for selection candidates to the Board of Directors to serve as nominees for director for the annual meeting of stockholders; and (vi) make other recommendations to the Board of Directors regarding affairs relating to the directors of the Company, including director compensation.

Director Nomination Process

The process of reviewing and making recommendations for nominations and appointments to the Board of Directors is the responsibility of the Nominating and Corporate Governance Committee. Our directors have a critical role in guiding our strategic direction and in overseeing management. The Nominating and Corporate Governance Committee will consider candidates for the Board of Directors based upon several criteria, including their broad-based business and professional skills and experiences, concern for the long-term interests of shareholders, personal integrity and judgment. Candidates should have reputations, both personal and professional, consistent with our image and reputation. Directors must have time available to devote to activities of the Board of Directors and to enhance their knowledge of the Company’s industry. Accordingly, the Board of Directors seeks to attract and retain highly qualified directors who have sufficient time to attend to their substantial duties and responsibilities for the Company, and who are expected to contribute to an effective Board of Directors.

The Nominating and Corporate Governance Committee utilizes the following process for identifying and evaluating nominees to the Board of Directors. In the case of incumbent directors, each year the Board of Directors informally reviews each director’s overall service to the Company during the term, including the number of meetings attended, level of participation and performance. In the case of new director candidates, the Nominating and Corporate Governance Committee may solicit from existing directors the names of potential candidates who meet the criteria above; the Nominating and Corporate Governance Committee may discuss candidates suggested by our shareholders; and, if deemed appropriate by the Board of Directors, the Nominating and Corporate Governance Committee may engage a professional search firm. To date, the Nominating and Corporate Governance Committee has not engaged a professional search firm to identify or evaluate potential nominees, but it retains the right to do so in the future, if necessary. The Nominating and Corporate Governance Committee meets to discuss and consider these candidates’ qualifications and then chooses new candidates by majority vote.

Shareholder Nominations

The Nominating and Corporate Governance Committee has the authority to consider nominations for directors made by the Company’s shareholders.

To be considered, the shareholder’s nomination must contain: (i) the name and address of each proposed nominee; (ii) the principal occupation of each proposed nominee; (iii) the total number of shares of the Company’s capital stock that will be voted for each proposed nominee; (iv) the name and residence address of the notifying shareholder; and (v) the number of our shares of capital stock owned by the notifying shareholder. In addition, the nomination should include any other information relating to the proposed nominee required to be included in a proxy statement filed pursuant to the proxy rules of the SEC and the nominee’s written consent to serve as a director if elected.

9

Communications with Directors

Shareholders who wish to communicate with the Board, or one or more individual directors may do so by contacting the Secretary of the Company by mail at GrowGeneration Corp., 930 W 7th Ave, Suite A, Denver, Colorado 80204. The Secretary will refer such communication to the Board.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics, which was filed as Exhibit 14.1 to the 2019 10-K.

Insider Trading Policy

The Company has adopted an Insider Trading Policy which sets forth the procedure regarding trading by insiders in securities of the Company.

Anti-Hedging/Pledging Policy

The Company’s Insider Trading Policy prohibits officers, directors and other designated persons from pledging, hedging or short sales involving securities of the Company.

Involvement in Certain Legal Proceedings

To our knowledge, during the past ten years, none of our directors, executive officers, promoters, control persons, or nominees other than Michael Salaman (see biographical information of Michael Salaman above regarding the Chapter 11 Bankruptcy protection filed by Skinny Nutritional Corp. in 2013) has:

| ● | been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| ● | had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time; |

| ● | been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity; |

| ● | been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| ● | been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| ● | been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

10

Limitation of Directors Liability and Indemnification

The Colorado Business Corporations Act authorizes corporations to limit or eliminate, subject to certain conditions, the personal liability of directors to corporations and their stockholders for monetary damages for breach of their fiduciary duties.

Bylaws of the Company provide that the Company will indemnify its directors and officers who, by reason of the fact that he or she is one of the Company’s officers or directors, is involved in a legal proceeding of any nature.

The Company has purchased director and officer liability insurance to cover certain liabilities its directors and officers may incur in connection with their services to the Company.

