UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934

| | | | | |

|

| Filed by the Registrant |

| ☐ | Filed by a Party other than the Registrant |

Check the appropriate box: | | | | | | | | |

|

| ☐ | Preliminary Proxy Statement |

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Section 240.14a-12 |

| |

GROWGENERATION CORP.

(Exact name of Registrant as specified in its charter)

| | |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | | | | |

Payment of Filing Fee (check the appropriate box): |

| | |

| No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

GROWGENERATION CORP.

5619 DTC Parkway, Suite 900

Greenwood Village, Colorado 80111

(800) 935-8420

NOTICE OF 2022 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 23, 2022

To the Shareholders of GrowGeneration Corp.:

The 2022 Annual Meeting of Shareholders (the “Annual Meeting”) of GrowGeneration Corp., a Colorado corporation (the “Company”), will be held on Thursday, June 23, 2022 at 4:00 p.m., Eastern Daylight Time. Due to public health concerns relating to COVID-19, as well as to facilitate broader shareholder attendance and cost savings, it will be a virtual meeting. Shareholders may attend the Annual Meeting, vote and submit questions during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/GRWG2022. Prior to the Annual Meeting, you will be able to vote over the Internet, by phone or by mail.

The Annual Meeting will be for the following purposes:

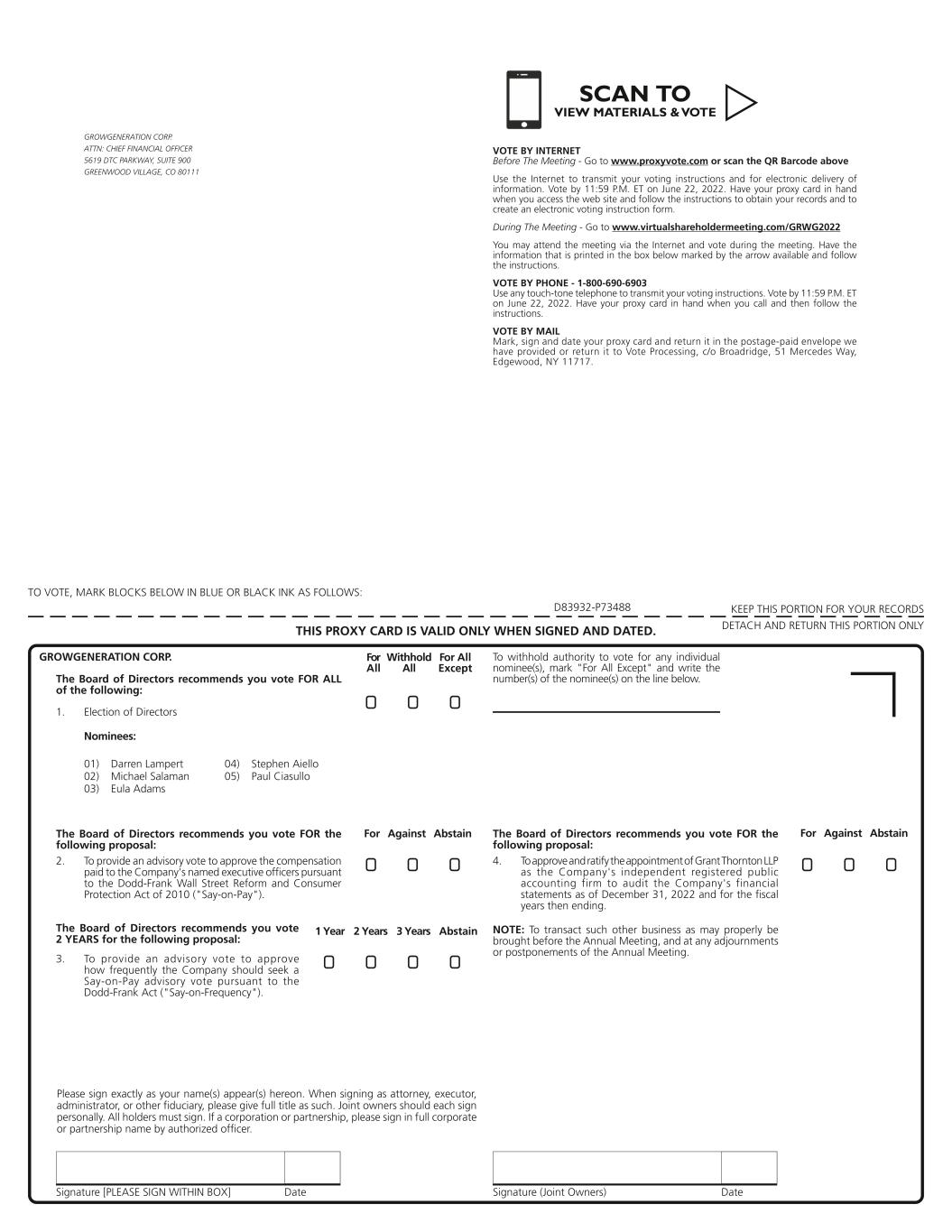

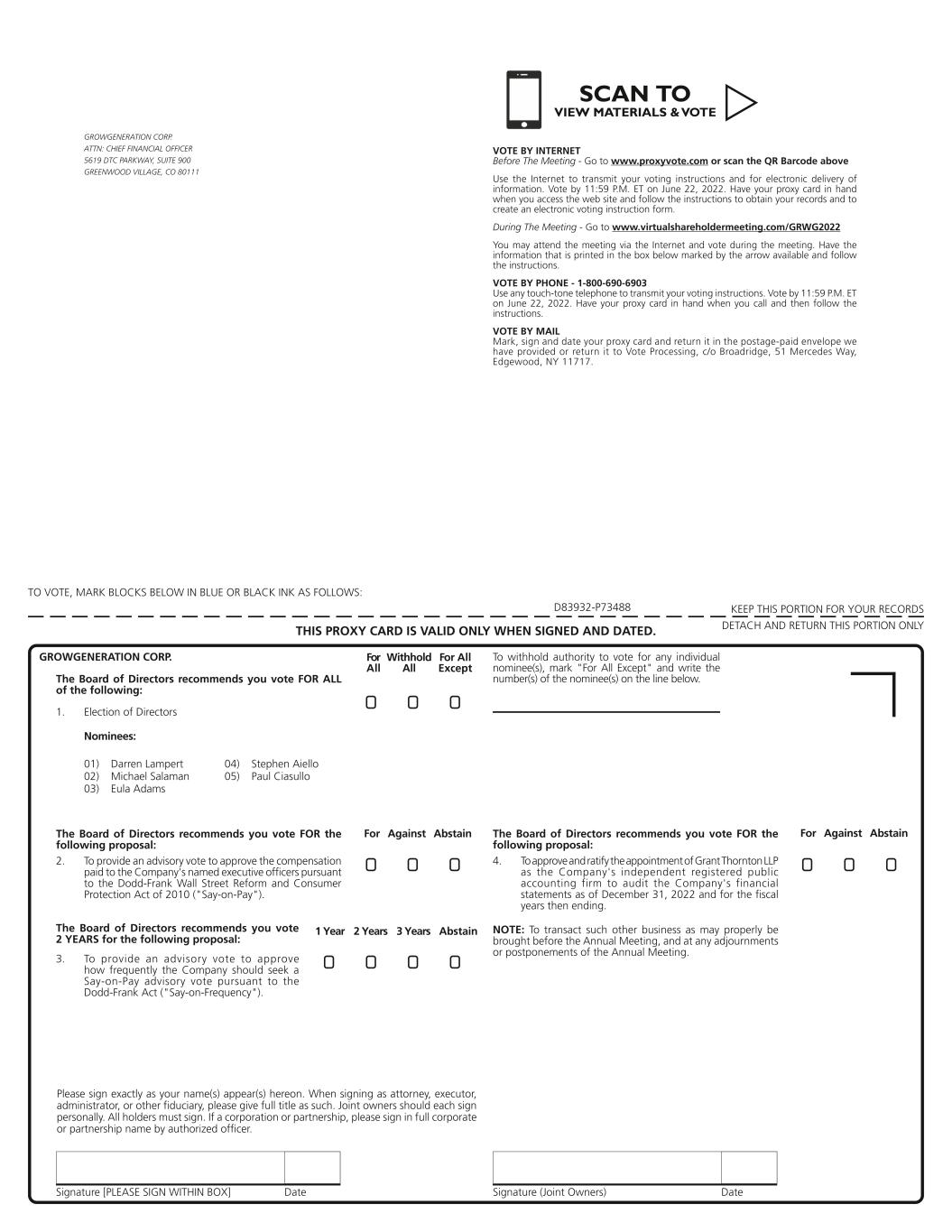

1.To elect five (5) directors to the Board of Directors of the Company to serve until the Company’s 2023 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified;

2.To conduct an advisory vote on the compensation of the Company’s named executive officers;

3.To conduct an advisory vote on the frequency of advisory votes on the compensation of the Company’s named executive officers;

4.To approve and ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm to audit the Company’s financial statements as of December 31, 2022 and for the fiscal year then ending; and

5.To transact such other business as may properly be brought before the Annual Meeting, and at any adjournments or postponements of the Annual Meeting.