There is no pending litigation or proceeding involving any of our directors, officers, employees or agents in which indemnification will be required or permitted. The Company is not aware of any threatened litigation or proceeding that may result in a claim for such indemnification.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers, directors and persons who own more than ten percent of the issued and outstanding shares of common stock to file reports of beneficial ownership and changes in beneficial ownership with the SEC and to furnish copies of all Section 16(a) forms to the Company. Based solely upon a review of Section 16(a) forms filed with the SEC, the Company believes all reports required to be filed under Section 16(a) with the SEC were timely filed in 2020, with the following exceptions: (1) Mr. Lampert filed two Form 4’s late (i) on January 17, 2020 related to his sale of shares of common stock on January 14, 2020; and (ii) on January 22, 2020 related to an issuance of shares to him on January 1, 2020 pursuant to his employment agreement. (2) Mr. Salaman filed two Form 4’s late (i) on January 17, 2020 related to his sale of shares of common stock on January 14, 2020; and (ii) on January 22, 2020 related to an issuance of shares to him on January 1, 2020 pursuant to his employment agreement. (3) Mr. Lamirato filed one Form 4 late on January 21, 2020 related to an issuance of shares to him on December 31, 2019 as year-end bonus and another issuance of shares on January 1, 2020 pursuant to his employment agreement. (4) Mr. Aiello filed one Form 4 late on May 21, 2020 related to a grant of options on May 12, 2020 to purchase 50,000 shares of common stock. (5) Mr. Stiefel filed one Form 4 late on May 21, 2020 related to a grant of options on May 12, 2020 to purchase 50,000 shares of common stock. (6) Gotham Green Partners LLC filed one Form 4 late on February 20, 2020 related to its ten sale transactions of shares during the period from February 10, 2020 to February 14, 2020.

Report of Audit Committee

The Audit Committee is currently comprised of three members of our Board of Directors. Based upon the review described above under “Corporate Governance - Director Independence,” our Board of Directors has determined that each member of the Audit Committee is independent as defined in the applicable standards and rules of the Nasdaq Capital Market and the SEC. The duties and responsibilities of the Audit Committee are set forth in the Audit Committee Charter.

11

In accordance with its written charter adopted by the Board of Directors, the Audit Committee has oversight responsibility for the quality and integrity of the financial reporting practices of the Company. While the Audit Committee has oversight responsibility, the primary responsibility for the Company’s financial reporting, disclosure controls and procedures and internal control over financial reporting and related internal controls and procedures rests with management, and the Company’s independent registered public accounting firm is responsible for auditing the Company’s financial statements. In discharging its oversight responsibility as to the audit process, the Audit Committee reviewed and discussed the audited financial statements with management, and discussed with the independent auditors the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. The Audit Committee received the written disclosures and the letter from the independent accountant required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence and has discussed with the independent accountant the independent accountant’s independence. Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for fiscal year ended December 31, 2020.

The Audit Committee also has approved the selection of the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021 and have approved submitting such selection for approval and ratification by the stockholders.

MEMBERS OF THE AUDIT COMMITTEE

Paul Ciasullo (Chairman)

Stephen Aiello

Sean Stiefel

EXECUTIVE OFFICERS

The following tables set forth information concerning the Company’s current executive officers:

Executive Officers

| Name | Age | Position | ||

| Michael Salaman | 58 | President and Director | ||

| Darren Lampert | 60 | Chief Executive Officer and Director | ||

| Jeffery Lasher | 57 | Chief Financial Officer and Secretary | ||

| Tony Sullivan | 56 | Chief Operating Office and Executive Vice President |

Set forth below is biographical information with respect to Messrs. Lasher and Sullivan. Biographical information for Messrs. Salaman and Lampert is set forth under the caption “Proposal No. 1: Election of Directors.”

Jeffery Lasher joined the Company as Chief Financial Officer and Secretary on April 15, 2021. Mr. Lasher was with Crocs, Inc. from 2009 to 2015 serving as Chief Accounting Officer from 2009 to 2011 then as Chief Financial Officer of CROCS, Inc. from 2011 to 2015 He served as Executive Vice President, Chief Financial Officer of West Marine from 2015 until 2018. He also was employed as Chief Financial Officer of International Car Wash Group, Inc. (now a division of Driven Brands, Inc.) from 2018 to 2020 and Chief Financial Officer of Coravin, Inc. from 2020 to 2021. Mr. Lasher is a graduate of the University of Alabama and received an MBA from Pennsylvania State University.

Tony Sullivan has been our Chief Operating Office and Executive Vice President since November 2019. From 2017 to joining the Company, Mr. Sullivan served as Executive Vice President and Chief Operating Officer of Forman Mills, a $300 million Private Equity sponsored business. From 2015 to 2017, he was Senior Vice President Operations for Dollar Express, a $500 million carve-out of 330 Family Dollar stores in 36 states, Private Equity sponsored business. From 2006 to 2015, he was employed at Anna's Linens for 9+ years where he served in several operating roles, most recently as SVP, Chief Operating Officer. Previously Mr. Sullivan served for 20+ years at Foot Locker Inc. leading more than 2100 stores, 3 Divisions (Foot Locker, Kids Foot Locker and Foot Action) over $2.5 billion in sales as VP Store Operations. Mr. Sullivan is known and respected for his expertise in wide-range governance, hypergrowth, and macro-level strategic management methodologies, with an emphasis on identifying and addressing business infrastructure to position organizations for expansion and profitability. He has achieved outstanding success scaling businesses for rapid profits and market dominance in start-ups, private, PE-backed, and public companies with revenues up to $2.5+ billion.

12

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table presents information regarding the total compensation awarded to, earned by, or paid to our chief executive officer and the three most highly-compensated executive officers (other than the chief executive officer) who were serving as executive officers as of the Record Date for services rendered in all capacities to us for the years ended December 31, 2020 and 2019.

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Option Awards ($)(1) | Stock Based Awards ($)(2) | All Other Compensation ($) | Total ($) | |||||||||||||||||||

| Darren Lampert | 2020 | 302,500 | 568,160 | - | - | - | 870,660 | |||||||||||||||||||

| Chief Executive Officer | 2019 | 211,750 | 358,765 | 1,147,700 | 1,224,000 | - | 2,914,215 | |||||||||||||||||||

| Michael Salaman | 2020 | 302,500 | 568,160 | - | 870,660 | |||||||||||||||||||||

| President | 2019 | 211,750 | 358,765 | 1,147,700 | 1,224,000 | - | 2,942,215 | |||||||||||||||||||

| Monty Lamirato (3) | 2020 | 205,000 | - | - | - | - | 205,000 | |||||||||||||||||||

| Chief Financial Officer and Secretary | 2019 | 175,000 | 30,750 | 389,100 | 373,500 | - | 968,350 | |||||||||||||||||||

| Tony Sullivan | 2020 | 270,000 | 75,000 | - | - | - | 345,000 | |||||||||||||||||||

| Chief Operating Officer | 2019 | 45,000 | - | 726,300 | 498,000 | - | 1,269,300 | |||||||||||||||||||

| (1) | The amounts in the Option Awards column reflect the aggregated grant date fair value of awards granted during 2020 and 2019 as computed in accordance with FASB ASC Topic 718. |

| (2) | The amounts in the Stock Based Awards column reflect the aggregated grant date fair value of awards granted during 2020 and 2019 as computed in accordance with FASB ASC Topic 718. |

| (3) | As of May 15, 2021, Monty Lamirato resigned as Chief Financial Officer and Secretary. |

Employment Agreements

On September 22, 2017, the Company entered into employment agreements with Darren Lampert, Chief Executive Officer, and Michael Salaman, President, who have each agreed to devote their full time and attention to the Company’s business and each receive compensation of $175,000 per annum, subject to a 10% increase each January 1 during the term of the agreements. In addition, commencing with the year ending December 31, 2017, each of Mr. Lampert and Mr. Salaman is entitled to receive a cash bonus payment equal to 0.5% multiplied by the difference between revenue in each fiscal year less $7,980,471, and is granted up to 300,000 options to purchase shares of common stock of the Company, of which 30,750 have been granted as of the date of their respective agreements.

On June 21, 2019, the Board of Directors approved the terms of new three-year employment agreements, effective January 1, 2020, with Mr. Lampert and Mr. Salaman. On March 23, 2020, the Company entered into three-year executive employment agreements with each of Mr. Lampert and Mr. Salaman, respectively, pursuant to which the Company agreed to pay each of them a salary of $275,000 per annum, subject to a 10% increase each January 1 during the term of the agreements. In addition, commencing with the year ending December 31, 2020, each of Mr. Lampert and Mr. Salaman is eligible for a cash bonus payment equal to 0.5% multiplied by the difference between revenue in each fiscal year less $79,773,568. The Company also agreed to (i) issue each of them a total of 300,000 shares of common stock in three equal installments each year; and (ii) grant each of them 300,000 options to purchase shares of Common Stock of the Company with a three year vesting schedule with 100,000 options vested as of January 1, 2020, 100,000 options as of January 1, 2021 and 100,000 options as of January 1, 2022. In addition, Mr. Lampert and Mr. Salaman each received a one-time signing bonus of 100,000 shares of common stock as of January 1, 2020.

13

On May 15, 2017, the Company entered into a three-year executive employment agreement with Monty Lamirato as Chief Financial Officer and Secretary, pursuant to which the Company agreed to pay Mr. Lamirato a salary of $150,000 per annum for the first year, $162,500 for the second year and $175,000 for the third year. The Company also agreed to issue to Mr. Lamirato 25,000 shares of common stock and 50,000 stock options as of July 10, 2017, May 15, 2018 and May 15, 2019, respectively.