Holders of record of the Company’s common stock at the close of business on April 20, 2022 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements of the Annual Meeting. If there are insufficient shares present in person or represented by proxy at the Annual Meeting in order to obtain a quorum, the Annual Meeting may be adjourned or postponed to permit further solicitation of proxies.

ALL SHAREHOLDERS AS OF APRIL 20, 2022 ARE CORDIALLY INVITED TO ATTEND THE MEETING. HOWEVER, EVEN IF YOU PLAN TO ATTEND THE MEETING, PLEASE VOTE YOUR SHARES OVER THE INTERNET, BY TELEPHONE OR BY MAIL SO THAT YOUR SHARES WILL BE REPRESENTED WHETHER OR NOT YOU ARE ABLE TO ATTEND THE MEETING. THE PROMPT RETURN OF PROXIES WILL SAVE US THE EXPENSE OF FURTHER REQUESTS FOR PROXIES TO ENSURE A QUORUM AT THE MEETING. VOTING OVER THE INTERNET, BY TELEPHONE OR BY MAILING A PROXY CARD WILL NOT LIMIT YOUR RIGHT TO ATTEND THE ANNUAL MEETING AND VOTE YOUR SHARES IN PERSON.

By Order of the Board of Directors,

_____________________________________

Darren Lampert, Chief Executive Officer

Greenwood Village, CO

April 27, 2022

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING OF SHAREHOLDERS TO BE HELD ON THURSDAY, JUNE 23, 2022

The Notice of the 2022 Annual Meeting of Shareholders, the Proxy Statement, and the Annual Report for Fiscal Year ended December 31, 2021 are available on the Internet at www.proxyvote.com. Please have your 16-digit control number (included in your Notice, on your proxy card or in the instructions that accompanied your proxy materials) in hand when accessing this website.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 23, 2022

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Why did I receive this Proxy Statement?

The Board of Directors (the “Board”) of GrowGeneration Corp. (“GrowGeneration” or the “Company”) is furnishing this Proxy Statement to solicit proxies on its behalf to be voted at the 2022 Annual Meeting of Shareholders of the Company (the “Annual Meeting”) or at any adjournment or postponement thereof. The Annual Meeting is scheduled to be held on Thursday, June 23, 2022 at 4:00 p.m., Eastern Daylight Time, virtually at www.virtualshareholdermeeting.com/GRWG2022. This Proxy Statement summarizes the information you need to know to vote by proxy or in person at the Annual Meeting. You do not need to attend the Annual Meeting in person in order to vote. Prior to the Annual Meeting, you will be able to vote over the Internet, by phone or by mail.

When is this Proxy Statement first being sent or made available to shareholders?

We will begin mailing the Notice of the Annual Meeting (the “Notice”) on or shortly after the date of this Proxy Statement to holders of record of the Company’s common stock, par value $0.001 per share (the “Common Stock”), as of the close of business on April 20, 2022 (the “Record Date”). As indicated in the Notice, this Proxy Statement and other materials are available on the Internet at www.proxyvote.com. Shareholders may request to receive a full package of the proxy materials by following the instructions included in the Notice.

Who is entitled to vote at the Annual Meeting?

Holders of record of GrowGeneration’s Common Stock as of the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting. As of close of business on the Record Date, there were 60,743,143 shares of Common Stock issued and outstanding.

What is the quorum for the meeting?

The presence, in person or by proxy, of one-third of the outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes (described below) will be counted as present for purposes of determining the presence of a quorum at the meeting but will not be counted as present for any other purpose, including voting (described below). No business may be conducted at the Annual Meeting if a quorum is not present. If a quorum is not present, a majority of the shares represented at the Annual Meeting may adjourn the Annual Meeting to another date, time or place. Notice need not be given of the new date, time or place if announced at the meeting before an adjournment is taken, unless a new record date is fixed for the Annual Meeting or the meeting is adjourned for more than 60 days (in which case a notice of the adjourned meeting will be given to each shareholder of record entitled to vote at the meeting). At any such adjourned meeting, shareholders present in person or by proxy representing a majority of the shares entitled to vote at the adjourned meeting constitute a quorum.

How can I attend the meeting?

The Annual Meeting will be a completely virtual meeting due in part to the ongoing public health impact of the COVID-19 pandemic. This decision was made in light of the protocols that federal, state, and local governments have imposed or may impose in the near future and taking into account the health and safety of our shareholders, directors, members of management and other attendees. The Company expects that a virtual meeting will also facilitate broader shareholder attendance and cost savings.

To attend and participate in the virtual Annual Meeting, please visit www.virtualshareholdermeeting.com/GRWG2022 and have available the 16-digit control number included in your Notice, on your proxy card or in the

instructions that accompanied your proxy materials. You are entitled to participate in the virtual Annual Meeting only if you have a 16-digit control number. If you hold shares as a beneficial owner in “street name” and do not receive a 16-digit control number from the Company, please follow the instructions on how to generate the control number from your broker, bank or other institution.

Online access to the audio webcast will open 15 minutes prior to the start of the meeting to allow time for shareholders to log in and test the computer audio system. If you experience any technical difficulties, please call the phone number displayed on the virtual annual meeting website.

Even if you plan to attend the Annual Meeting, the Company recommends that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Annual Meeting.

How many votes do I have?

Each share of Common Stock entitles its owner to one vote on all matters brought before the Annual Meeting.

How do shareholders of record vote?

If you are a record holder, which means your shares are registered in your name, you may vote or submit a proxy:

1. Over the Internet — If you have Internet access, you may go to www.proxyvote.com and complete the electronic proxy card. You must specify how you want your shares voted, or your vote will not be registered and you will receive an error message. Your shares will be voted according to your instructions.

2. By Telephone — You may authorize the voting of your shares by calling 1-800-690-6903. You must specify how you want your shares voted, or your vote will not be registered and you will receive an error message. Your shares will be voted according to your instructions.

3. By Mail — If you have chosen to receive a full package of proxy materials, which include a proxy card, you may mail the completed proxy card by following the instructions set forth in the proxy card. You may use the postage prepaid envelope provided in the package to mail the proxy card. Your shares will be voted according to your instructions. If you sign your proxy card but do not specify how you want your shares voted, they will be voted in accordance with the recommendations of the Board. Unsigned proxy cards will not be voted.

4. In Person at the Meeting — If you attend the virtual Annual Meeting in person, you may vote your shares electronically at the Annual Meeting through the virtual shareholder meeting portal.

How do I vote my shares if they are held by my broker?

If you hold your shares of Common Stock through a broker, bank or other financial institution, you are considered the beneficial owner of shares held in “street name” and you will receive instructions on how to vote from your broker, bank or other institution. The voting deadlines and availability of mail, telephone and Internet voting for beneficial owners of shares held in “street name” will depend on the voting processes of the organization that holds your shares. Therefore, we urge you to carefully review and follow the voting instruction card and any other materials that you receive from that organization.