On November 5, 2019, the Company entered into a new three-year executive employment agreement, effective January 1, 2020, with Monty Lamirato as Chief Financial Officer and Secretary, pursuant to which the Company agreed to pay Mr. Lamirato a salary of $205,000 per annum for the first year, $225,000 for the second year and $250,000 for the third year. The Company also agreed to issue to Mr. Lamirato a total of 90,000 shares of Common Stock in three equal installments each year and grant a total of 150,000 stock options with 50,000 options vesting on January 1, 2020, January 1, 2021 and January 1, 2022.

On November 4, 2019, the Company entered into a three-year executive employment agreement with Tony Sullivan as Chief Operating Officer and Executive Vice President, pursuant to which the Company agreed to pay Mr. Sullivan a salary of $270,000 per annum, subject to a 10% increase each year on the anniversary date of this agreement. In addition, the Company agreed to pay Mr. Sullivan a bonus with respect to each fiscal year in an amount equal to a minimum of $75,000. The Company also agreed to issue to Mr. Sullivan a total of 120,000 shares of Common Stock in three equal installments each year and grant a total of 280,000 stock options with 160,000 vested on November 4, 2019, 60,000 on November 4, 2020 and 60,000 on November 4, 2021. Mr. Sullivan was also paid a relocation fee of up to $80,000.

On March 21, 2021, the Company entered into a three-year executive employment agreement, effective from April 15, 2021, with Jeffrey Lasher as Chief Financial Officer and Secretary. On the same day, Mr. Lamirato resigned as Chief Financial Officer and Secretary. Pursuant to the agreement, the Company agreed to pay Mr. Lasher (i) a base wage of $316,000 per year which shall increase 12.5% effective January 1 of each calendar year; (ii) an annual bonus equal to 40% of the then current base annual wage per year; (iii) 60,000 shares of common stock vesting in six-month intervals through April 12, 2024; (iv) a potential year-end performance cash bonus and/or equity award; and (v) other company benefits and paid time off.

Additionally, each member of management may receive a year-end cash bonus and options as determined by the Compensation Committee and the Board of Directors.

Outstanding Equity Awards

The following table summarizes, for each of the named executive officers, the number of shares of Common Stock underlying outstanding stock options held as of December 31, 2020. Market values for outstanding stock awards are presented as of the end of 2020 based on the closing price on the NASQAQ Market on December 31, 2020 of $40.22.

14

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||||

| Name | Number of securities underlying unexercised options, exercisable | Number of securities underlying unexercised options, exercisable | Equity Incentive Plan Awards: Number of Securities underlying exercisable Options | Equity Incentive Plan Awards: Number of Securities underlying unexercised unearned Options | Option Exercise Price | Option Expiration Date | Number of Shares or Units of Stock that have not Vested | Market Value of Shares or Units of Stack that Have Not Vested | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that Have Not Vested | Equity Incentive Plan Awards: Market of Payout Value of Unearned Shares, Units or Other Rights that Have Not Vested | ||||||||||||||||||||||||||||

| Darren Lampert | 200,000 | $ | 8,044,000 | |||||||||||||||||||||||||||||||||||

| Darren Lampert | 133,335 | $ | 1.76 | 9/22/2022 | ||||||||||||||||||||||||||||||||||

| Darren Lampert | 16,667 | - | $ | 3.59 | 10/23/2023 | |||||||||||||||||||||||||||||||||

| Darren Lampert | 33,333 | - | $ | 2.96 | 3/26/2024 | |||||||||||||||||||||||||||||||||

| Darren Lampert | 93,219 | 200,000 | $ | 4.10 | 12/31/2024 | |||||||||||||||||||||||||||||||||

| Michael Salaman | 200,000 | $ | 8,044,000 | |||||||||||||||||||||||||||||||||||

| Michael Salaman | 133,335 | $ | 1.76 | 9/22/2022 | ||||||||||||||||||||||||||||||||||

| Michael Salaman | 16,667 | - | $ | 3.59 | 10/23/2023 | |||||||||||||||||||||||||||||||||

| Michael Salaman | 33,333 | - | $ | 2.96 | 3/26/2024 | |||||||||||||||||||||||||||||||||

| Michael Salaman | 93,219 | 200,000 | $ | 4.10 | 12/31/2024 | |||||||||||||||||||||||||||||||||

| Tony Sullivan | 40,000 | $ | 1,608,800 | |||||||||||||||||||||||||||||||||||

| Tony Sullivan | 140,000 | 60,000 | $ | 4.43 | 11/3/2024 | |||||||||||||||||||||||||||||||||

| Monty Lamirato * | 60,000 | $ | 2,413,200 | |||||||||||||||||||||||||||||||||||

| Monty Lamirato * | 100,000 | $ | 4.16 | 11/4/2024 | ||||||||||||||||||||||||||||||||||

* Mr. Lamirato resigned from the positions of Chief Financial Officer and Secretary as of April 15, 2021.

2014 Equity Compensation Plan

On March 6, 2014, the Board of the Company adopted an Equity Compensation Plan (the “2014 Plan”). The 2014 Plan was approved by the shareholders on March 6, 2014. The total number of shares issuable under the 2014 Plan is 2,500,000. As of the date hereof, there are a total of 2,281,500 options issued under the 2014 Plan (of which 2,063,833 options have been exercised 172,667 have been forfeited and 45,000 remain outstanding), and 375,000 shares of Common Stock issued. There are a total of 16,167 shares of Common Stock available to be issued under the 2014 Plan.

The 2014 Plan contains substantially the same terms as the 2018 Plan (defined and described below), other than the total number of shares authorized to be issued thereunder respectively. The full text of the 2014 Plan was filed as an exhibit to a Registration Statement on Form S-1 filed on November 9, 2015.

The following table sets forth stock options that were approved by the Board to the persons and groups named below under the 2014 Plan as of December 31, 2020.

| Name and Position | Number of Shares of Common Stock underlying Stock Options | |||

| Darren Lampert, Chief Executive Officer | 680,750 | |||

| Michael Salaman, President | 430,750 | |||

| Monty Lamirato, Chief Financial Officer* | 150,000 | |||

| Tony Sullivan, Chief Operating Officer | - | |||

| All executive officers as a group | 1,311,500 | |||

| All non-executive directors as a group | 75,000 | |||

| All non-executive officer employees as a group | 895,000 | |||

* Mr. Lamirato resigned from the positions of Chief Financial Officer and Secretary as of April 15, 2021.

15

2018 Equity Compensation Plan

On January 7, 2018, the Board adopted the 2018 Equity Incentive Plan (the “2018 Plan”), which was approved and ratified by the shareholders on April 20, 2018. On February 7, 2020, the Board approved the amendment and restatement of the 2018 Plan to increase the number of shares issuable thereunder from 2,500,000 to 5,000,000, which amendment was approved by shareholders on May 11, 2020 (as amended and restated, the “Amended 2018 Plan”). As of the date hereof, there have been a total of (i) 1,963,000 options issued (of which 1,437,827 options are currently outstanding, 487,506 have been exercised, and 37,667 have been forfeited which will be available for future grants), and (ii) 1,316,579 shares of Common Stock issued. There are a total of 1,758,088 shares of Common Stock available to be issued under the Amended 2018 Plan.

The general purpose of the Amended 2018 Plan is to provide an incentive to the Company’s employees, directors, consultants and advisors by enabling them to share in the future growth of the Company’s business. The Board believes that the granting of stock options, restricted stock awards, unrestricted stock awards and similar kinds of equity-based compensation promotes continuity of management and increases incentive and personal interest in the welfare of the Company by those who are primarily responsible for shaping and carrying out its long-range plans and securing its growth and financial success.

The Board believes that the Amended 2018 Plan will advance the Company’s interests by enhancing its ability to (a) attract and retain employees, consultants, directors and advisors who are in a position to make significant contributions to the Company’s success; (b) reward the Company’s employees, consultants, directors and advisors for these contributions; and (c) encourage employees, consultants, directors and advisors to take into account the Company’s long-term interests through ownership of its shares.

Description of the Amended and Restated 2018 Equity Incentive Plan

The following description of the principal terms of the Amended 2018 Plan is a summary and is qualified in its entirety by the full text of the Amended 2018 Plan, which was filed as an exhibit to the Proxy Statement on Schedule 14A filed on March 27, 2020.

Administration. The Amended 2018 Plan will be administered by our Board. Our Board may grant options to purchase shares of our common stock, stock appreciation rights, restricted stock units, restricted or unrestricted shares of our common stock, performance shares, performance units, other cash-based awards and other stock-based awards. The Board also has broad authority to determine the terms and conditions of each option or other kind of equity award, adopt, amend and rescind rules and regulations for the administration of the Amended 2018 Plan and amend or modify outstanding options, grants and awards.

Eligibility. Persons eligible to receive awards under the Amended 2018 Plan are employees, directors and consultants of our Company and our subsidiaries. As of the date hereof, approximately 592 employees, three non-employee directors, and approximately 4 consultants are eligible to participate in the Amended 2018 Plan. The Board may at any time and from time to time grant awards under the Amended 2018 Plan to eligible persons on a discretionary basis.