As a beneficial owner, if you have the 16-digit control number and attend the virtual Annual Meeting, you may vote your shares or change your votes at the virtual meeting.

What am I voting on?

At the Annual Meeting, GrowGeneration’s shareholders will be asked:

1.To elect Darren Lampert, Michael Salaman, Eula Adams, Stephen Aiello, and Paul Ciasullo to the Board, to serve until the Company’s 2023 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified;

2.To provide an advisory vote to approve the compensation paid to the Company’s named executive officers pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Say-on-Pay”);

3.To provide an advisory vote to approve how frequently the Company should seek a Say-on-Pay advisory vote pursuant to the Dodd-Frank Act (“Say-on-Frequency”);

4.To approve and ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm to audit the Company’s financial statements as of December 31, 2022 and for the fiscal year then ending; and

5.To transact such other business as may properly be brought before the Annual Meeting, and at any adjournments or postponements of the Annual Meeting.

What vote is required for each proposal?

Proposal 1 – Election of Directors

If a quorum is present, directors will be elected pursuant to the affirmative vote of a plurality of the shares of Common Stock present in person or represented by proxy at the Annual Meeting. This means that the five nominees who receive the most affirmative votes will be elected to the Board of Directors.

Proposal 2 – Say-on-Pay

If a quorum is present, the non-binding approval of named executive officer compensation as disclosed in this Proxy Statement will require the number of votes cast in favor of the proposal to exceed the number of votes cast against the proposal.

Proposal 3 – Say-on-Frequency

Generally, if a quorum is present, approval of a proposal (other than the election of directors) will require the number of votes cast in favor of the proposal to exceed the number of votes cast against the proposal. With respect to how frequently the Company will seek an advisory vote on executive compensation, shareholders may vote in favor of holding such vote once every year, once every two years or once every three years, or may abstain from voting. Because this proposal involves more than two possible outcomes, and because the vote is advisory and non-binding, the vote frequency option receiving the greatest number of votes will be considered the frequency option recommended by the Company’s shareholders.

Proposal 4 – Independent Auditor

If a quorum is present, the approval and ratification of the appointment Grant Thornton LLP as the Company’s independent registered public accounting firm for the 2022 fiscal year will require the number of votes cast in favor of the proposal to exceed the number of votes cast against the proposal.

How are abstentions and broker “non-votes” treated?

Abstentions

Pursuant to Colorado law, abstentions are counted as present for purposes of determining the presence of a quorum at the Annual Meeting. Abstentions will have no effect on Proposal 1 (Election of Directors), as this proposal is decided by a plurality of the votes cast. Abstentions will also have no effect on Proposal 2 (Say-on-Pay), Proposal 3 (Say-on-Frequency) or Proposal 4 (Independent Auditor), as only votes “For” or “Against” will be counted for these proposals.

Broker “non-votes”

Broker non-votes occur when a beneficial owner of shares held in street name does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” such as ratification of appointment of the independent auditor, but may not vote those shares with respect to “non-routine” matters, such as election of directors.

Broker non-votes are counted to determine whether a quorum is present at a shareholders’ meeting if at least one routine matter (such as ratification of appointment of the independent auditor) will be voted on at the meeting. Accordingly, broker non-votes will be counted as present for purposes of determining the presence of a quorum at the Annual Meeting, but will not be counted as present for any other purpose. As a result, broker non-votes will not have any effect on the approval of the proposals contained in this Proxy Statement.

What happens if I submit or return my proxy card without voting?

If you properly submit your proxy via the Internet, telephone or mail, the shares it represents will be voted at the Annual Meeting in accordance with your directions. If you properly submit your signed proxy with no direction, the proxy will be voted “FOR” the proposals as recommended by the Board of Directors.

Can I change my vote after I have voted?

If you have submitted a proxy pursuant to this solicitation, you may revoke such proxy at any time prior to its exercise by:

•written notice delivered to the Secretary at 5619 DTC Parkway, Suite 900, Greenwood Village, CO 80111;

•executing and delivering a proxy with a later date;

•submitting an Internet or telephone vote with a later date; or

•attending the Annual Meeting and voting in person.

With respect to Internet and telephone votes, the last vote transmitted will be the vote counted. Attendance at the Annual Meeting will not, in itself, constitute revocation of a proxy.

If you are the beneficial owner of shares held in street name, you must submit new voting instructions to your stockbroker, bank or other nominee pursuant to the instructions you have received from them.

Will anyone contact me regarding this vote?

No arrangements or contracts have been made with any proxy solicitors as of the date of this Proxy Statement. However, the Company may retain a proxy solicitor if it appears reasonably likely that it may not obtain a quorum to conduct the Annual Meeting. In addition, the Company’s directors, officers and employees may solicit proxies in person and by telephone or e-mail; however, these persons will not receive any additional compensation for any such solicitation efforts.

Brokerage firms, nominees, custodians and fiduciaries also may be requested to forward proxy materials to the beneficial owners of shares held as of the Record Date.

How will voting results be communicated?

Preliminary voting results will be announced at the Annual Meeting. We will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the Annual Meeting. If final results are

unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose final voting results within four business days after final voting results are known.

How do I submit questions for the Annual Meeting?

Shareholders may submit questions before or after the Annual Meeting by contacting the Secretary of the Company by mail at GrowGeneration Corp., 5619 DTC Parkway, Suite 900, Greenwood Village, CO 80211. Shareholders may also submit questions during the Annual Meeting via the virtual shareholder meeting portal.

Who has paid for this proxy solicitation?

All expenses incurred in connection with the solicitation of proxies, including the printing and mailing of this Proxy Statement and related materials, will be borne by the Company.

How do I obtain a list of GrowGeneration’s shareholders?

A list of GrowGeneration’s shareholders as of the Record Date for the Annual Meeting will be available for inspection at GrowGeneration’s corporate headquarters, located at 5619 DTC Parkway, Suite 900, Greenwood Village, Colorado 80111, during normal business hours beginning the earlier of ten (10) days immediately prior to the Annual Meeting or two (2) business days after the notice of the Annual Meeting is given, and continuing through the Annual Meeting, and any adjournment thereof.

How do I submit a proposal for the 2023 Annual Meeting of Shareholders?

For a shareholder proposal to be considered for inclusion in GrowGeneration’s 2023 Annual Meeting of Shareholders, it must be submitted in writing together with proof of stock ownership and received by GrowGeneration’s Chief Financial Officer at GrowGeneration’s corporate headquarters, located at 5619 DTC Parkway, Suite 900, Greenwood Village, CO 80111, no later than December 31, 2022. All shareholder proposals must comply with Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

[remainder of page intentionally left blank]

PROPOSAL 1: ELECTION OF DIRECTORS

Upon the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has nominated Darren Lampert, Michael Salaman, Eula Adams, Stephen Aiello, and Paul Ciasullo to stand for election to the Board of Directors of GrowGeneration, each to hold office until the 2023 Annual Meeting of Shareholders and until their respective successors are elected and qualified. All of the director nominees are incumbent directors.

Set forth below is biographical information for each person nominated for election to the Board of Directors, including a description of the experience, qualifications, attributes and skills that led to the conclusion that the person should serve as a director of the Company, in light of the Company’s business strategy, prospects and structure. Also below is diversity information regarding the composition of the Board of Directors.

The Company has no reason to believe that any of these nominees will refuse or be unable to serve as a director if elected; however, if any of the nominees refuses or is unable to serve, each proxy that does not direct otherwise will be voted for a substitute nominee designated by the Board of Directors.

Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement.