Shares Subject to the Amended 2018 Plan. The aggregate number of shares of common stock available for issuance in connection with options and awards granted under the Amended 2018 Plan is 5,000,000, subject to customary adjustments for stock splits, stock dividends or similar transactions. Incentive Stock Options may be granted under the Amended 2018 Plan with respect to all of those shares. If any option or stock appreciation right granted under the Amended 2018 Plan terminates without having been exercised in full or if any award is forfeited, or if shares of common stock are withheld to cover withholding taxes on options or other awards, the number of shares of common stock as to which such option or award was forfeited, or which were withheld, will be available for future grants under the Amended 2018 Plan. The maximum aggregate number of shares of common stock with respect to one or more awards that may be granted to any employee, director or consultant during any calendar year shall be 1,000,000 and the maximum aggregate amount of cash that may be paid in cash during any calendar year with respect to one or more awards payable in cash shall be $600,000.

16

Terms and Conditions of Options. Options granted under the Amended 2018 Plan may be either “incentive stock options” that are intended to meet the requirements of Section 422 of the Code or “nonstatutory stock options” that do not meet the requirements of Section 422 of the Code. Incentive stock options may be granted only to employees. Each option grant will be evidenced by an award agreement that will specify the terms and conditions as determined by the Board. The Board will determine the exercise price of options granted under the 204 Plan. The exercise price of stock options may not be less than the fair market value, on the date of grant, per share of our common stock issuable upon exercise of the option (or 110% of fair market value in the case of incentive options granted to a ten-percent stockholder).

If on the date of grant the common stock is listed on a stock exchange or a national market system, the fair market value shall be the closing sale price on the last trading day before the date of grant. If no such prices are available, the fair market value shall be determined in good faith by the Board based upon the advice of a qualified valuation expert.

No option may be exercisable for more than ten years (five years in the case of an incentive stock option granted to a ten-percent stockholder) from the date of grant. Options granted under the Amended 2018 Plan will be exercisable at such time or times as the Board prescribes at the time of grant. No employee may receive incentive stock options that first become exercisable in any calendar year in an amount exceeding $100,000.

Generally, the option price may be paid (a) in cash or by bank check, (b) through delivery of shares of our common stock having a fair market value equal to the purchase price, (c) through cashless exercise, or (d) a combination of these methods.

No option may be transferred other than by will or by the laws of descent and distribution, and during a recipient’s lifetime an option may be exercised only by the recipient. Options granted under the 2018 Plan will be exercisable at such time or times as the Board prescribes at the time of grant. No employee may receive incentive stock options that first become exercisable in any calendar year in an amount exceeding $100,000.

The following table sets forth stock options that were approved by the Board to the persons and groups named below under the Amended 2018 Plan as of December 31, 2020.

| Name and Position | Number of Shares of Common Stock underlying Stock Options | |||

| Darren Lampert, Chief Executive Officer | 375,000 | |||

| Michael Salaman, President | 375,000 | |||

| Monty Lamirato, Chief Financial Officer* | 170,000 | |||

| Tony Sullivan, Chief Operating Officer | 280,000 | |||

| All executive officers as a group | 1,200,000 | |||

| All non-executive directors as a group | 300,000 | |||

| All non-executive officer employees as a group | 463,000 | |||

* Mr. Lamirato resigned from the positions of Chief Financial Officer and Secretary as of April 15, 2021.

17

Stock Appreciation Rights. The Board may grant stock appreciation rights under the Amended 2018 Plan in such amounts as the Board in its sole discretion will determine. Each stock appreciation right grant will be evidenced by an award agreement that will specify the terms and conditions as determined by the Board. The exercise price per share of a stock appreciation right will be determined by the Board but will not be less than 100% of the fair market value of a share of our common stock on the date of grant. The maximum term of any SAR granted under the Amended 2018 Plan is ten years from the date of grant. Generally, each SAR stock appreciation right will entitle a participant upon exercise to an amount equal to:

| ● | the excess of the fair market value on the exercise date of one share of our common stock over the exercise price, multiplied by | |

| ● | the number of shares of common stock covered by the stock appreciation right. |

Payment may be made in shares of our common stock, in cash, or partly in common stock and partly in cash, all as determined by the Board.

Restricted Stock and Restricted Stock Units. The Board may award restricted common stock and/or restricted stock units under the Amended 2018 Plan in such amounts as the Board in its sole discretion will determine. The Board will determine the restrictions and conditions applicable to each award of restricted stock or restricted stock units, as evidenced in an award agreement, which may include performance-based conditions. Dividends and other distributions with respect to restricted stock may be paid to the holder of the shares as and when dividends are paid to stockholders, unless otherwise provided in the award agreement. Unless the Board determines otherwise, holders of restricted stock will have the right to vote the shares.

Performance Shares and Performance Units. The Board may award performance shares and/or performance units under the Amended 2018 Plan in such amounts as the Board in its sole discretion will determine. Each performance unit will have an initial value that is established by the Board on or before the date of grant. Each performance share will have an initial value equal to the fair market value of a share on the date of grant. The Board at its discretion will set performance objectives or other vesting provisions. The Board will determine the restrictions and conditions applicable to each award of performance shares and performance units, as evidenced in an award agreement.

Effect of Certain Corporate Transactions. In the event of a change in control (as defined in the Amended 2018 Plan), the Board has the discretion and without the need for the consent of any recipient of an award to take the following actions as to an outstanding award: (i) awards will be assumed, or substantially equivalent awards will be substituted, by the acquiring or succeeding corporation; (ii) awards will terminate upon or immediately prior to the consummation of such change in control; (iii) outstanding awards will vest and become exercisable, or restrictions applicable to an award will lapse, in whole or in part prior to or upon consummation of such change in control, and terminate upon or immediately prior to the effectiveness of such change in control; (iv) an award is terminated in exchange for an amount of cash and/or property, if any, equal to the amount that would have been attained upon the exercise of such award; (v) an award is replaced with other rights or property selected by the Board in its sole discretion; or (vi) any combination of the foregoing.

Amendment, Termination. The Board may at any time amend, alter, amend the terms of awards in any manner not inconsistent with the Amended 2018 Plan, provided that no amendment shall adversely affect the rights of a participant with respect to an outstanding award without the participant’s consent. In addition, our Board may at any time amend, suspend, or terminate the Amended 2018 Plan, provided that (i) no such amendment, suspension or termination shall materially and adversely affect the rights of any participant under any outstanding award without the consent of such participant and (ii) to the extent necessary to comply with any applicable law or stock exchange rule, the Company will obtain stockholder consent of amendment to the plan.

Tax Withholding

Prior to the delivery of any shares or cash pursuant to an award or exercise thereof, the Company will have the power and the right to deduct or withhold, or require a holder of such award to remit to the Company, an amount sufficient to satisfy federal, state, local, foreign or other taxes required to be withheld with respect to such award or exercise thereof.

Grants of Awards

The grant of awards under the Amended 2018 Plan is discretionary, and the Company cannot determine now the specific number or type of options or awards to be granted in the future to any particular person or group.

18

Equity Compensation Plan Information

The following table provides certain information with respect to all of our equity compensation plans in effect as of the fiscal year ended December 31, 2020.

| Number of common shares to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding option, warrants and rights (b) | Number of common shares remaining available for future issuance under equity compensation plans (excluding shares reflected in column (a)) (c) | ||||||||||

| Equity compensation plans approved by security holders | ||||||||||||

| 2014 Equity Compensation Plan | 50,000 | $ | 3.46 | 11,166 | ||||||||

| 2018 Equity Compensation Plan | 1,486,438 | $ | 4.39 | 1,961,688 | ||||||||

| Equity compensation plans not approved by security holders | — | $ | — | — | ||||||||

| Total | 1,536,438 | $ | 4.30 | 1,972,854 | ||||||||

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS, DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the number of shares of Common Stock beneficially owned as of the Record Date by:

| ● | each of our stockholders who is known by us to beneficially own 5% or more of our Common Stock; | |

| ● | each of our executive officers; | |

| ● | each of our directors; and | |

| ● | all of our directors and current executive officers as a group. |

Beneficial ownership is determined based on the rules and regulations of the Securities and Exchange Commission (the “SEC”). A person has beneficial ownership of shares if such individual has the power to vote and/or dispose of shares. This power may be sole or shared and direct or indirect. Applicable percentage ownership in the following table is based on the total of 58,430,212 shares of Common Stock outstanding as of the Record Date. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of Common Stock that are subject to options or warrants held by that person and exercisable as of, or within 60 days of, the Record Date. These shares, however, are not counted as outstanding for the purposes of computing the percentage ownership of any other person(s). Except as may be indicated in the footnotes to this table and pursuant to applicable community property laws, each person named in the table has sole voting and dispositive power with respect to the shares of Common Stock set forth opposite that person’s name. Unless indicated below, the address of each individual listed below is c/o GrowGeneration Corp., 930 W 7th Ave, Suite A, Denver, Colorado 80204.