Nominees for Director

| | | | | | | | | | | |

| Name | | Age | Tenure |

| Darren Lampert | | 61 | 8.1 |

| Michael Salaman | | 59 | 8.1 |

| Eula Adams | | 72 | 0.7 |

| Stephen Aiello | | 61 | 8.0 |

| Paul Ciasullo | | 63 | 2.0 |

Darren Lampert has been our Chief Executive Officer and a Director since our inception in 2014. Mr. Lampert began his career in 1986 as a founding member of the law firm of Lampert and Lampert (1986-1999), where he concentrated on securities litigation, NASD (now FINRA) compliance and arbitration and corporate finance matters. Mr. Lampert has represented clients in actions and investigations brought before government agencies and self-regulatory bodies. From 1999 to 2014, Mr. Lampert worked as a portfolio manager and proprietary trader at a number of broker-dealer firms. From 2010 to 2014, Mr. Lampert was a private investor. Mr. Lampert graduated in 1982 with a Bachelor of Science degree in business administration from Ithaca College. Mr. Lampert received a J.D. from Bridgeport University School of Law in 1985. Mr. Lampert was admitted to practice law in New York in 1986 and is also admitted to practice before the United States District Courts for the Southern and Eastern Districts of New York.

Michael Salaman has been our President and a Director since our inception. Mr. Salaman served as the Chairperson of Skinny Nutritional Corp. from 2002 to 2014 and as Chief Executive Officer and President of Skinny Nutritional Corp. from 2010 to 2014. Skinny Nutritional Corp. filed for Chapter 11 Bankruptcy protection in 2013 and the assets were sold to a private equity firm in 2014. Mr. Salaman has over 20 years’ experience in the area of start-ups, new product development, distribution and marketing. Mr. Salaman began his business career as Vice President of Business Development for National Media Corp., an infomercial marketing company in the United States, from 1985 to 1993. From 1993 to 1995, Mr. Salaman worked as a consultant. From 1995 to 2001, Mr. Salaman started a digital media company called American Interactive Media, Inc., a developer of Web TV set-top boxes and ISP services. In 2002, Mr. Salaman became the principal officer of that entity, directing its operations as a marketing and distribution company, and in 2005 focused its efforts in the enhanced water business. Mr. Salaman received a Bachelor of Business Administration degree in business from Temple University in 1986.

Eula Adams has been a Director of the Company since September 2021. Mr. Adams began his career as an auditor at Touche Ross in 1972, eventually becoming an audit partner there (which became Deloitte & Touche following a

merger in 1989) until 1991. From 1991 to 2003, Mr. Adams worked at First Data Corporation (now Fiserv), holding positions as President of Merchant Services, President of Card Issuer Services and President of Teleservices. From 2004 to 2008, Mr. Adams served as Senior Vice President at Sun Microsystems responsible for systems, software and data storage. From 2008 to 2013, Mr. Adams was Chief Operating Officer of Xcore Corporation. Most recently, Mr. Adams was Chief Executive Officer and director at Neuromonics, Inc. from 2013 to 2019. Mr. Adams currently serves on the board of directors of Your Way Cannabis Brands Inc., as well as the White House Historical Association and the Transportation Commission of Colorado. Mr. Adams is a graduate of Morris Brown College with a Bachelor of Science degree in accounting, has a Master of Business Administration from Harvard Business School, and is a Certified Public Accountant.

Stephen Aiello has been a Director of the Company since 2014. Mr. Aiello has been a private investor focusing on cannabis and real estate since 2008. Mr. Aiello was a partner at Jones and Company from 2004 to 2008. From 2001 to 2003, he worked at 033 Asset Management, a long/short equity fund where he was responsible for day-to-day trading of the portfolio. From 1986 to 2001, he was a partner at Montgomery Securities, where he managed the sales and trading institutional desk. Mr. Aiello received a Bachelor of Arts in Psychology from Ithaca College and a Master of Business Administration from Fordham University.

Paul Ciasullo has been a Director of the Company since 2020. He has also been a board member of Leafline Labs, LLC since 2018. In 2010, Mr. Ciasullo founded Wallstreet Research Solutions, LLC, which provided sales, marketing and customer account services primarily in partnership with a fixed income research firm specializing in bond and loan covenants called Covenant Review, LLC (with which he had been working to build the business since 2007). Covenant Review and Wallstreet Research Solutions merged and later re-branded as Fulcrum Financial Data LLC, where Mr. Ciasullo acted as President of Global Marketing and Sales and was a board member from 2014 to 2018 when the company was sold to Fitch Ratings Services. From 2005 to 2006, Mr. Ciasullo was a Managing Director at Soleil Securities Group Inc., responsible for developing a strategy for bringing alternative research such as industry knowledge into a stock research environment. From 2000 to 2004, Mr. Ciasullo was a founder of and acted as President of CreditSights, Inc., an institutional investment research firm specializing in fixed income research for institutional investors. Prior to that, Mr. Ciasullo held a number of Managing Director positions as head of trading at large brokerage firms. Mr. Ciasullo graduated from Brown University in 1981 with a Bachelor of Arts in Economics and International Relations.

The Board of Directors recommends that you vote “FOR” the election of each of the nominees named above.

[remainder of page intentionally left blank]

CORPORATE GOVERNANCE

BOARD OF DIRECTORS

General

Pursuant to the Company’s bylaws and the Colorado Business Corporations Act, management of the affairs, property, and business of the Company is vested in its Board of Directors.

The Company’s bylaws provide that the size of the Board of Directors shall be determined from time to time by resolution of the Board of Directors but shall not consist of less than one director or more than ten directors. If any member or nominee is unable to serve as a director or if any director leaves the Board between Annual Meetings, the Board, by resolution, may reduce the number of directors or elect an individual to fill the resulting vacancy. As of the date of this Proxy Statement, the Board of Directors has six members: Michael Salaman, Darren Lampert, Eula Adams, Stephen Aiello, Paul Ciasullo and Sean Stiefel.

On April 4, 2022, Mr. Stiefel notified the Company that he will not stand for re-election as a director of the Company at the end of his current term, which expires at the Annual Meeting. The decision of Mr. Stiefel to not stand for re-election was not the result of a disagreement with the Company on any matter relating to the Company’s operations, policies, or practices.

Darren Lampert, Michael Salaman, Eula Adams, Stephen Aiello, and Paul Ciasullo have been nominated for re-election at the Annual Meeting. If all of the nominees are elected, the Board will be composed of five members immediately following the Annual Meeting.

Board Leadership Structure and Role in Risk Oversight

The Board of Directors’ primary responsibility is to seek to maximize long-term shareholder value. The Board selects management of the Company, monitors management and performance of the Company, and provides advice and counsel to management. Among other things, the Board of Directors regularly reviews the Company’s business strategies and results and approves its budget and certain major transactions. Management keeps the Board informed through regular communication, including reports and presentations at Board and Committee meetings.

Effective risk oversight is an important priority of the Board of Directors. The Board discusses risk throughout the year generally and in connection with specific matters or proposed actions. The approach to risk oversight includes understanding the critical risks in GrowGeneration’s business and strategy, evaluating risk management processes, allocating responsibilities for risk oversight, and fostering an appropriate culture of integrity and compliance with legal responsibilities.

In fulfilling the Board of Directors’ responsibilities, non-employee directors have full access to management, external auditors, legal counsel and other advisers. Non-employee directors also conduct separate executive sessions without Company management present as and when they deem necessary. The Board believes this structure is operating effectively to provide independent analysis and decision-making when appropriate. The Board has not designated a lead independent director, nor adopted a formal policy on whether the Chairperson and Chief Executive Officer positions should be separate or combined. The Board of Directors is currently chaired by Mr. Darren Lampert, who also serves as Chief Executive Officer. The Board believes that Mr. Lampert’s service in both roles is in the best interest of the Company and its shareholders.

Board Oversight during the Pandemic

The risk landscape associated with the COVID-19 pandemic and management’s strategic handling of such risks have been, and continue to be, regularly discussed with the full Board as well as Board committees, as appropriate. Over the course of 2021, management regularly updated the directors on the pandemic’s impact to the Company’s business and the strategic, operational and financial risks associated with the pandemic. Discussions with the Board

and its committees have covered a wide array of topics, including business continuity, customer and employee health and safety, technology and cybersecurity, specific impacts of the pandemic in the geographic markets we serve and supply and demand for our products. The Board and management continue to monitor the risks and potential impacts to the Company’s business and strategies on a regular basis.

Director Independence

The Board of Directors is composed of a majority of “independent” directors within the meaning of the rules of Nasdaq Capital Market.

The Board of Directors examines the independence of the directors annually. The following directors were determined to be independent as of the last time the Board reviewed director independence: Eula Adams, Stephen Aiello, Paul Ciasullo and Sean Stiefel.

For a director to be considered independent, the Board of Directors must determine that the director does not have any relationship with the Company or any of its affiliates, either directly or as a partner, shareholder or officer of an organization that has such a relationship which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

A director will not be considered independent if, among other things, the director has:

•Been employed by the Company or its affiliates at any time in the current year or during the past three years;

•Accepted any payments from the Company or its affiliates in excess of $120,000 during any period of twelve consecutive months within the preceding three years (except for board services, retirement plan benefits, or non-discretionary compensation);

•An immediate family member who is, or has been in the past three years, employed by the Company or its affiliates as an executive officer;

•Been a partner, controlling shareholder or an executive officer of any “for profit” business to which the Company made or from which it received payments (other than those which arise solely from investments in the Company’s securities) that exceed 5% of the entity’s or the Company’s consolidated gross revenues for that year, or $200,000, whichever is more, in any of the preceding three years;

•Been employed as an executive officer of another entity where any of the Company’s executive officers serve on that entity’s compensation committee; or

•Been, or has a family member who has been, employed as a partner or employee of the Company’s outside auditors in any of the preceding three years.

Board Diversity

In assessing the appropriate composition of the Board, the Nominating and Corporate Governance Committee considers all relevant factors, including diversity. Although the Board does not maintain a specific policy with respect to Board diversity, the Board believes that the Board should be a diverse body, and the Nominating and Corporate Governance Committee considers a broad range of backgrounds and experiences in its assessment.

| | | | | | | | | | | | | | |

Board Diversity Matrix (As of April 27, 2022) |

| Total Number of Directors | 6 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | | | | |

| Directors | — | | 6 | | — | | — | |

| Part II: Demographic Background | | | | |

| African American or Black | — | | 1 | | — | | — | |

| Alaskan Native or Native American | — | | — | | — | | — | |

| Asian | — | | — | | — | | — | |

| Hispanic or Latinx | — | | — | | — | | — | |

| Native Hawaiian or Pacific Islander | — | | — | | — | | — | |

| White | — | | 5 | | — | | — | |

| Two or More Races or Ethnicities | — | | — | | — | | — | |

| LGBTQ+ | — | | — | | — | | — | |

| Did Not Disclose Demographic Background | — | | — | | — | | — | |

Board Meetings

During the fiscal year ended December 31, 2021, the Board of Directors held 4 meetings, including meetings conducted by teleconference. No director attended less than 75% of all board meetings during the fiscal year ended December 31, 2021, to the extent such director was a director as of the date of such meetings. No director attended less than 75% of all meetings of any committee on which such director served during the fiscal year ended December 31, 2021, to the extent such director was a director as of the date of such meetings.

All current Board members and all nominees for election to the Board of Directors are encouraged but not required to attend the virtual Annual Meeting.

Board Committees

The Board of Directors has established three committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The Board has adopted a charter for each Committee, which is available on the Company’s investor relations website at ir.growgeneration.com.

The current members of each Committee are set forth in the table below. As noted above under “Corporate Governance - Board of Directors - General,” Mr. Stiefel will not stand for re-election as a director of the Company at the end of his current term, which expires at the Annual Meeting, and therefore will also no longer be a member of any Committee after the Annual Meeting.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | |

| Director Name | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee |

| Eula Adams | | X* | | | X | | | | |

| Stephen Aiello | | X | | | X* | | | X* | |

| Paul Ciasullo | | X | | | X | | | X | |

| Sean Stiefel | | X | | | X | | | | |

* Denotes Chairperson

Audit Committee

During the fiscal year ended December 31, 2021, the Audit Committee held 4 meetings, including meetings conducted by teleconference.

The purpose of the Audit Committee is to perform and to assist the Board of Directors in fulfilling its oversight responsibility relating to: (i) the Company’s financial statements and financial reporting and the Company’s systems of internal accounting and financial controls; (ii) the integrity of the Company’s financial statements; (iii) the appointment, retention and performance of the internal auditors, if applicable; (iv) the annual independent audit of the Company’s financial statements, the engagement and compensation of the independent auditors and the evaluation of the independent auditors’ qualifications, independence and performance; (v) the compliance by the Company with legal and regulatory requirements, including the Company’s disclosure controls and procedures; (vi) the evaluation of management’s process to assess and manage the Company’s enterprise risk issues; and (vii) the fulfillment of the other responsibilities set out in the Audit Committee Charter or otherwise delegated to the Audit Committee by the Board of Directors.

The Board has determined that all Audit Committee members are independent directors, and that Mr. Adams qualifies as an “audit committee financial expert” within the meaning of the rules of the Securities Exchange Commission (the “SEC”) and Nasdaq Capital Markets.

Compensation Committee

During the fiscal year ended December 31, 2021, the Compensation Committee held 2 meetings, including meetings conducted by teleconference.

The Board of Directors has established a Compensation Committee for the purposes of: (i) reviewing, determining and approving all forms of compensation and the terms thereof to be provided to the Company’s executive officers and monitoring the executive officers’ determination of any equity compensation to be provided to other employees and consultants of the Company; (ii) setting goals for and monitoring the performance of the Company’s executive officers; (iii) administering the Company’s stock-based compensation plans; (iv) reviewing and approving public disclosures and reporting relating to the Company’s compensation arrangements; and (v) fulfilling the other responsibilities set out in the Compensation Committee Charter or otherwise delegated to the Compensation Committee by the Board of Directors.

In 2021, the Compensation Committee hired Hays Companies, a Brown & Brown company, as an independent compensation consultant to assist the Compensation Committee in fulfilling its responsibilities, including to review executive compensation levels in comparison to those of competitors and market practices generally, as well as to update the Company’s executive compensation philosophy, policies and practices. The Compensation Committee has the sole authority to hire or fire its compensation consultants and to approve fee arrangements for work performed.

In fiscal year 2021, Hays did work for the Compensation Committee as well as management. The Compensation Committee has assessed the independence of Hays pursuant to SEC rules and concluded that Hays’ work for the Compensation Committee does not raise any conflict of interest.

None of the members of the Compensation Committee has at any time during the last fiscal year been an officer or employee of the Company, nor has any Committee member had any relationship requiring disclosure under Item 404 of Regulation S-K under the Exchange Act, which requires disclosure of certain relationships and related party transactions. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on the Company’s Board of Directors or Compensation Committee.

Nominating and Corporate Governance Committee

During the fiscal year ended December 31, 2021, the Nominating and Corporate Governance Committee held no meetings.

The purpose of the Nominating and Corporate Governance Committee is to: (i) oversee all aspects of the Company’s corporate governance functions on behalf of the Board; (ii) make recommendations to the Board regarding corporate governance issues; (iii) identify, review and evaluate candidates to serve as directors of the Company and review and evaluate incumbent directors, in each case consistent with criteria approved by the Board and applicable law and securities exchange rules; (iv) serve as a focal point for communication between such candidates, non-committee directors and the Company’s management; (v) select or recommend to the Board for selection candidates to the Board to serve as nominees for director for the annual meeting of shareholders; (vi) make other recommendations to the Board regarding affairs relating to the directors of the Company, including director compensation; and (vii) fulfill the other responsibilities set out in the Nominating and Corporate Governance Committee Charter or otherwise delegated to the Nominating and Corporate Governance Committee by the Board of Directors.

Director Compensation

In addition to equity awards (set forth in the table below), non-employee directors of the Company currently receive cash compensation of $2,000 per month for services rendered as a director.

Director Compensation Philosophy

Our director compensation program is intended to enable us to:

•attract and retain qualified non-employee directors by providing compensation that is competitive with other companies; and

•align directors’ interests with shareholders’ interests by including equity as a significant portion of each non-employee director’s compensation package.

In setting director compensation, we consider compensation offered to directors by other companies, the amount of time that our directors spend providing services to us and the experience, skill and expertise that our directors have. Directors who are employees of the Company receive no separate compensation for their service as directors.