19

| Name of Beneficial Owner | Number of Shares Beneficially Owned |

Percentage of Shares Beneficially Owned |

||||||

| Michael Salaman, President and Director | 1,451,027 | 1 | 2.47 | % | ||||

| Darren Lampert, Chief Executive Officer and Director | 1,399,942 | 2 | 2.38 | % | ||||

| Tony Sullivan, Chief Operating Office and Executive Vice President | 247,970 | 3 | * | |||||

| Jeffrey Lasher, Chief Financial Officer and Secretary | 0 | * | ||||||

| Stephen Aiello, Director | 647,637 | 4 | 1.10 | % | ||||

| Sean Stiefel, Director | 643,396 | 5 | 1.10 | % | ||||

| Paul Ciasullo, Director | 433,334 | 6 | * | % | ||||

| All Officers and Directors (7 Persons) | 4,823,306 | 8.10 | % | |||||

| BlackRock, Inc. | 2,711,140 | 4.64 | % | |||||

| Gotham Green Fund 1, L.P. | 3,591,700 | 7 | 6.15 | % | ||||

| * | Less than 1% |

| 1 | Includes i) 1,074,473 shares of common stock; and ii) 376,554 vested stock options. Mr. Salaman also owns 100,000 options exercisable on January 1, 2022. |

| 2 | Includes i) 1,023,388 shares of common stock; and ii) 376,554 vested stock options. Mr. Lampert also owns 100,000 options exercisable on January 1, 2022. |

| 3 | Includes i) 130,543 shares of common stock; and ii) 117,427 vested options. Mr. Sullivan also owns 33,427 options exercisable commencing November 4, 2020 and 60,000 options exercisable commencing November 4, 2021. |

| 4 | Includes i) 196,774 shares of common stock owned by Aiello Family Trust; ii) 48,387 shares of common stock underlying warrants held by Aiello Family Trust; iii) 269,143 shares owned by Stephen Aiello; iv) 116,667 vested stock options; and (v) 16,666 options exercisable commencing May 12, 2021. Mr. Aiello also owns 16,667 options exercisable commencing May 12, 2022. |

| 5 | Includes (i) 111,252 shares of common stock; (ii) 16,667 vested stock options; (iii) 16,666 options exercisable commencing May 12, 2021; and (iv) 498,811 shares of common stock held by Navy Capital Green Fund, LP (“Navy Capital”). Mr. Stiefel is a manager and Chief Executive Officer of Navy Capital Green Management, LLC (“NCG”) and a manager of Navy Capital Green Management Partners, LLC (“NCGMP”). NCGMP is the general partner of Navy Capital. NCG is the investment manager of Navy Capital. Accordingly, Mr. Stiefel may be deemed to indirectly beneficially own the shares held by Navy Capital. Mr. Stiefel also owns 16,667 options exercisable commencing May 12, 2022. |

| 6 | Includes (i) 400,000 shares of common stock; (ii) 16,667 vested stock options; and (iii) 16,667 options exercisable commencing May 12, 2021. Mr. Ciasullo also owns 16,666 options exercisable on May 12, 2022. |

| 7 | Includes (i) 1,841,162 shares of common stock held by Gotham Green Fund 1 (Q), L.P.; (ii) 460,216 shares of common stock held by Gotham Green Fund 1, L.P.; (iii) 1,101,135 shares of common stock held by Gotham Green Fund II (Q), L.P.; and (iv) 189,187 shares of common stock held by Gotham Green Fund II, L.P.. |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Other than compensation arrangements which are described under “Executive Compensation,” during the last two fiscal years, there are no transactions or series of similar transactions to which the Company was a party or will be a party, in which:

| ● | the amounts involved exceeded or will exceed $120,000; and | |

| ● | any of the Company’s directors, director nominees, executive officers or holders of more than 5% of its capital stock, or any member of the immediate family of the foregoing persons, had or will have a direct or indirect material interest. |

[remainder of page intentionally left blank]

20

PROPOSAL 2: APPROVAL AND RATIFICATION OF THE APPOINTMENT OF INDEPENDENT AUDITORS

Connolly Grady & Cha served as the Company’s independent registered public accounting firm for 2019 and 2018. On March 27, 2020, the Audit Committee and the Board of Directors approved the dismissal of Connolly Grady & Cha as the Company’s independent registered public accounting firm and approved the appointment of Plante & Moran as the Company’s new independent registered public accounting firm to perform independent audit services for the fiscal year ending December 31, 2020.

The following table shows the fees that were billed for the audit and other services provided by this firm for 2020 and 2019.

| 2020 | 2019 | |||||||

| Audit Fees | $ | 624,250 | $ | 155,000 | ||||

| Audit-Related Fees | $ | - | $ | - | ||||

| Tax Fees | $ | 44,500 | $ | - | ||||

| All Other Fees | $ | 56,400 | $ | - | ||||

| Total | $ | 695,150 | $ | 155,000 | ||||

Audit Fees — This category includes the audit of our annual financial statements, review of financial statements included in our Quarterly Reports on Form 10-Q and services that are normally provided by the independent registered public accounting firm in connection with engagements for those fiscal years. This category also includes advice on audit and accounting matters that arose during, or as a result of, the audit or the review of interim financial statements.