Non-Employee Director Compensation

The following table summarizes the compensation paid to each non-employee director in 2021.

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash | Stock Awards | Option Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other Compensation | Total |

| Eula Adams | $ | 6,000 | | $ | 59,375 | | $ | — | | $ | — | | $ | — | | $ | 366 | | $ | 65,741 | |

| | | | | | | |

| Stephen Aiello | $ | — | | $ | 73,325 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 73,325 | |

| | | | | | | |

| Paul Ciasullo | $ | 6,000 | | $ | 73,325 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 79,325 | |

| | | | | | | |

| Sean Stiefel | $ | 24,000 | | $ | 73,325 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 97,325 | |

| | | | | | | |

(1) The amounts set forth in the “Stock Awards” and “Option Awards” columns in the table above reflect the aggregate grant date fair value computed in accordance with the Financial Accounting Standards Board Accounting Standards Codification Topic No. 718, Compensation-Stock Compensation (FASB ASC Topic 718), excluding the effect of any estimated forfeiture rate. These amounts may not correspond to the actual value eventually realized by the director, which depends in part on the market value of our Common Stock in future periods. Assumptions used in the calculation of these amounts are described in the Notes to Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC.

Director Nomination Process

The process of reviewing and making recommendations for nominations and appointments to the Board of Directors is the responsibility of the Nominating and Corporate Governance Committee. Our directors have a critical role in guiding our strategic direction and in overseeing management. The Nominating and Corporate Governance Committee will consider candidates for the Board of Directors based upon several criteria, including their broad-based business and professional skills and experiences, concern for the long-term interests of shareholders, personal integrity and judgment. Candidates should have reputations, both personal and professional, consistent with our image and reputation. Directors must have time available to devote to activities of the Board of Directors and to enhance their knowledge of the Company’s industry. Accordingly, the Board of Directors seeks to attract and retain highly qualified directors who have sufficient time to attend to their substantial duties and responsibilities for the Company, and who are expected to contribute to an effective Board of Directors. The Nominating and Corporate Governance Committee has not adopted a formal diversity policy in connection with the consideration of director nominations or the selection of nominees. However, the Committee will consider issues of diversity among its members in identifying and considering nominees for director, and strive where appropriate to achieve a diverse balance of backgrounds, perspectives, experience, age, gender, ethnicity, country of citizenship and other characteristics on the Board of Directors and Committees.

The Nominating and Corporate Governance Committee utilizes the following process for identifying and evaluating nominees to the Board of Directors. In the case of incumbent directors, each year the Board of Directors informally reviews each director’s overall service to the Company during the term, including the number of meetings attended, level of participation and performance. In the case of new director candidates, the Nominating and Corporate Governance Committee may solicit from existing directors the names of potential candidates who meet the criteria above, consider candidates suggested by our shareholders and/or engage a professional search firm. To date, the Nominating and Corporate Governance Committee has not engaged a professional search firm to identify or evaluate potential nominees, but it retains the right to do so in the future, if necessary. The Nominating and

Corporate Governance Committee considers these candidates’ qualifications and then chooses new candidates by majority vote.

Shareholder Nominations

The Nominating and Corporate Governance Committee has the authority to consider nominations for directors made by the Company’s shareholders. To be considered, the shareholder’s nomination must contain: (i) the name and address of each proposed nominee; (ii) the principal occupation of each proposed nominee; (iii) the total number of shares of the Company’s capital stock that will be voted for each proposed nominee; (iv) the name and residence address of the notifying shareholder; and (v) the number of our shares of capital stock owned by the notifying shareholder. In addition, the nomination should include any other information relating to the proposed nominee required to be included in a proxy statement filed pursuant to the proxy rules of the SEC and the nominee’s written consent to serve as a director if elected.

Communications with Directors

Shareholders who wish to communicate with the Board or one or more individual directors may do so by contacting the Secretary of the Company by mail at GrowGeneration Corp., 5619 DTC Parkway, Suite 900, Greenwood Village, CO 80211. The Secretary will refer such communication to the Board.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics, which was filed as Exhibit 14.1 to the Company’s 2019 Annual Report on Form 10-K.

Insider Trading Policy

The Board has adopted an Insider Trading Policy which sets forth restrictions and procedures regarding trading by insiders in securities of the Company.

Involvement in Certain Legal Proceedings

To our knowledge, during the past ten years, none of our directors, executive officers, promoters, control persons, or nominees other than Michael Salaman (see biographical information of Mr. Salaman above regarding the Chapter 11 Bankruptcy protection filed by Skinny Nutritional Corp. in 2013) has:

•been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

•had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time;

•been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity;

•been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

•been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or

commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

•been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

Limitation of Directors Liability and Indemnification

The Colorado Business Corporations Act authorizes corporations to limit or eliminate, subject to certain conditions, the personal liability of directors to corporations and their shareholders for monetary damages for certain breaches of their fiduciary duties.

The bylaws of the Company provide that the Company will indemnify its directors and officers who, by reason of the fact that he or she is one of the Company’s officers or directors, is involved in a legal proceeding of any nature.

The Company has purchased director and officer liability insurance to cover certain liabilities its directors and officers may incur in connection with their services to the Company.

There is no pending litigation or proceeding involving any of our directors, officers, employees or agents in which indemnification will be required or permitted. The Company is not aware of any threatened litigation or proceeding that would reasonably be expected to result in a claim for such indemnification.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires the Company’s officers, directors and persons who own more than ten percent of the issued and outstanding shares of common stock to file reports of beneficial ownership and changes in beneficial ownership with the SEC and to furnish copies of all Section 16(a) forms to the Company. Based solely upon a review of Section 16(a) forms furnished to the Company, the Company believes all reports required to be filed under Section 16(a) with the SEC were timely filed in 2021, with the following exceptions:

•Mr. Adams filed one Form 4 late on April 20, 2022 related to an issuance of shares on October 12, 2021.

•Mr. Aiello filed one Form 4 late on December 29, 2021 related to an issuance of shares on August 17, 2021.

•Mr. Ciasullo filed one Form 4 late on December 29, 2021 related to an issuance of shares on August 17, 2021.

•Mr. Lampert filed one Form 4 late on July 7, 2021 related to his transfer of shares on June 30, 2021.

•Mr. Lasher filed one Form 4 late on April 30, 2021 related to an issuance of shares to him on April 15, 2021 pursuant to his employment agreement.

•Mr. Rutenis filed one Form 3 late on January 24, 2022 related to his hiring and initial beneficial ownership on June 21, 2021.

•Mr. Salaman filed one Form 4 late on July 7, 2021 related to his transfer of shares on June 30, 2021.

•Mr. Stiefel filed one Form 4 late on December 29, 2021 related to an issuance of shares on August 17, 2021.

•Mr. Sullivan filed two Form 4’s late: (i) on April 26, 2021 related to the issuance of shares to him upon the exercise on April 14, 2021 of stock options granted pursuant to his employment agreement and (ii) on

November 5, 2021 related to an issuance of shares to him on November 1, 2021 pursuant to his employment agreement and the disposal of shares.

Report of Audit Committee

The Audit Committee is currently comprised of four members, identified under “Corporate Governance - Board of Directors - Board Committees” above. Based upon the review described above under “Corporate Governance - Board of Directors - Director Independence,” our Board of Directors has determined that each member of the Audit Committee is independent as defined in the applicable standards and rules of the Nasdaq Capital Market and the SEC. The duties and responsibilities of the Audit Committee are set forth in the Audit Committee Charter.

In accordance with its Charter adopted by the Board of Directors, the Audit Committee has oversight responsibility for the quality and integrity of the financial reporting practices of the Company. While the Audit Committee has oversight responsibility, the primary responsibility for the Company’s financial reporting, disclosure controls and procedures and internal control over financial reporting and related internal controls and procedures rests with management, and the Company’s independent registered public accounting firm is responsible for auditing the Company’s financial statements. In discharging its oversight responsibility as to the audit process, the Audit Committee reviewed and discussed the audited financial statements with management, and discussed with the independent auditors the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. The Audit Committee received the written disclosures and the letter from the independent accountant required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence and has discussed with the independent accountant the independent accountant’s independence. Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for fiscal year ended December 31, 2021.

The Audit Committee also has approved the selection of the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 and has approved submitting such selection for approval and ratification by the shareholders.

MEMBERS OF THE AUDIT COMMITTEE

Eula Adams (Chairperson)

Stephen Aiello

Paul Ciasullo

Sean Stiefel

Report of Compensation Committee

The Compensation Committee has reviewed and discussed with management the “Compensation Discussion and Analysis” included elsewhere in this Proxy Statement and, based on such review and discussions, the Compensation Committee recommended to the Board of Directors (and the Board of Directors approved) to include such disclosure in this Proxy Statement.

MEMBERS OF THE COMPENSATION COMMITTEE

Stephen Aiello (Chairperson)

Eula Adams

Paul Ciasullo

Sean Stiefel

EXECUTIVE OFFICERS

The Board of Directors selects and oversees management of the Company. Members of management may be removed and replaced at the discretion of the Board, subject to the terms of any applicable employment agreement or other arrangement.

The following tables set forth information concerning the Company’s executive officers as of December 31, 2021:

Executive Officers

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Michael Salaman | | 59 | | President and Director |

| Darren Lampert | | 61 | | Chief Executive Officer and Director |

| Jeff Lasher | | 58 | | Chief Financial Officer |

| Paul Rutenis | | 56 | | Chief Merchandising Officer |

Set forth below is biographical information with respect to Mr. Lasher and Mr. Rutenis. Biographical information for Messrs. Salaman and Lampert is set forth under the caption “Proposal 1: Election of Directors.”

Jeff Lasher joined the Company as Chief Financial Officer in April 2021. Mr. Lasher was CFO at Crocs from 2009 to 2015, which grew from $700 million to $1.2 billion during this time. At West Marine (formerly Nasdaq: WMAR), then a publicly traded $700 million specialty retailer of boating supplies, apparel, and accessories with 250 stores in 38 states, he became CFO in November of 2015 and then became interim CEO. He helped lead the Company’s sale to Monomoy Capital, which was finalized in September 2017. Most recently, Mr. Lasher was the CFO at a private equity backed multi-unit services company, International Car Wash Group, Inc., now a division of Driven Brands, Inc. (Nasdaq: DRVN), with over 900 car washes in 14 countries. Directly prior to his start with GrowGeneration, he served as CFO of Coravin, Inc. Mr. Lasher is a graduate of the University of Alabama and received an MBA from Pennsylvania State University.

Paul Rutenis joined the Company as Chief Merchandise Officer in May 2021. Mr. Rutenis has two decades of experience in retail spanning management positions at several large public companies. Mr. Rutenis provided consulting services from 2018 to May 2021 to multiple organizations on building added value and achieving performance excellence. From 2015 to 2018, Mr. Rutenis served as Executive Vice President at West Marine, where he helped grow the top and bottom line by successfully moving the company to an omnichannel format that enhanced the company’s brick-and-mortar format. From 2013 to 2015, he served at Radio Shack as Chief Merchandising Officer. From 2011 to 2012, at JC Penney, he was VP – Divisional Merchandise Manager, Furniture and Home Décor and promoted to SVP – General Merchandise Manager, Home from 2012 to 2013. From 2006 to 2011, at Dicks Sporting Goods, he helped drive sales and gross margin expansion in private label and branded products. Mr. Rutenis received a B.S. degree from Clemson University and received an MBA from the University of St. Louis.

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis, or CD&A, discusses the compensation program for the executives identified as named executive officers (“NEOs”) in the Summary Compensation Table and below. In this CD&A, the terms “we,” “us,” “our,” “GrowGeneration” and the “Company” refer to GrowGeneration Corp. and not to the Compensation Committee.

Executive Summary

The Company’s fiscal year 2021 results reflect the emergence of the industry supporting controlled environment agriculture and outdoor cultivation, which has seen periods of tremendous growth and substantial industry contraction as weaker players exit the market. Our performance benefited from that expansion, particularly during

the first and second quarters, but was impacted by industry-wide contraction of grow facilities in the second half of 2021. For the year, net sales increased 119% to $422.5 million, net income increased 140% to $12.8 million, and diluted earnings per share increased to $0.21.

As the largest chain of hydroponic garden centers by revenue and number of stores in the United States based on management’s estimates, we believe that we have the following core competitive advantages over our competitors:

•We offer a one-stop shopping experience to all types of growers by providing “selection, service, and solutions”;

•We provide end-to-end solutions for our commercial customers from capex built-out to consumables to nourish their plants;

•We have a knowledge-based sales team with deep horticultural experience;

•We offer the options to transact online, in store, or buy online and pick up in store;

•We consider ourselves to be a leader of the products we offer, from launching new technologies to the development of our private label products; and

•We have a professional team for mergers and acquisitions and to acquire and open new locations, products and technologies and successfully add them to our company portfolio.

Core to our growth strategy is to expand the number of our retail garden centers throughout North America. In addition to the 13 states in which we are currently operating, we have identified new market opportunities in states that include Connecticut, Ohio, Illinois, Pennsylvania, New York, New Jersey, Mississippi, Missouri and Virginia. The Company acquired 23 new locations in 2021 and expects to open more new stores in 2022.

Secondary to this growth strategy is the expansion of distribution and sales capabilities for products that the Company owns, distributes, or represents to independent retail garden centers for resale.

Overview of Executive Compensation Program

In this CD&A, we describe our overall compensation philosophy, objectives and practices. Our compensation philosophy and objectives generally apply to all of our employees, and most of our key employees are eligible to participate in the main components of our compensation program: (i) base salary, (ii) annual, short-term incentive compensation and (iii) long-term, equity-based compensation. The relative value of each of these components of our compensation program varies from year to year and for each employee, depending primarily on our financial and stock price performance, the employee’s role and responsibilities and competitive market data.

Compensation Philosophy

The compensation philosophy of the Company is to complement and support the Company’s mission by attracting, motivating, rewarding and retaining the right talent so that the Company’s mission and purpose can be achieved. We do this by offering a competitive, consistent and fair compensation structure that meets the market and allows for flexibility to exceed the market when performance factors warrant it.

Compensation Objectives

Leadership and motivation of our executive officers are critical to our long-term success, and the market for high-quality executive officers in our industry remains competitive. Our challenge is to offer a compensation program that is competitive and at the same time reinforces our commitment to being a brand-led, consumer-first organization and our strategic priorities.

Compensation Program Design

Our compensation program for our executive officers is designed to reward our executive officers competitively when they achieve targeted annual performance goals, increase shareholder value, and maintain long-term careers with us. In our view, a competitive pay package in our industry includes:

•a salary that provides for a minimum level of compensation for an executive officer;

•a meaningful short-term, performance-based cash bonus tied to achievement of corporate objectives;

•long-term equity incentives that offer significant rewards if the market price of our Common Stock increases in the future; and

•benefits that aim to be competitive with those that are offered by companies similar to ours.

The total compensation package for our executive officers is substantially weighted toward incentive compensation tied to corporate and stock performance. Therefore, when targeted performance levels are not achieved or our stock price decreases, executive officer compensation may be significantly reduced. When targeted performance levels are exceeded or our stock price increases, executive officer compensation may be significantly increased.

Risk and Compensation

We believe our compensation programs for executive officers are designed to encourage prudent risk-taking to achieve long-term growth in shareholder value. A variety of principles and practices contribute to the alignment of our executive compensation programs with our overall risk profile, including the following:

•All Compensation Committee members are independent, non-employee directors.

•Our programs are designed to drive achievement of our strategic objectives, short- and long-term financial performance and growth in shareholder value, while also promoting the attraction and retention of executive talent.

•Our programs balance strategic, financial and shareholder measures.

•Our programs balance short- and long-term performance through equity compensation.

•The vesting periods of long-term incentives provide long-term alignment with shareholders.

•Maximum amounts payable are established under performance-based incentive programs.

•Our Board and Compensation Committee generally establish both strategic and financial measures at the beginning of a performance period.

•Our Compensation Committee reviews all elements of executive compensation, with the assistance of our independent compensation consultant.

•Base salaries and annual adjustments for executive officers are generally based on market practices and our financial condition and aim to provide total compensation that is competitive with other similarly sized companies.

•Annual cash incentive payouts will vary over time, commensurate with business and individual executive performance.

•The Company maintains a policy prohibiting hedging by directors, executive officers, and other insiders.

Components of Compensation

The table below sets forth a summary of the key elements of our 2021 and 2022 compensation program for NEOs.

| | | | | | | | |

| Component | Description | Purpose |

| Base Salary | Fixed cash component. | Reward for level of responsibility, experience and sustained individual performance. |

| Annual Cash Incentive | Cash performance bonus based on achievement of predetermined performance goals. | Reward team achievement against specific objective financial goals. |

| Long-Term Incentives | Equity grants in 2021 consisted of: •Time-based restricted stock units, •Stock option awards. | Reward for the creation of stockholder value, align the interests of employees

and shareholders, and retain executives for the long-term. |

| Other Compensation | A matching contribution to our defined contribution 401(k) plan and various health, life and disability insurance plans and other customary employee benefits. | Provide an appropriate level of employee benefit plans and programs. |

| Other Policies | Insider trading policy, which includes anti-hedging and anti-pledging policies. | Enhance alignment with stockholder interests. |

Base Salary

The base salaries for our named executive officers are set forth in the Summary Compensation Table below.

Annual Cash Incentive

Short-term incentive compensation for the President and the CEO was established in their respective current employment agreements (each effective as of January 1, 2020) and is equal to 0.5% of revenue generated by the enterprise over $79.8 million each year.

In 2021, the Compensation Committee awarded executive officers (other than the President and CEO) bonuses from a discretionary pool based on financial and stock price performance, as well as the executive’s role and performance, among other factor considered relevant by the Committee.

For 2022, the Compensation Committee established a short-term incentive plan for executive officers (other than the President and CEO) that provides for annual cash bonuses to motivate and reward achievement of Company objectives, as further described below.

In connection with the new short-term incentive program, the Compensation Committee sets the corporate performance target levels so that they are challenging yet attainable from year to year and tied to driving strong operational performance. The Compensation Committee generally establishes targets early in the fiscal year based upon current forecasts, business strategies and expectations. The Compensation Committee has the discretion, at or prior to the time it sets the performance target, to include or exclude any extraordinary items affecting the performance target and to adjust the performance target to take into account changes in accounting.

For 2022, short-term incentive compensation for our executive officers (other than the President and CEO) is based on achievement of the specific financial goals, each of which is weighted, set forth in the list below:

•Enterprise generation of gross profit, weighted at 40% of target bonus opportunity;

•Adjusted EBITDA, weighted at 40% of target bonus opportunity; and

•Cash From Operations, weighted at 20% of target bonus opportunity.

For each of our NEOs (other than the President and CEO) in 2022, the Committee set a target bonus of 50% of base salary, which can be achieved by obtaining the target performance level. In addition, highest bonus opportunity is an amount equal to 100% of base salary, and lowest bonus opportunity is an amount equal to 25% of base salary. Highest bonus is achieved if actual performance is 120% or more of the target performance level, and lowest bonus

is achieved if actual performance is 80% of the target performance level. Bonus achievement varies accordingly for actual performance between 80% and 120% of target performance (again, with actual performance of 100% of target performance resulting in a bonus equal to 50% of base salary).

| | | | | | | | |

| Name | Target Bonus

(as a % of Salary) | Maximum Bonus (as a % of Salary) |

| Jeffrey J. Lasher | 50% | 100% |

| Paul Rutenis | 50% | 100% |

The Compensation Committee also generally may reduce, increase or eliminate the amount payable under the short-term cash incentive plan to an NEO based on factors that it determines warrant such a reduction or elimination. The Compensation Committee may also award discretionary bonuses.

Long-Term Incentives

With respect to long-term incentives, the Compensation Committee historically awarded time-based restricted stock and stock options to our executive officers. The Compensation Committee periodically reviews outstanding share-based compensation grants to monitor the effectiveness of such grants, especially considering the volatility of our stock price. Changes have been made to the cadence of the issuance of grants to address market driven compensation. Long-term incentive compensation for our NEOs is described in more detail below.

These components constitute what we refer to as “total direct compensation” with respect to each executive officer. We also provide compensation for our executive officers in the form of various other employee benefits and perquisites, most of which are generally available to all our U.S. employees.

Each of the elements of our compensation program helps us achieve the objectives of our program, and we believe that, together, they are effective in achieving our overall objectives.

Compensation Determinations

The use and weight of each compensation component is based on a determination by the Compensation Committee of the importance of each component in meeting our overall objectives. In general, the Compensation Committee seeks to put a significant amount of each NEO’s potential total direct compensation “at risk” based on corporate performance and our stock price.

As part of its process for determining compensation for our NEOs, the Compensation Committee reviews compensation analyses provided by its independent compensation consultant. As described in more detail below, the analyses include an estimate of the market 25th percentile, median and 75th percentile positions for base salary, target total cash compensation (base salary plus target bonus) and target total direct compensation (base salary plus target bonus plus target long-term incentive compensation) for each NEO. Although the Compensation Committee does not target a specific market position, it considers the median, or 50th percentile, of the market data as one among many factors in its analysis regarding the competitive, reasonable, and appropriate levels of compensation for our NEOs, and is guided by, and seeks to promote, the best interests of the Company and its shareholders. The Compensation Committee also considers several other factors when determining appropriate compensation levels for each executive officer, including:

•analyses of competitive compensation practices;

•individual performance in light of Company goals and objectives relevant to executive compensation;

•individual leadership, experience, expertise, skills, and knowledge;

•labor market conditions (which affect the compensation required to attract and retain key talent); and

•analyses and advice from its independent compensation consultant, including competitive market data pertaining to executive compensation at comparable companies.

The Compensation Committee’s approach to evaluating these factors is subjective and not formulaic, and the Compensation Committee may place more or less weight on a particular factor, or consider other factors it deems relevant, when determining compensation.

In determining the total compensation for each executive officer other than our President and CEO, the Compensation Committee also considers the specific recommendations of our President and CEO. Recommendations to the Compensation Committee typically include discussion of the role and responsibilities of the executive officer within the Company, the performance of the executive officer, the expected future contributions of the executive officer, the executive officer’s own expectations, and competitive and market considerations. Although our President and CEO make recommendations regarding other executive officers, neither participates in the discussions concerning his own compensation.

The Compensation Committee may consider, in addition to the factors described above:

•the individual’s accumulated vested and unvested equity awards;

•the vesting schedule of the individual’s outstanding equity awards;

•a comparison of individual equity awards between executive officers and in relation to other compensation elements;

•potential shareholder dilution resulting from stock awards to employees;

•total accounting expense resulting from executive compensation;

•shareholders’ advisory votes on executive compensation; and

•past levels of compensation awarded and earned.

Competitive Market Compensation Survey Information

As discussed above, the Compensation Committee considers competitive compensation practices as just one of many factors used to determine compensation for the Company’s executives, including for the purpose of determining the extent to which the Company’s executive compensation practices are competitive relative to competitors and peer companies to attract and retain talented executives. The Compensation Committee reviews aggregated data from survey sources analyzed by its independent compensation consultant, including general industry surveys, retail/wholesale surveys and consumer retail industry surveys. The Compensation Committee generally focuses on a subset of companies within a comparable industry and/or range of revenues. In December 2021, the Committee reviewed pay practices and compared compensation for the Company’s executive team against a set of peers that included: Hydrofarm Holdings Group, Inc.; e.l.f. Beauty; Funko, Inc.; Quotient Technology, Inc.; Duluth Holdings, Inc.; Central Garden and Pet Company; Ollie’s Bargain Outlet Holdings, Inc.; and At Home Group Inc. prior to their acquisition.

Tax Deductibility